☀️ Morning Price & Flow | Jan 6th

NQ ES GC Prep for Jan 6th

⚡️TL;DR

Overall signals look slightly bullish, but some top names are heavy for equities

NQ Levels: 25700s, 25660s, 25530s, 25450s

ES Levels: 6960s, 6950s, 6940s, 6900s

GC Levels: 4480s, 4470s, 4460s, 4430s

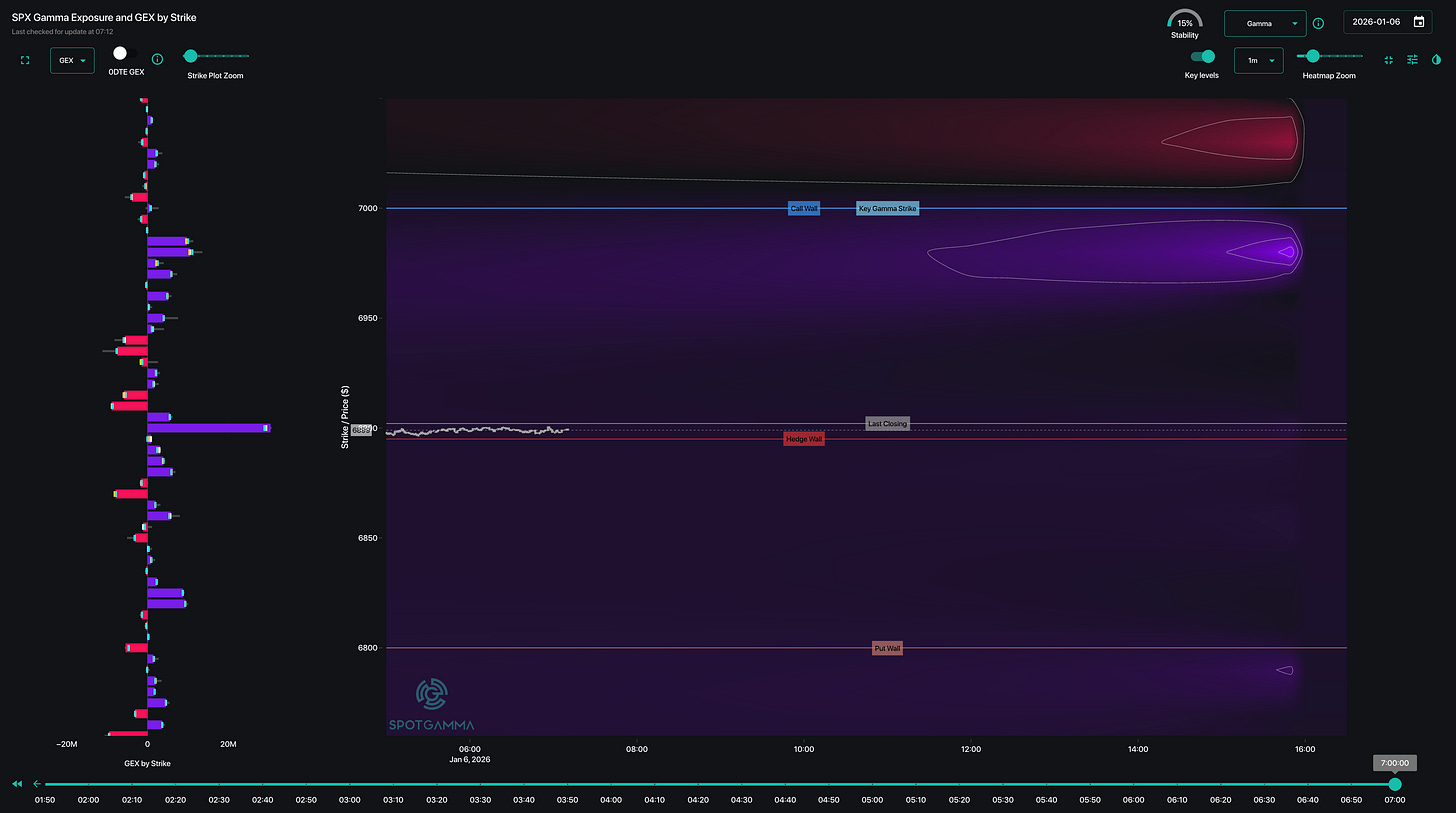

SPX positive gamma between 6880 to 6905, potential slow price range.

