☀️ Morning Price & Flow for January 9th

NQ ES GC Prep for Jan 9

⚡️TL;DR

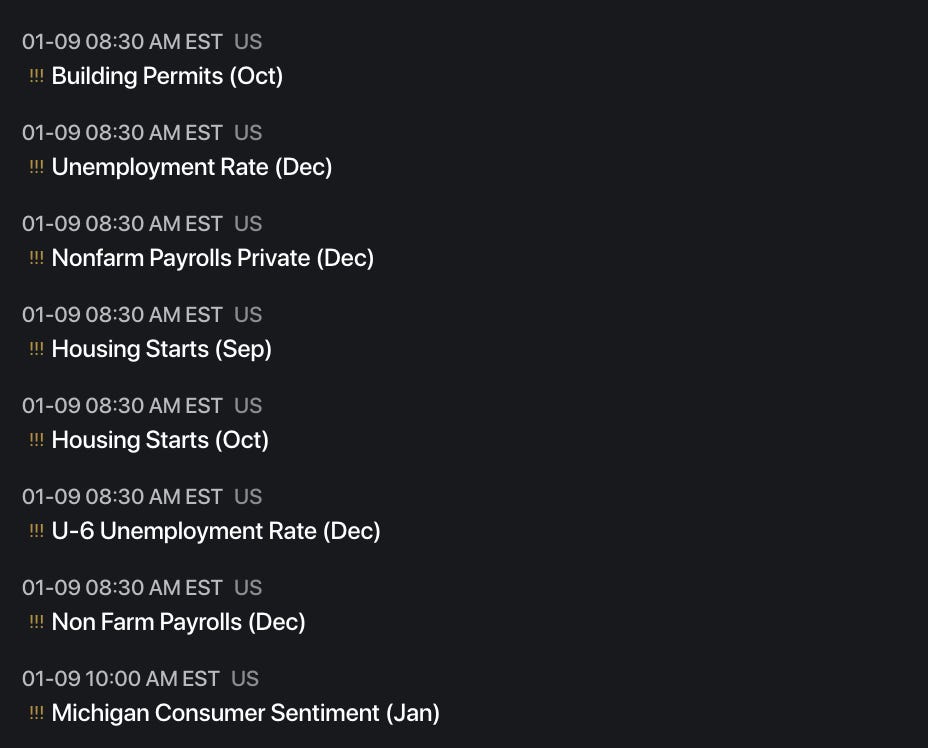

Today is NFP day, so any levels mentions could be thrown out the window when released, but still… preparation over prediction.

NQ feels neutral, ES neutral to bullish, and GC feels bullish going into the day

NQ Levels: 25950s, 25830s, 25630s, 25600s

ES Levels: 7000s, 6975s, 6950s, 6930s

GC Levels: 4500s, 4460s, 4440s, 4415s

🌐 Price & Flow

📊 Futures Indices

Price, Options Flow, Order Flow…

Price:

All indices are trending higher with RTY making new highs, and ES flirting with more highs. NQ swept recent resistance but not able to close above yet. VIX is steadily rising, but still down near 2025 lows.

Options Flow:

There is no agreement for QQQ/NDX, however, SPY/ES has more bearish flow, along with DIA/YM. Gold is bullish and VIX is slightly bullish. Russel is bullish into highs.

Order Flow:

NQ printing two negative CVD days in a row, while ES flipped green yesterday.

GC is printing increasing green CVD int he last two days. Big green CVD on YM, and neutral on RTY. Short term VIX looks like we want to increase.

Overall:

🟡 NQ feels neutral given we’re forming a wedge on the daily, options flow is mixed, and CVD is red the last two days.

🟡 ES feels mix as well, with bullish price and CVD, but bearish options flow.

🟢 GC feels the most bullish, as price push higher lows and highs pre-market, bullish options flow, and CVD climbing green in the last two days.

