☀️ Morning Prep

NQ ES GC Prep for Dec 30

📝 TL;DR

Last day and a half for the Santa rally to materialize for all Indices

Open to both sides, but looks like price wants to try for higher.

My last trading day of 2025, back on Jan 5th - Happy New Year!

⚡️Asking AI - Sentiment & Outlook:

NQ Bearish (tech profit-taking, thin liquidity)

ES Neutral (cautious ahead of Fed minutes)

GC Bullish (safe-haven rebound post-drop)

📅 Economic Reports & News

Dec 30 - ADP Employment Change, FOMC meeting minutes

Trump continues to talk on replacing FED chair

META acquisition of China based AI start-up

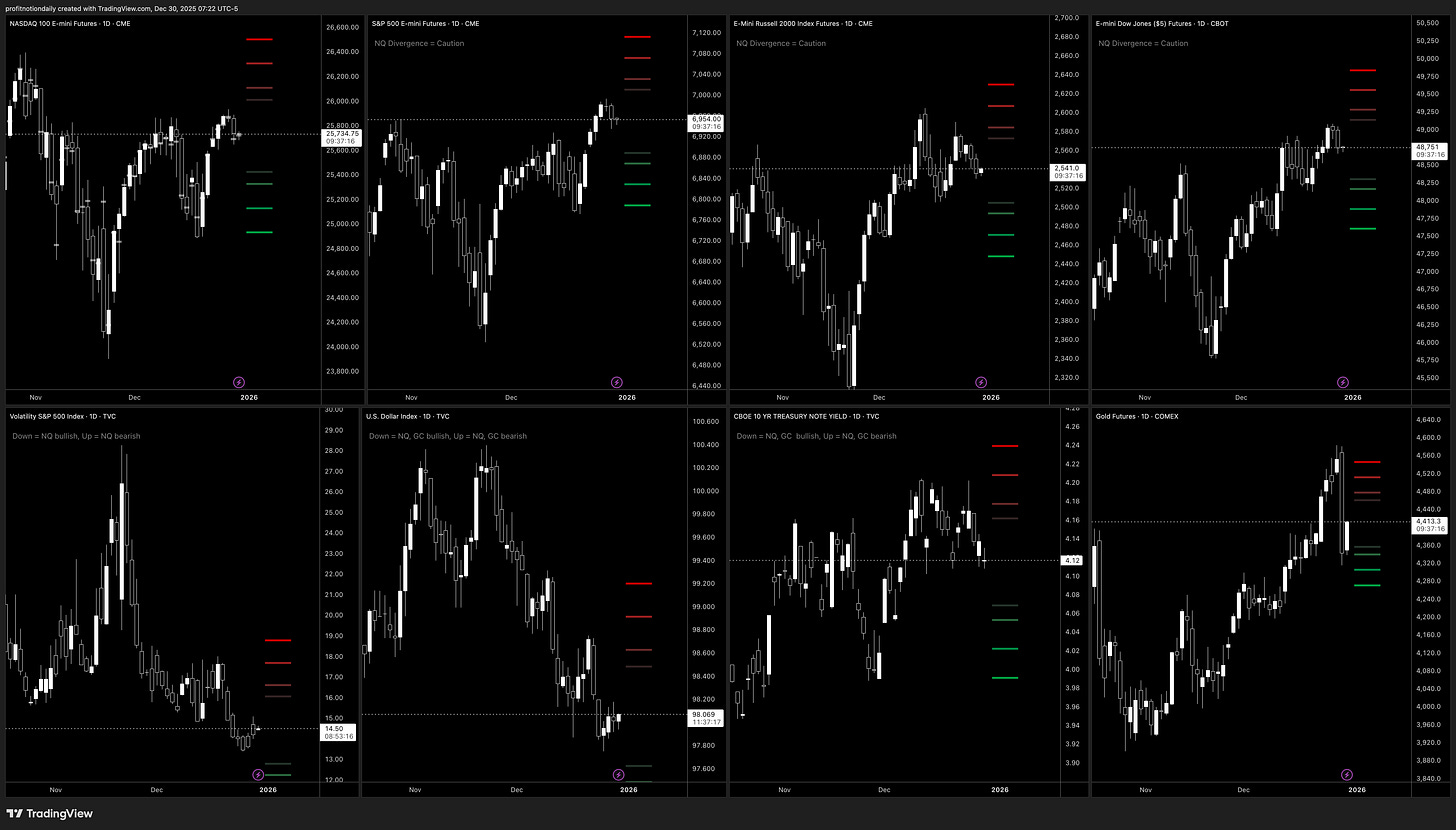

📊 Futures Indices

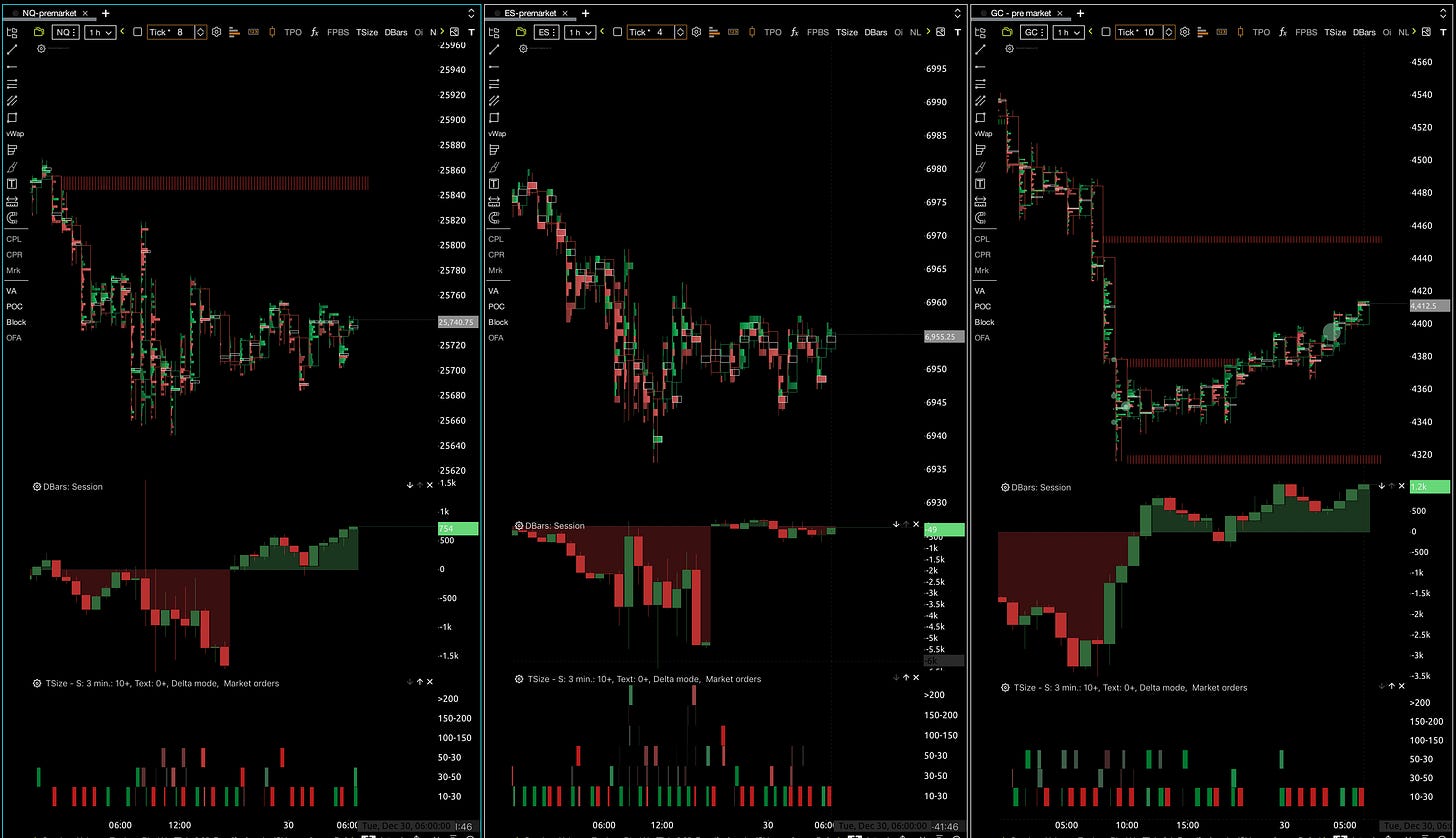

NQ, - Price rebounding with yesterday’s low holding. Bullish options flow, but negative volume delta over the last two days.

ES - Price rebounding with yesterday’s low holding. Bullish options flow, and positive volume delta over the last two days, but falling towards 0.