🌐 Price & Flow

📊 Futures Indices

Price, Options Flow, Order Flow…

YM leading us higher, followed by RTY and Gold. ES broke Friday’s high, and NQ stayed within the wide range of Friday.

NDX/QQQ/Nasdaq options flow is mixed, while SPY/ES/S&P options flow is bearish.

YM and ES cumulative order flow is positive, while NQ, GC, and RTY closed red yesterday. VIX still down but stair stepping upwards.

Overall, price is pointing up but flow is mixed for continuation upward.

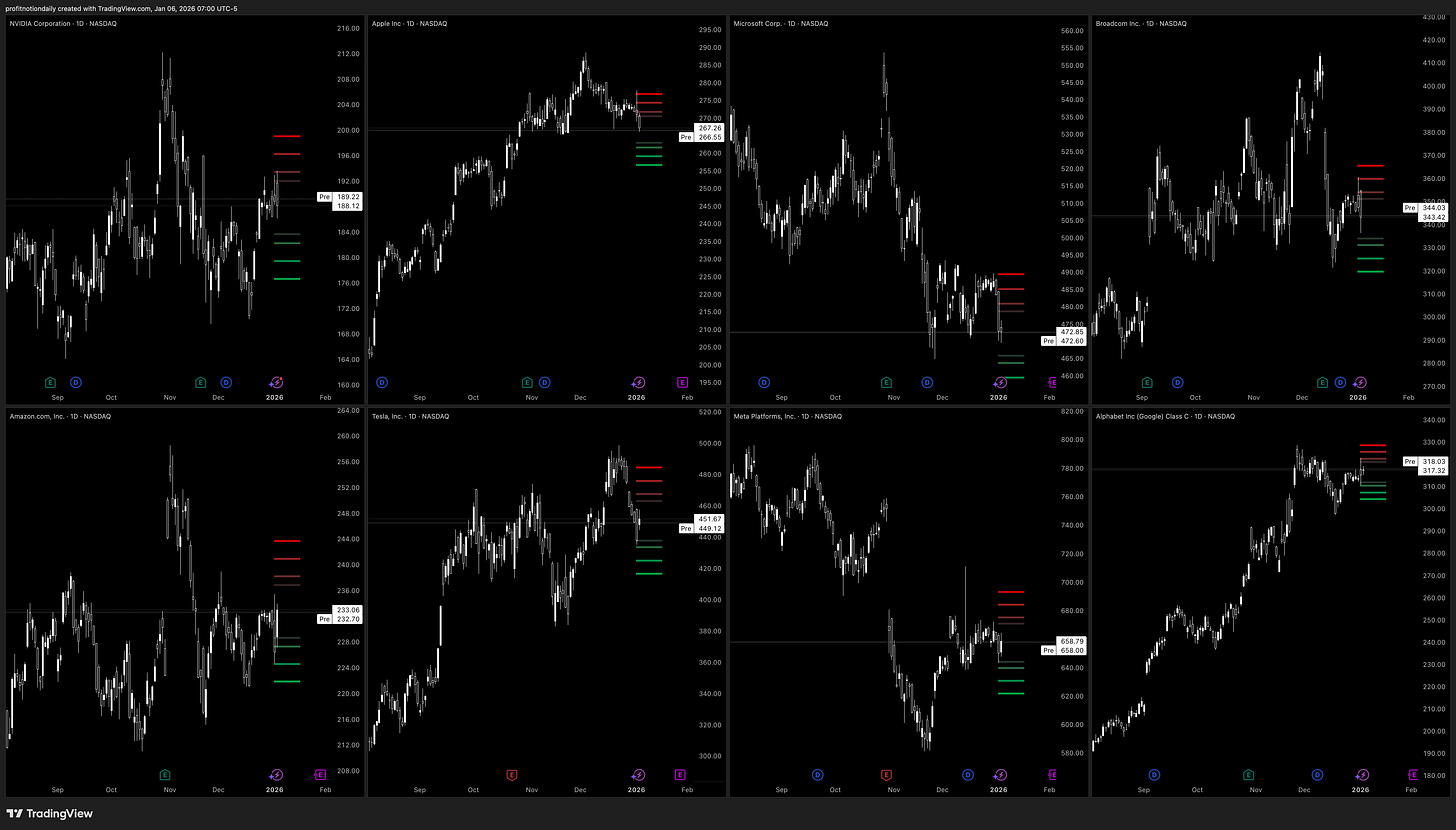

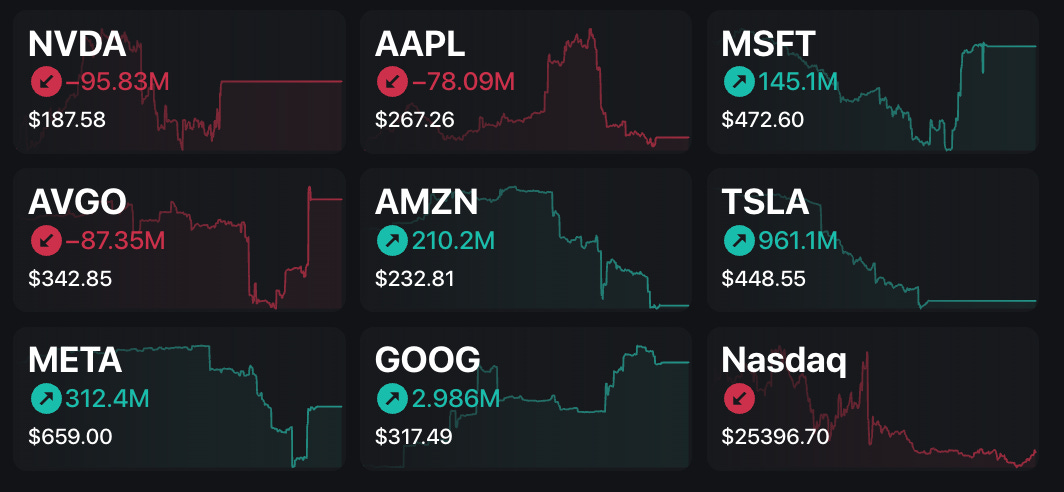

⚡️Review of Top Names QQQ (NQ), SPY (ES)

Price, Options Flow, Order Flow…

Most names breaking down with red cumulative order flow, but options flow is slight more bullish across the top eight. AMZN had a nice push up supported by CVD and options flow. AAPL, NVDA, AVGO saw the biggest bearish push across price and flow.

Overall, looks like we may be fighting to stay up, but still lots of support levels.