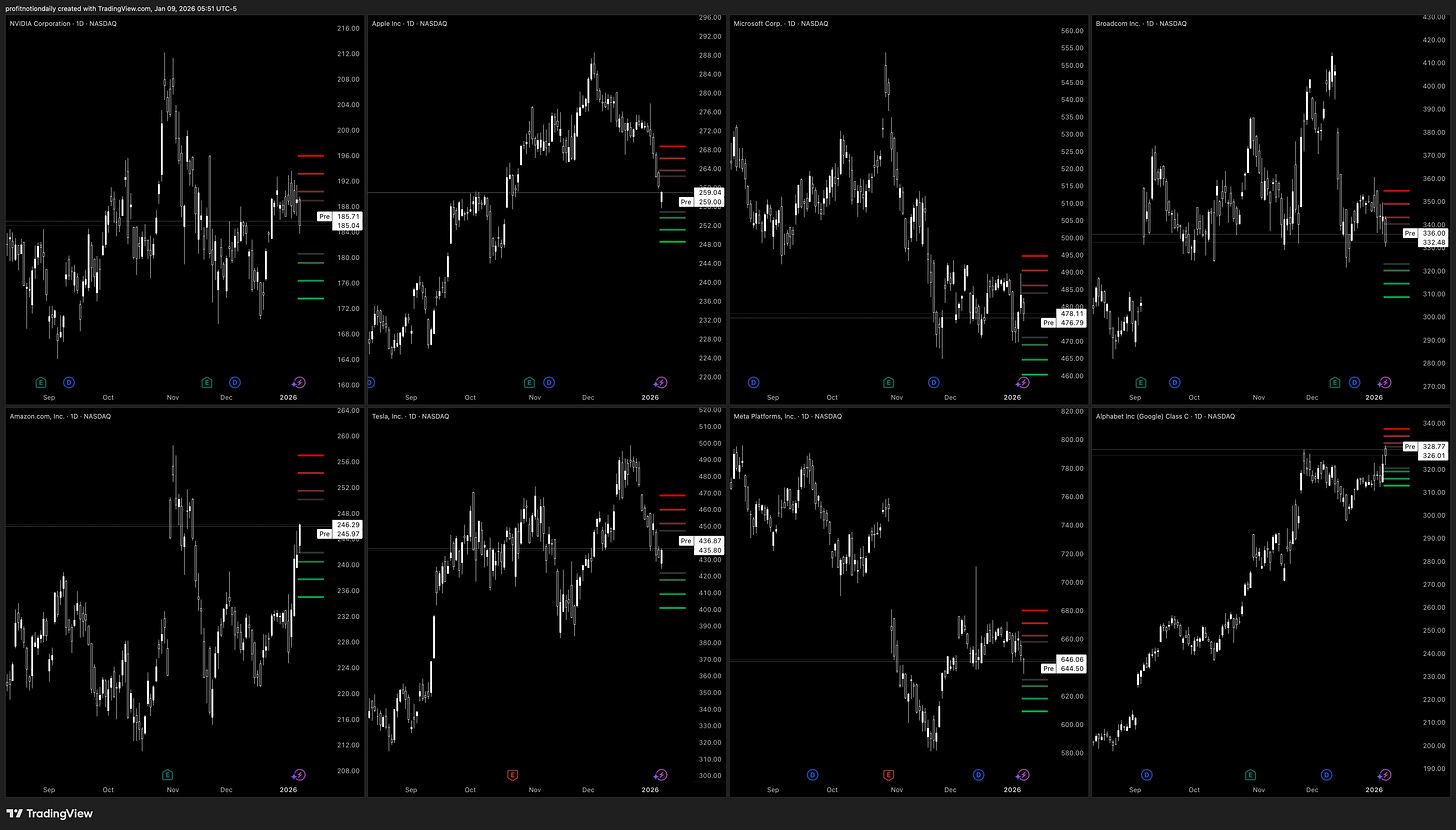

⚡️Review of Top Names QQQ (NQ), SPY (ES)

Price, Options Flow, Order Flow…

Overall: The names feel neutral to slightly bearish, but there is still some strength.

We have two names breaking out, and five breaking down in price.