RTY - Price starting to rebound with yesterday’s low holding. Bearish options flow, but strong positive vol delta with a nice bullish imbalance level holding at yesterday low.

YM - Price holding above yesterday’s low. Bearish options flow, and slight positive volume delta with a stacked bullish imbalance level below yesterday’s low.

VIX - Price is starting to wake up, but still low. Bullish options flow, with near-term volume delta growing positive over the last two days. Poised for a spike?

DXY - Price holding, not much happening.

TVC - Price still pegged at 4.10s level, not much happening

GC - Price regaining about 30% of the yesterday’s drop. Overall options flow is bearish, but increasing. Volume delta closed strong and positive on the day.

Overall, Indices price is trying to grind higher, and gold trying to claw back the sell off. There is still time to close on highs with the Santa rally, however, VIX is slowly creeping up. Lets see if employment numbers have a significant sway today.

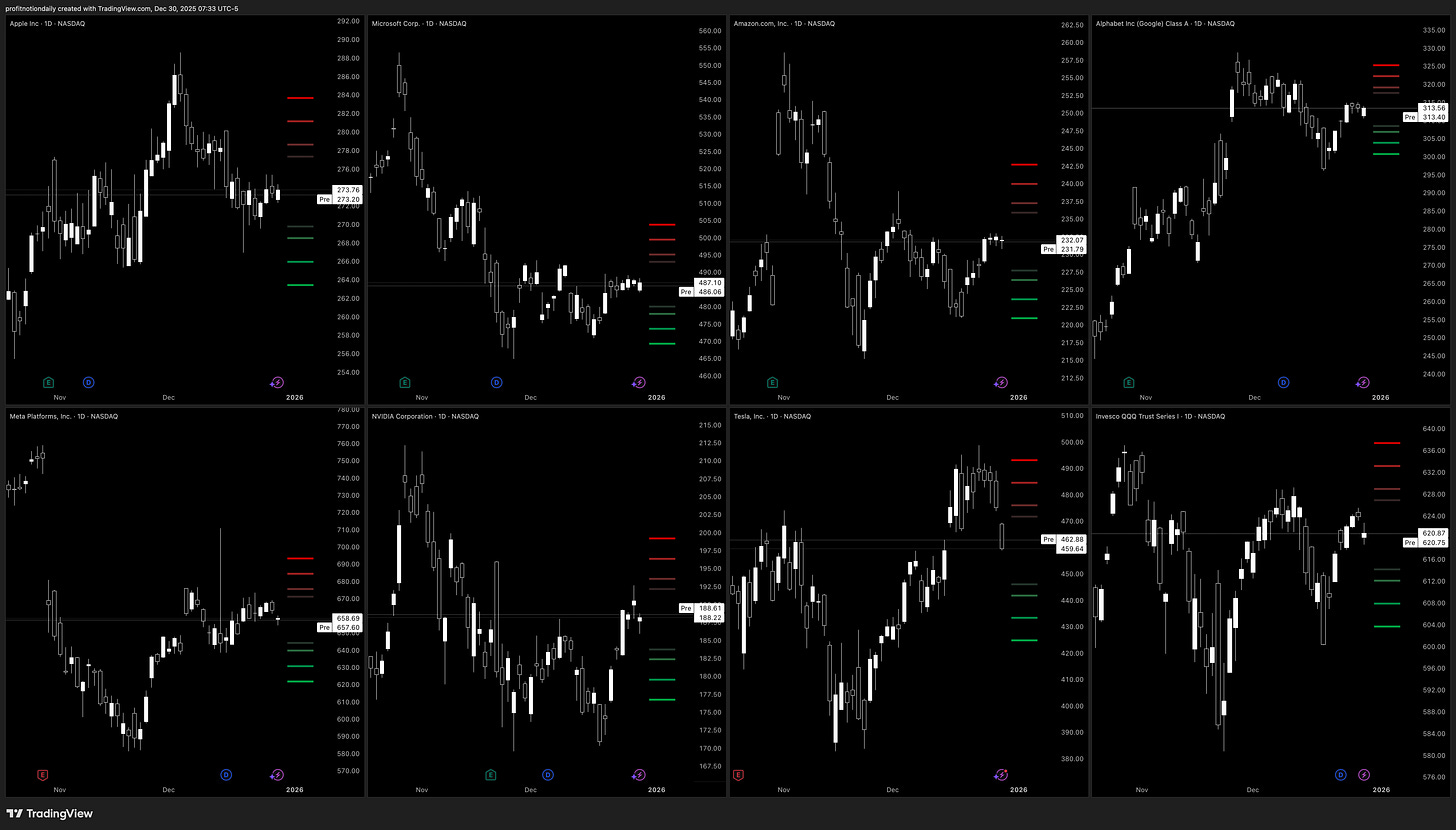

⚡️Review of Top QQQ / NQ Related

Overall, most tickets crawling back up, but are neutral. TSLA had a nice break down, lets see if that drags us down.