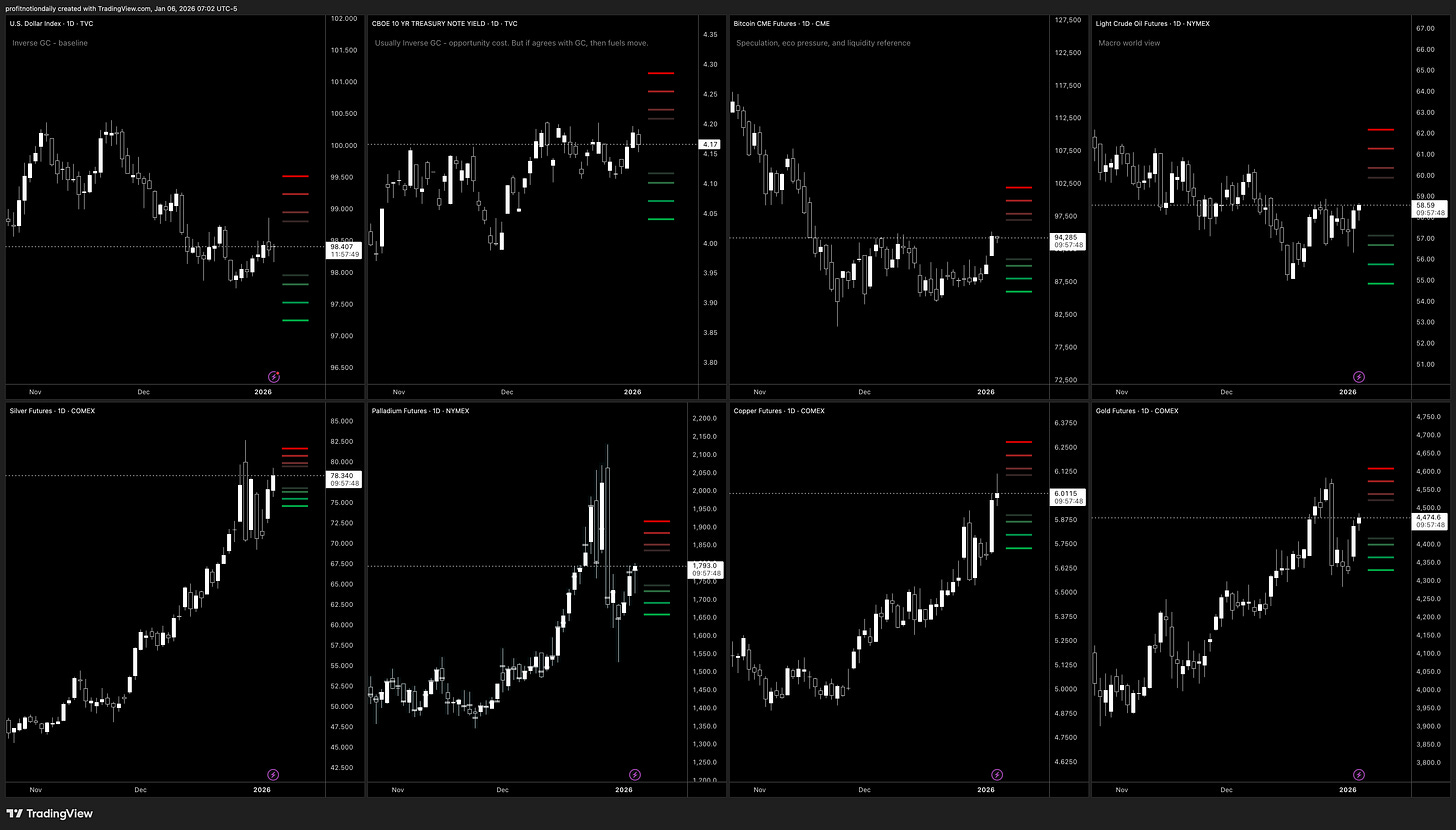

⚡️Review of Gold / Macro

Price, Options Flow…

Everything looks up - metals, bitcoin, even oil. Although, options flow for oils looks bearish to end yesterday.