NVDA trying to push up, but options flow is bearish, AAPL breaking down with red CVD, but we have bullish option flow — same for TSLA.

AMZN seems to be the most bullish where everything aligns upward.

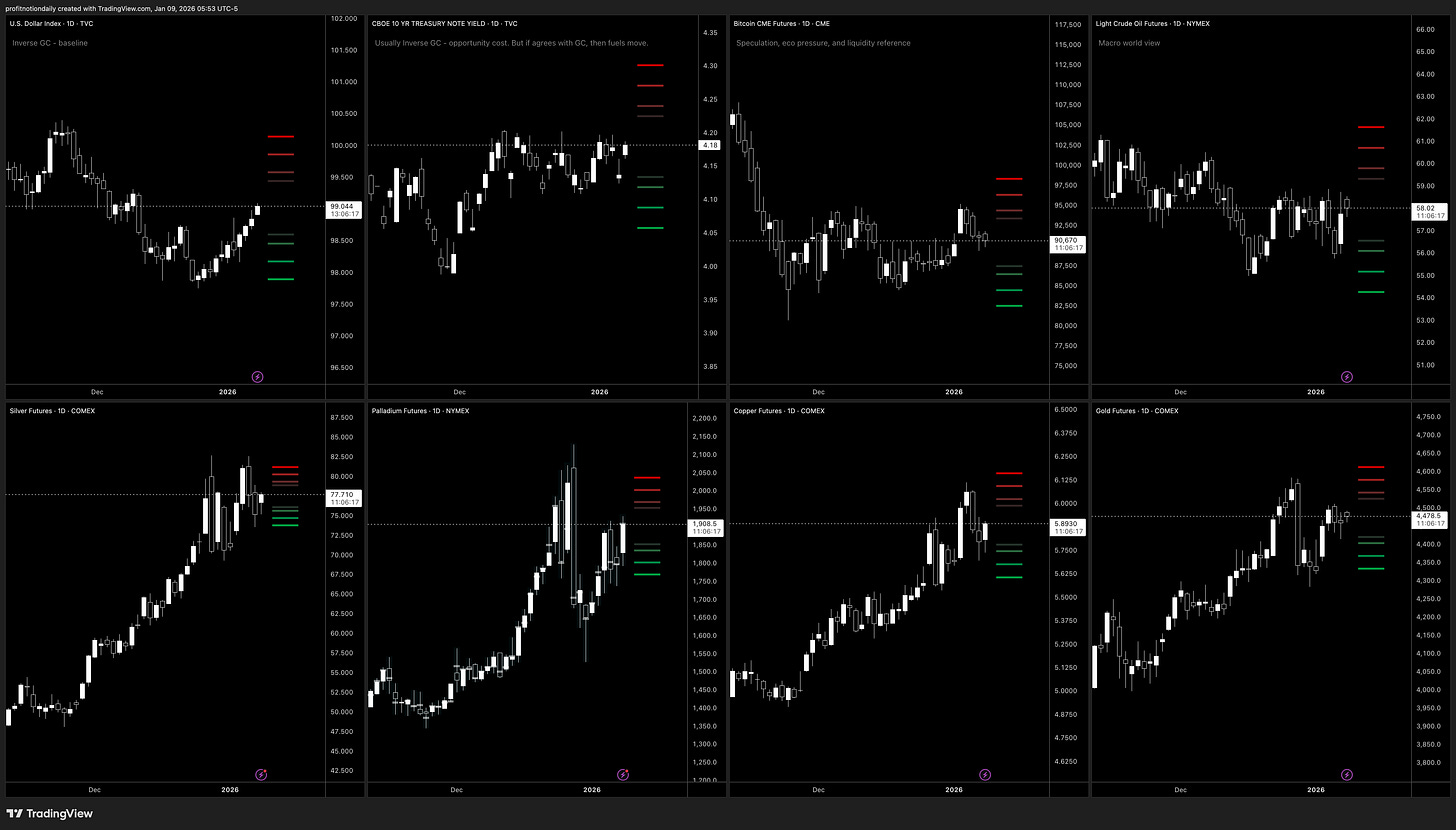

⚡️Review of Gold / Macro

Price, Options Flow…

Overall: Metals are bullish. Bitcoin is sideways with bullish options. Oil is sideways with bullish options. The dollar is showing strength so that could temper things. Treasury yields are sideways which means we could go either way.