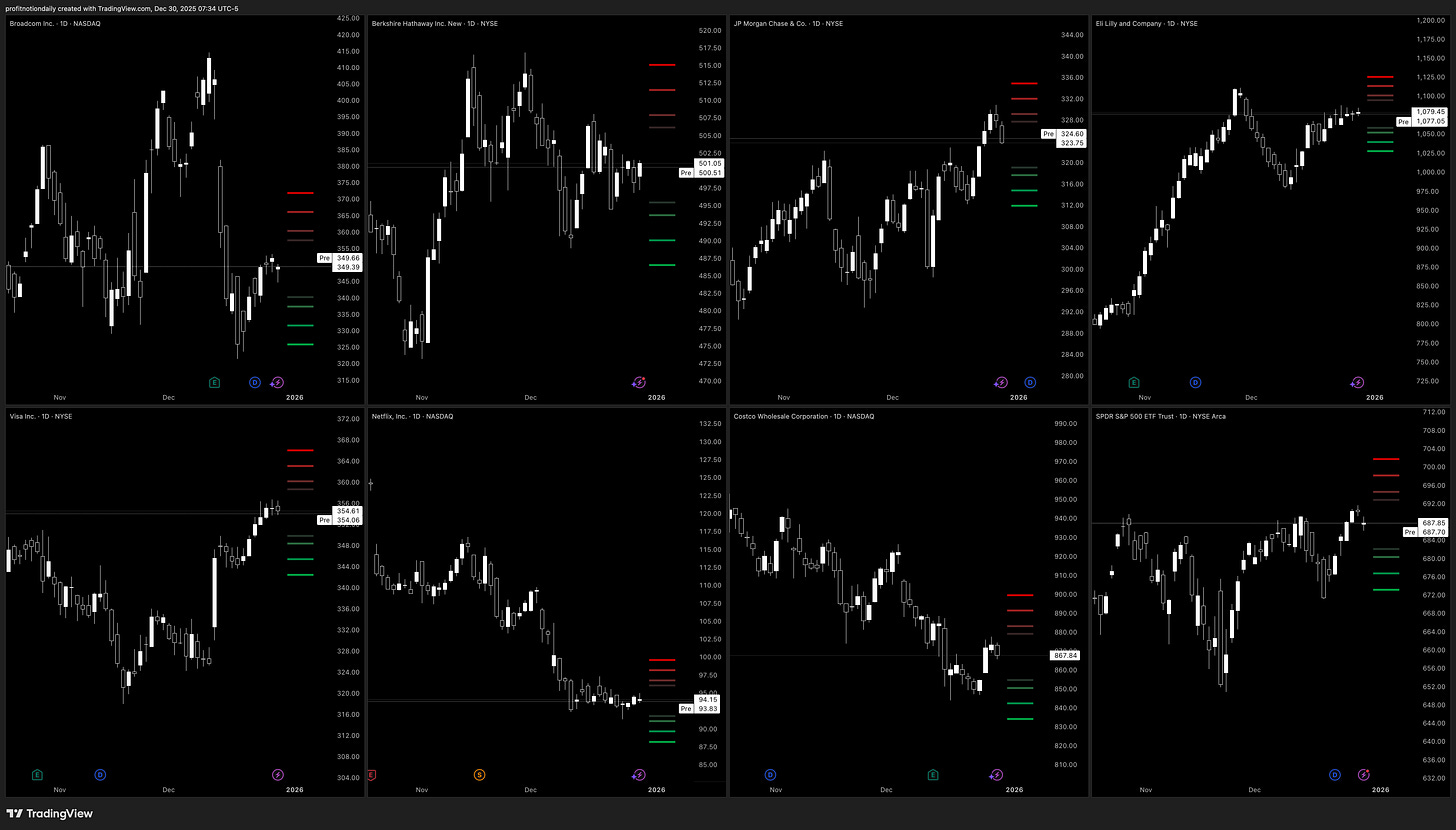

⚡️Review of Top SPY / ES Related

Overall, most tickets crawling back up, but are neutral. JPM had a nice break down, lets see if that drags us down.