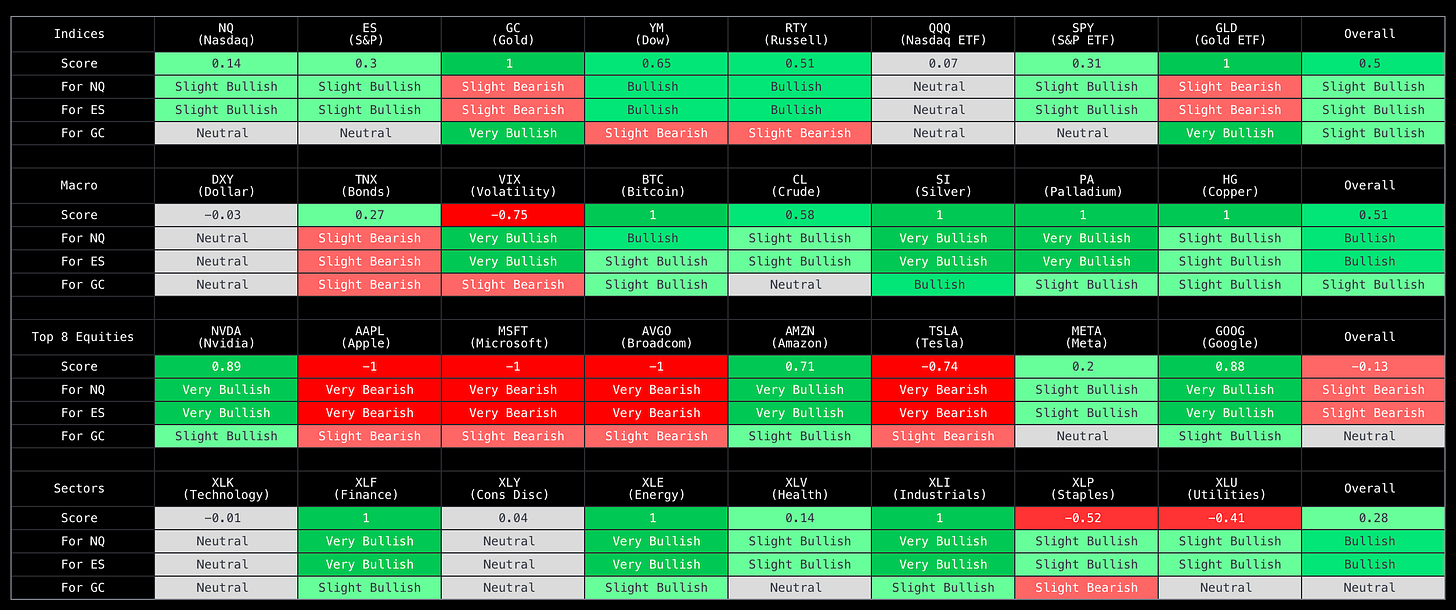

⚡️AI Powered Price Score Matrix

Proprietary matrix powered by AI that provides market breadth and what it means for NQ, ES, and GC futures.

In general, Indices are bullish, with macro, metals, and Sectors support upside.

In Top 8 equities, APPL, MSFT, AVGO, TSLA seem to be holding us slightly bearish.

Let’s see if we can flip green at the the open.