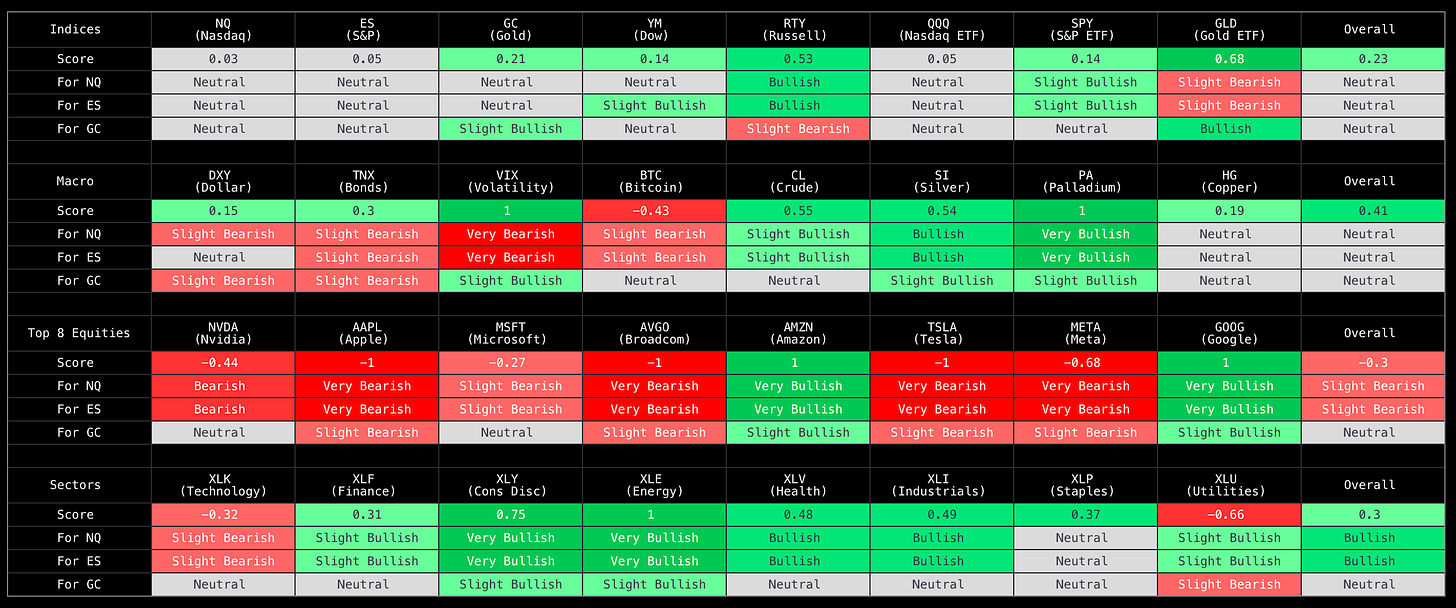

⚡️AI Powered Price Score Matrix

Proprietary matrix powered by AI that provides market breadth and what it means for NQ, ES, and GC futures.

⏱️ Daily timeframe.

⏱️ 4H timeframe

We are shifting away from slightly bullish to neutral going into Friday, with out top 8 equities slight bearish.