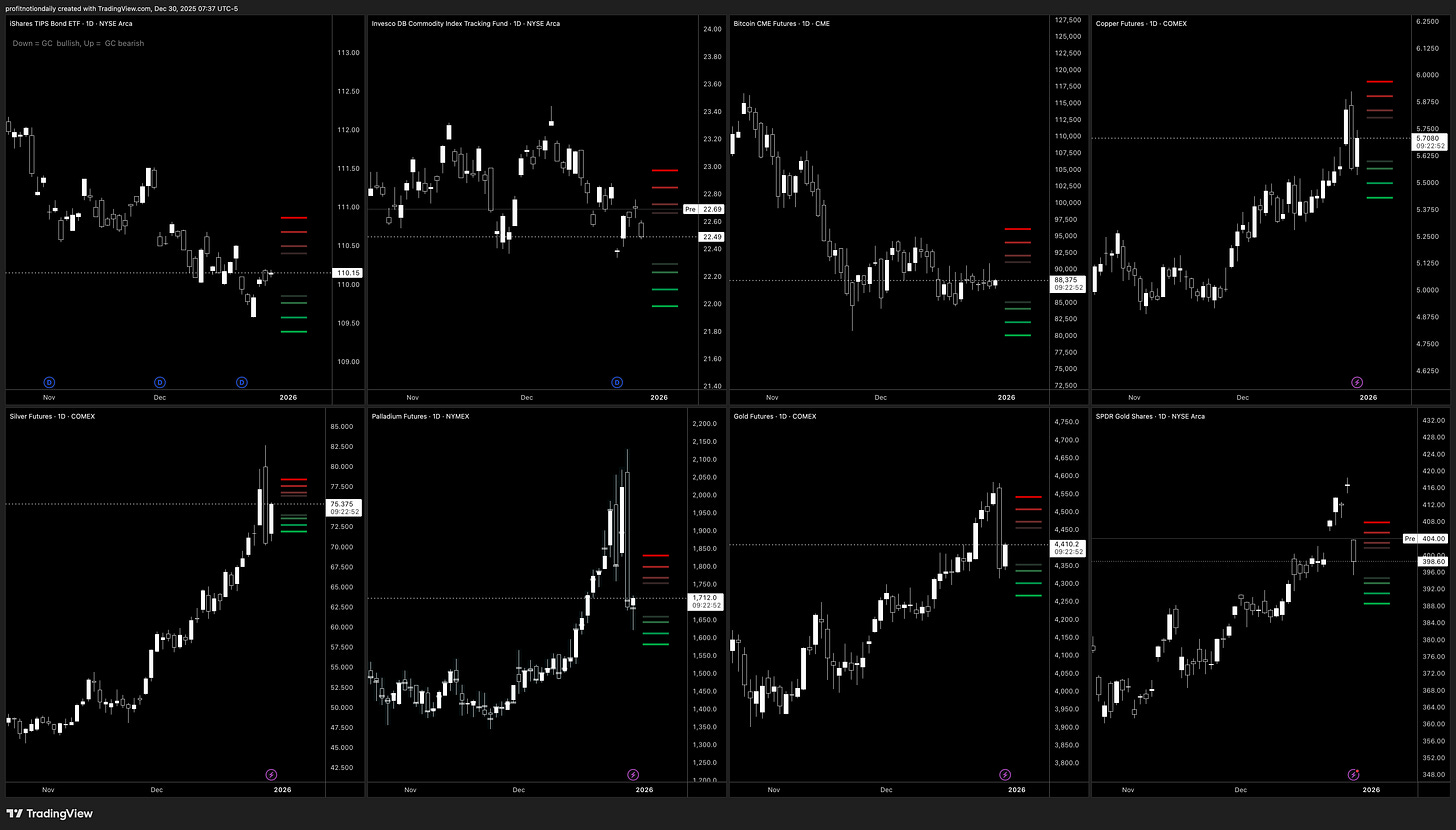

⚡️Review of Gold / GC / GLD Related Tickers

Overall, metals are trying to rebound after that big sell off. Palladium looks like the lagger, and Bitcoin continues to coil. Lets see if we keep grinding up.