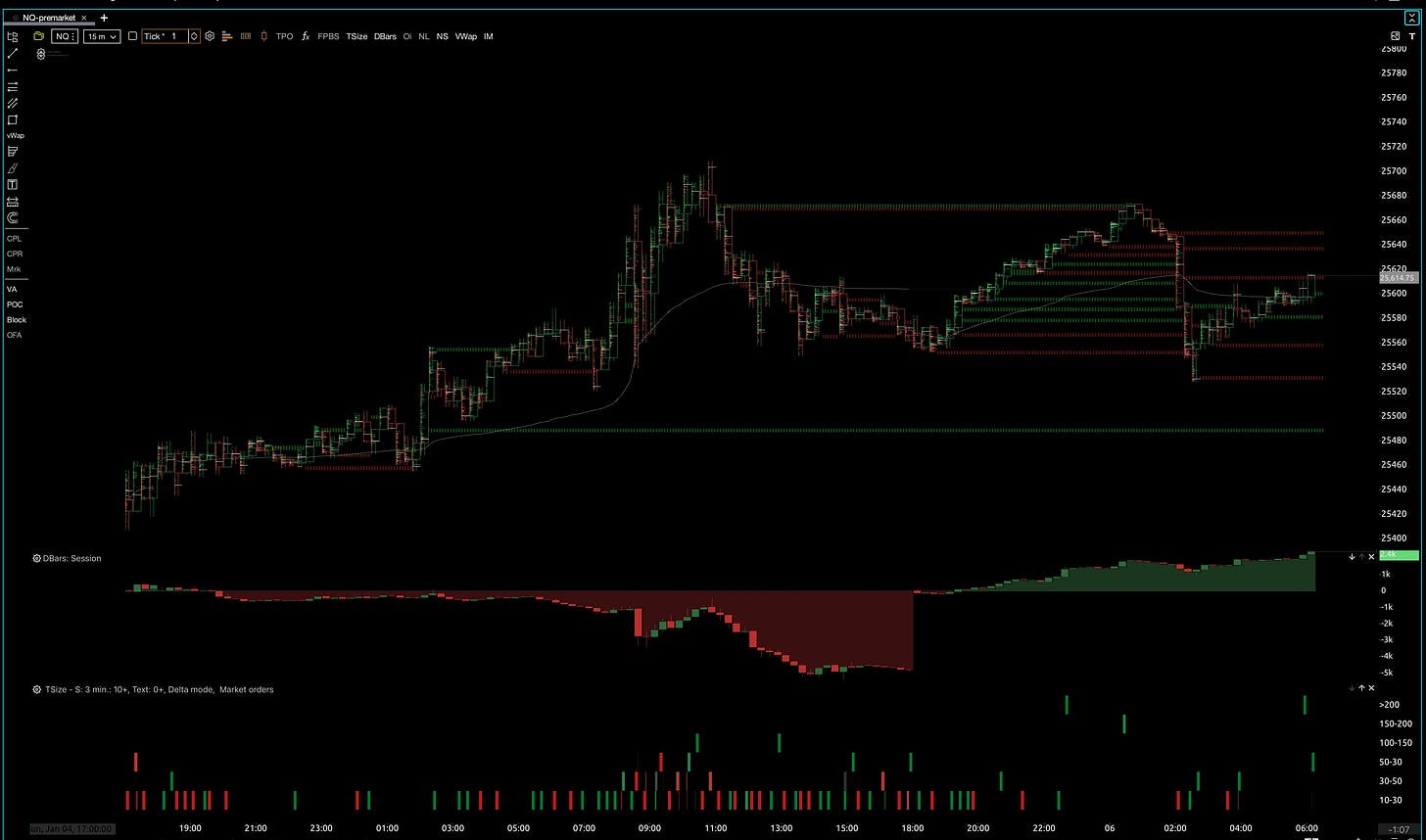

🎟️ Pre-Market Flow & Key Levels

Yesterday and Pre-market Order/Options flow using Exocharts and SpotGamma

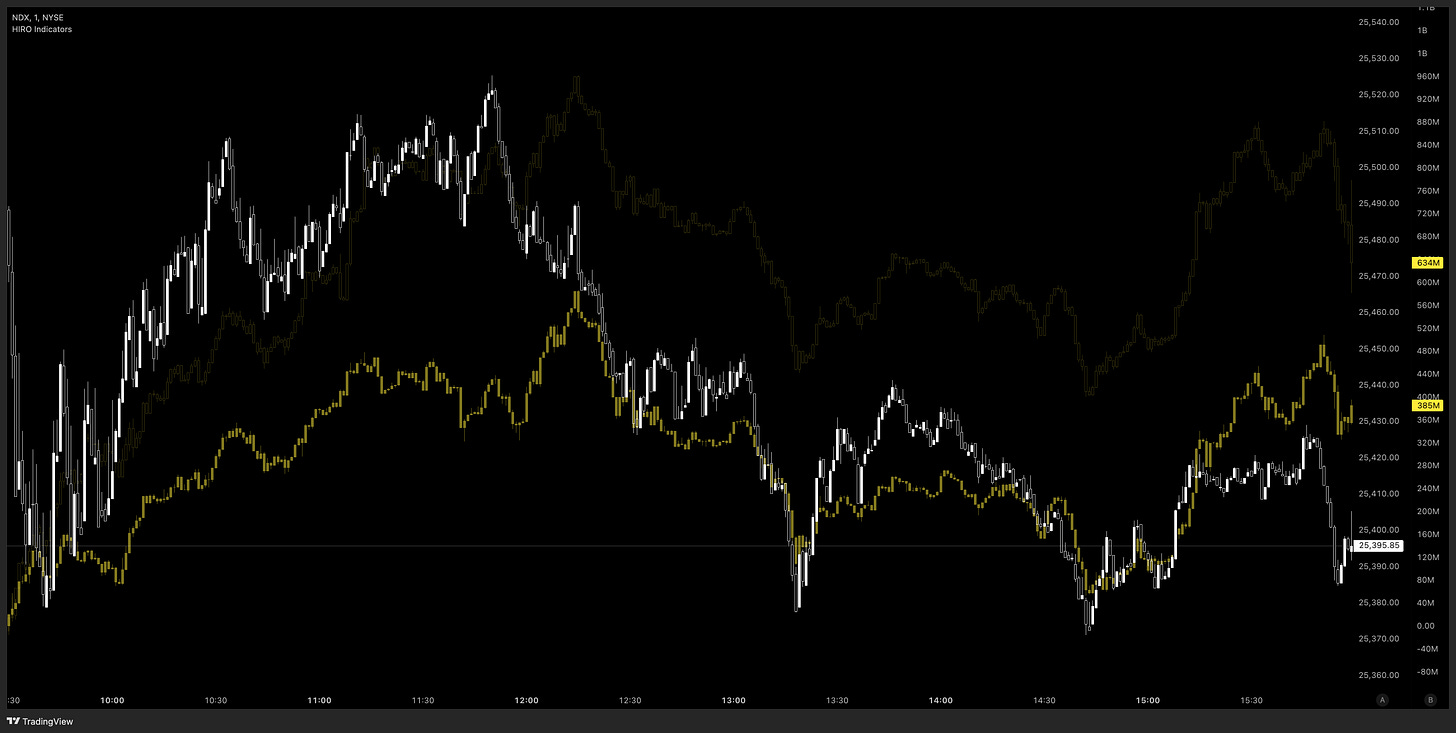

⚡️NQ Review

Options flow ended the day more positive on ODTE and longer dated options flow,

while pre-market has proven to be more bullish in CVD and large 200+ contract trades. Price did have a pullback overnight, but has been rebounding since then.