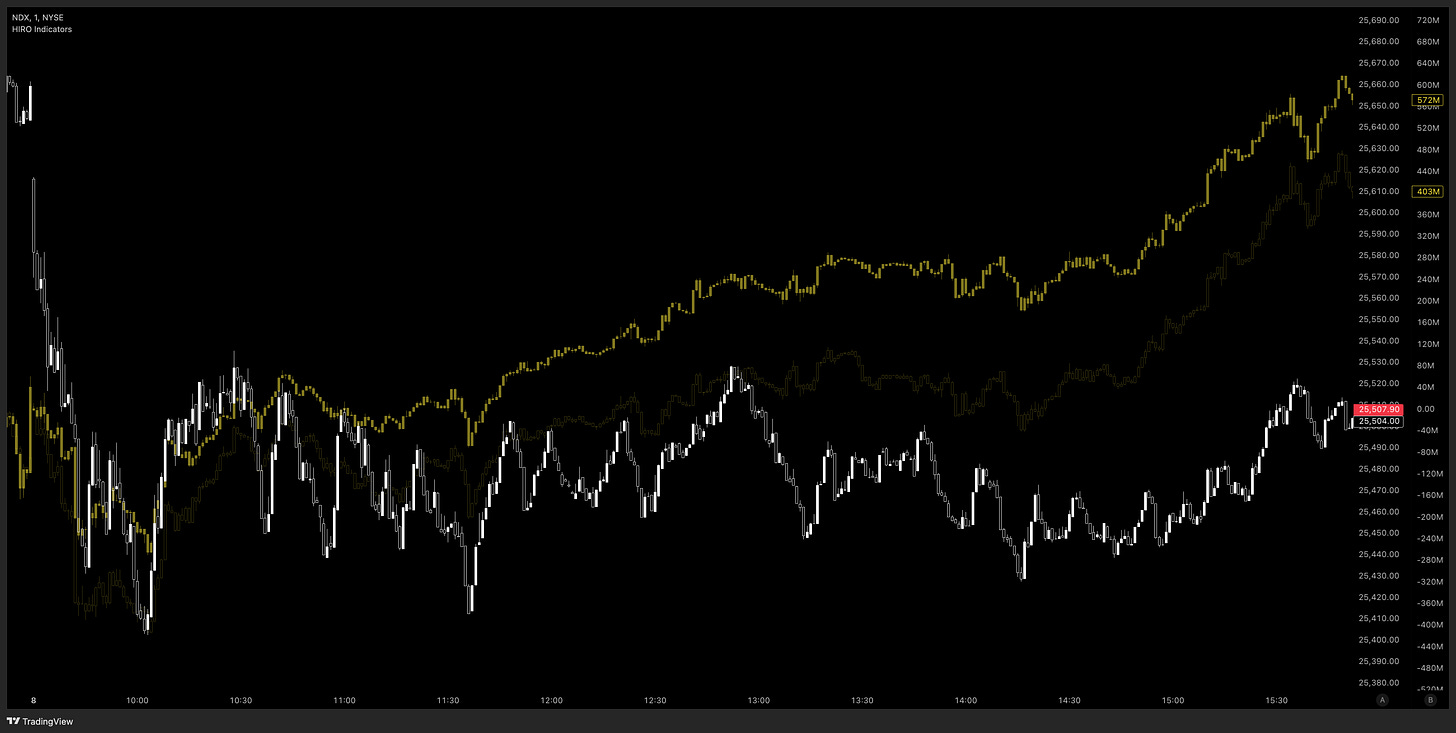

🎟️ Pre-Market Flow & Key Levels

Yesterday and Pre-market Order/Options flow using Exocharts and SpotGamma.

Bright yellow is 0DTE / short dated options, dim yellow is longer dated options flow.

⚡️NQ Review

*NDX is proxy for options

Options flow steadily increased from open to close, as price dumped and stayed sideways.

Pre-market CVD has turned green but we don’t see any massive trades placed, because NFP is coming up.