🔑 Key Levels

NQ - 25850s, 25820s, 25500s - 25450s

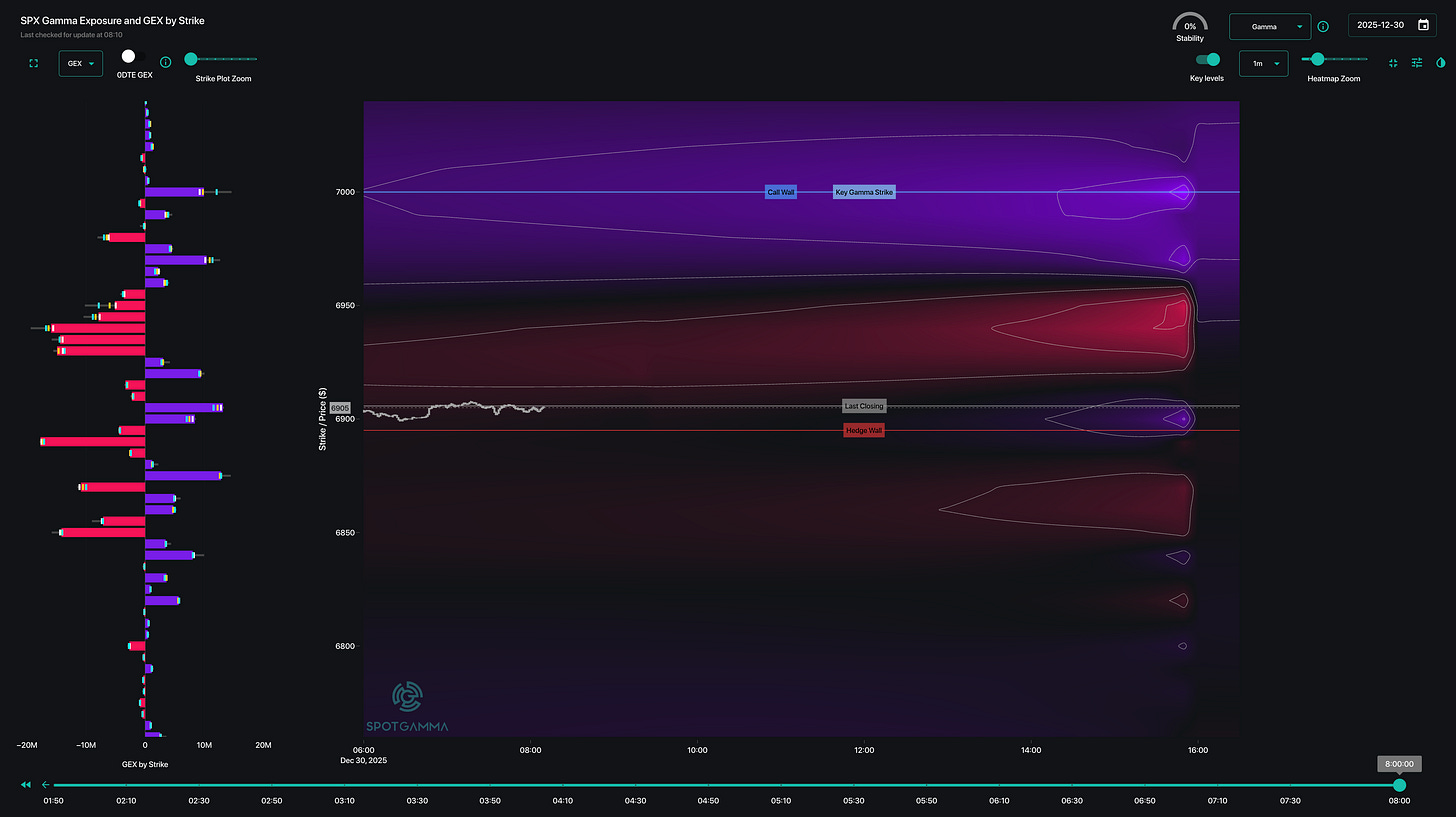

ES - 6975s, 6940s, 6920s, 6900s

GC - 4450s, 4380s, 4320s

📈 SPX Gamma Levels

Below 6900s will be interesting for bearish movement, but if we can get above 6925 maybe we really hit the santa rally.