Levels: 25700s, 25660s, 25530s, 25450s

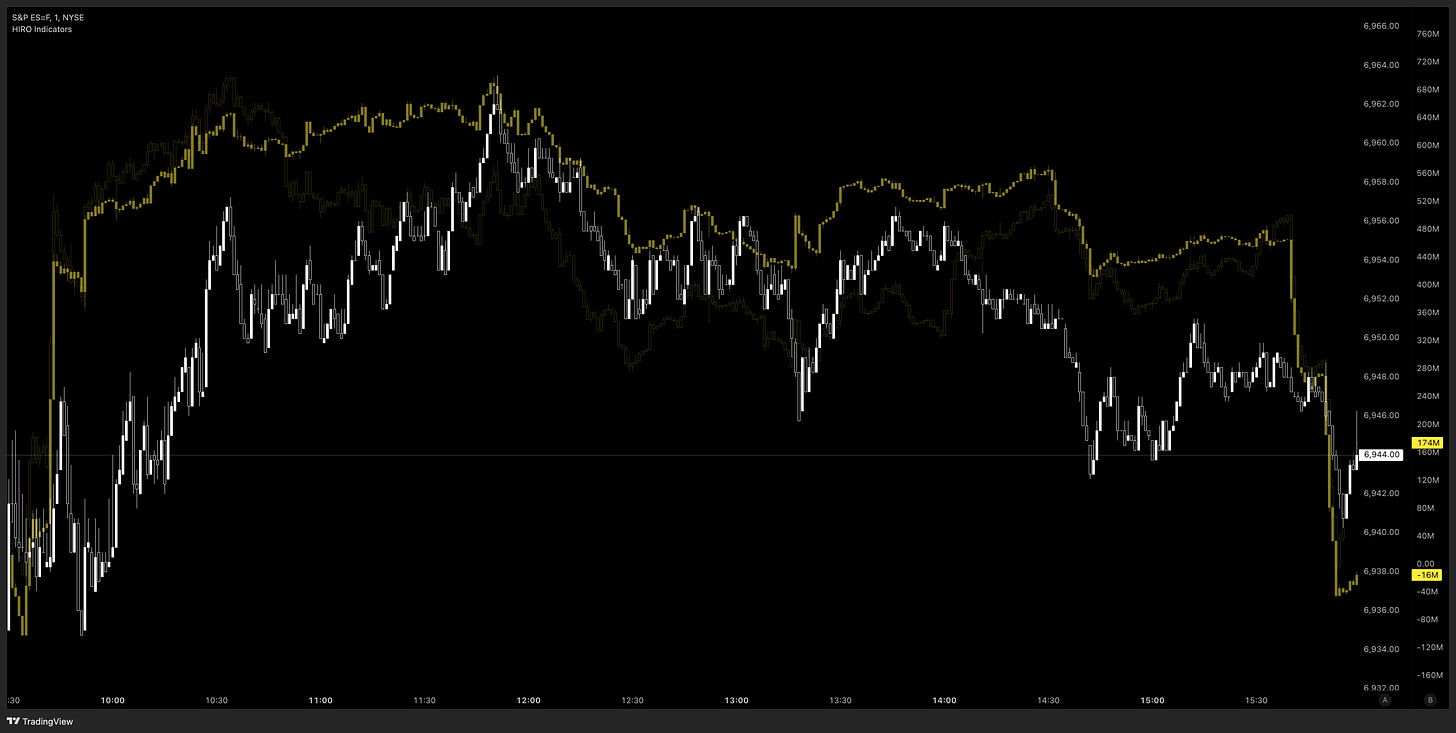

⚡️ES Review

ODTE and longer dated options flow started elevated but slowly fell bearish and ended where the day started, so upside did not sustain.