NQ Levels: 25950s, 25830s, 25630s, 25600s

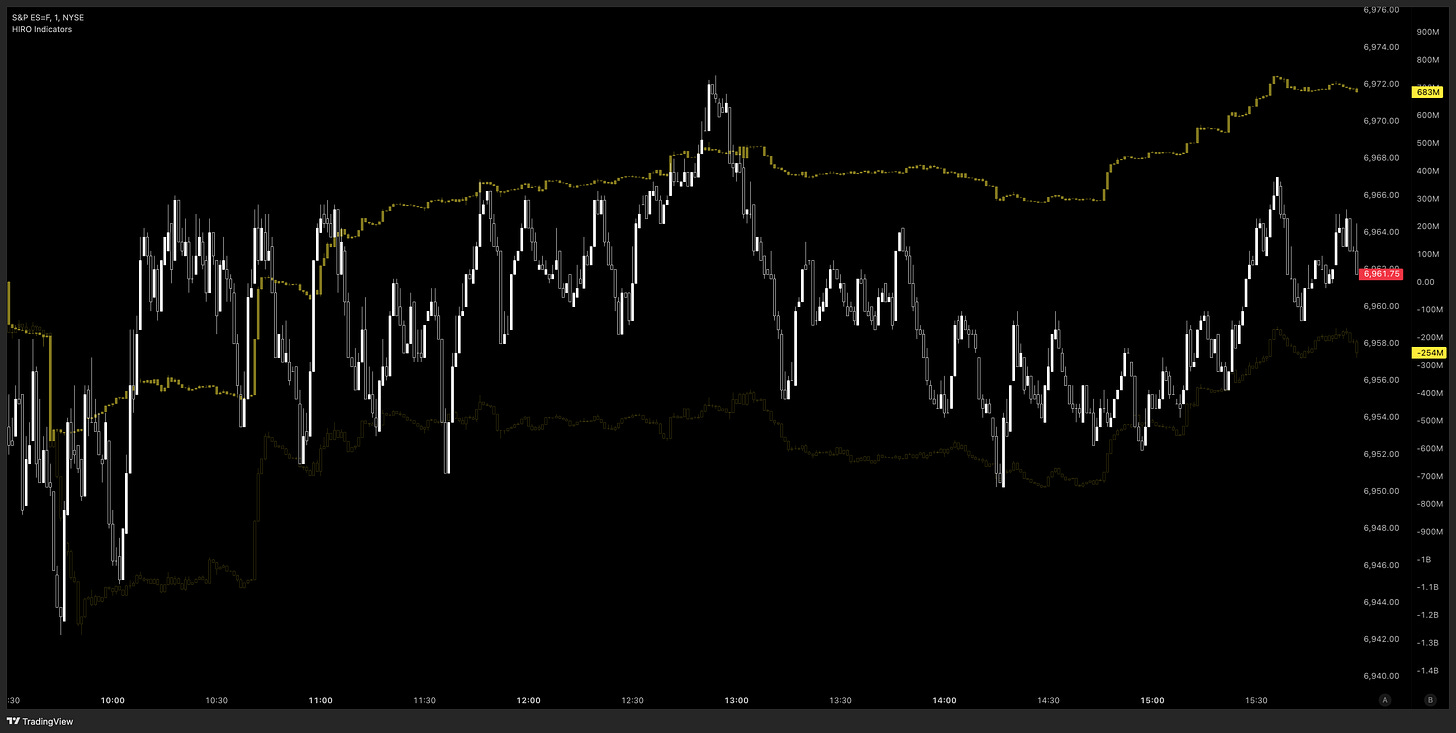

⚡️ES Review

Options flow stair stepped upward all day closing higher for both ODTE and longer-dated options premium

Strong green CVD yesterday with very big 200+ contract sell orders towards the close. Pre-market slight red so far with some shorts liquidated it looks like

(green bubble above vwap)

ES Levels: 7000s, 6975s, 6950s, 6930s

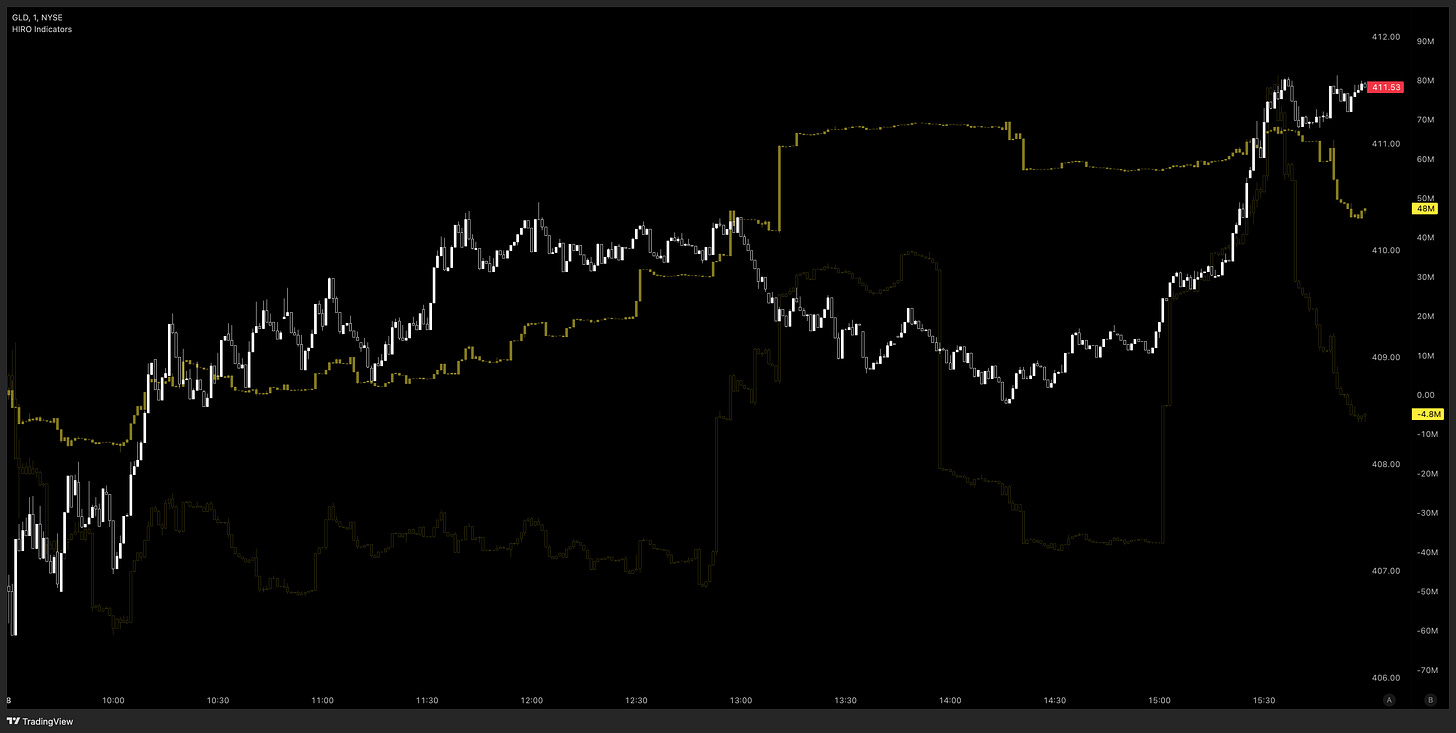

⚡️GC Review

*GLD is proxy for options

Short dated flow increased throughout the day, with a nice jump mid day, then slight sell off into the close. longer dated options flow was a roller coaster. It seems like options flow is not sure of direction.

CVD was mixed yesterday and has stayed red into pre-market. We did have a 50+ contract buy trade at VWAP recently, so maybe that’s a signal for things to come.