Pre-market CVD staying green, but many large 200+ contact orders being placed, signaling more upside bets. CVD is green, but has not surpassed levels from yesterday.

Levels: 6960s, 6950s, 6940s, 6900s

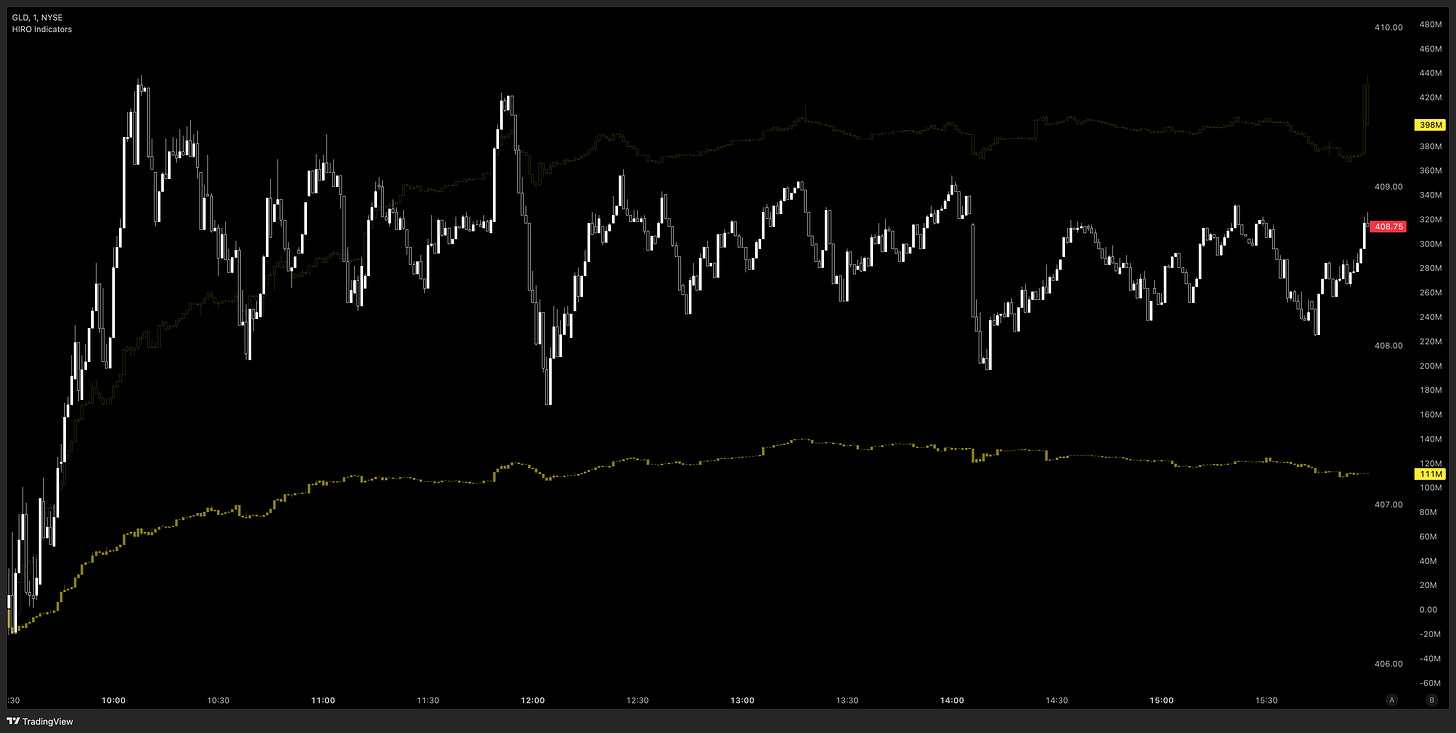

⚡️GC Review

Options flow relative flat all day yesterday, with longer dated flow having a bullish spike at end of day. CVD green overnight, but we seem to have bigger 50+ contract trades to the sell side.

Levels: 4480s, 4470s, 4460s, 4430s

⚡️SPX TRACE

Price is right below a big positive gamma level, so it may be hard to push higher at the the open. 6880 to 6905 may provide slow price movement, so lets see how things go.

📅 Important Events

Composite and Services PMI Final, FED speaker

Nvidia announces Alpamayo family of open-source AI models