GC Levels: 4500s, 4460s, 4440s, 4415s

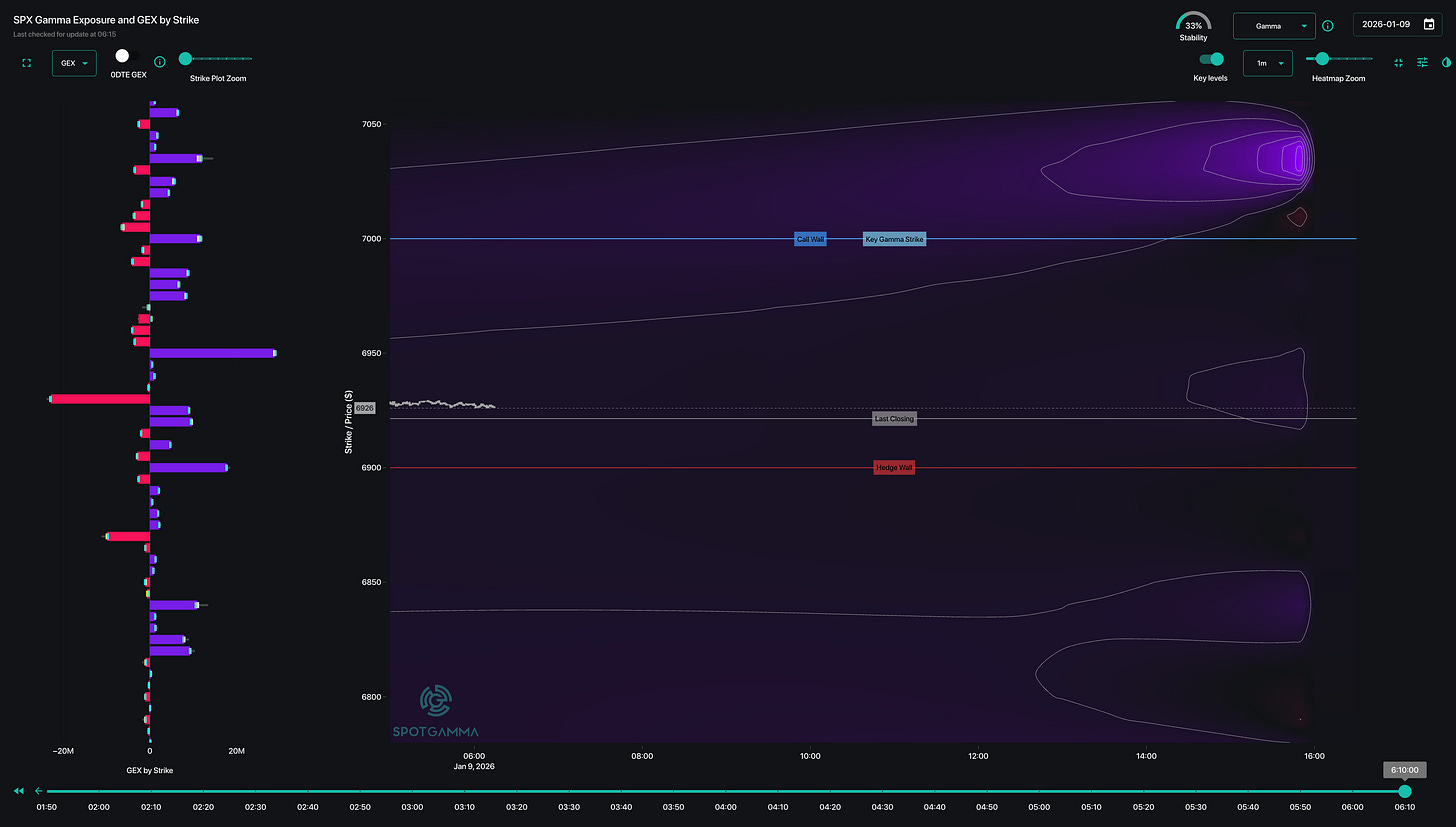

⚡️SPX TRACE

If we stay above 6930s we may shoot up to 6950s, and if we clear that then may up to 6975s. Will be watching if we can stay above 6900s all day, after NFP.

📅 Important Events

Donald Trump on Truth Social: Venezuela is releasing large numbers of political prisoners as a sign of “Seeking Peace.

Trump: Instructing my representatives to buy $200 bln dollars in mortgage bonds. - Truth Social

OpenAI: Introducing OpenAI for healthcare, January 8th, 2026.

Moody's Ratings Analyst: Substantial increase in US defence spending as proposed by President Trump for 2027 unlikely to be offset by savings or revenue.

Good luck and don’t get caught!