☀️ Quick Price & Flow for January 7

NQ ES GC Prep for Jan 7

⚡️TL;DR

YM making new highs, with everything else looking bullish. Watching if the upside continues or we sell off at key resistance.

Signals from options flow, CVD, AI matrix is mostly bullish as of yesterday.

NQ Levels: 25950s, 25900s, 25850s, 25690s, 25600s

ES Levels: 6995s, 6980s, 6965s

GC Levels: 4900s, 4885s, 4435s, 4405s

SPX price currently trading at a big positive gamma level 6940s to 6950s

🌐 Price & Flow

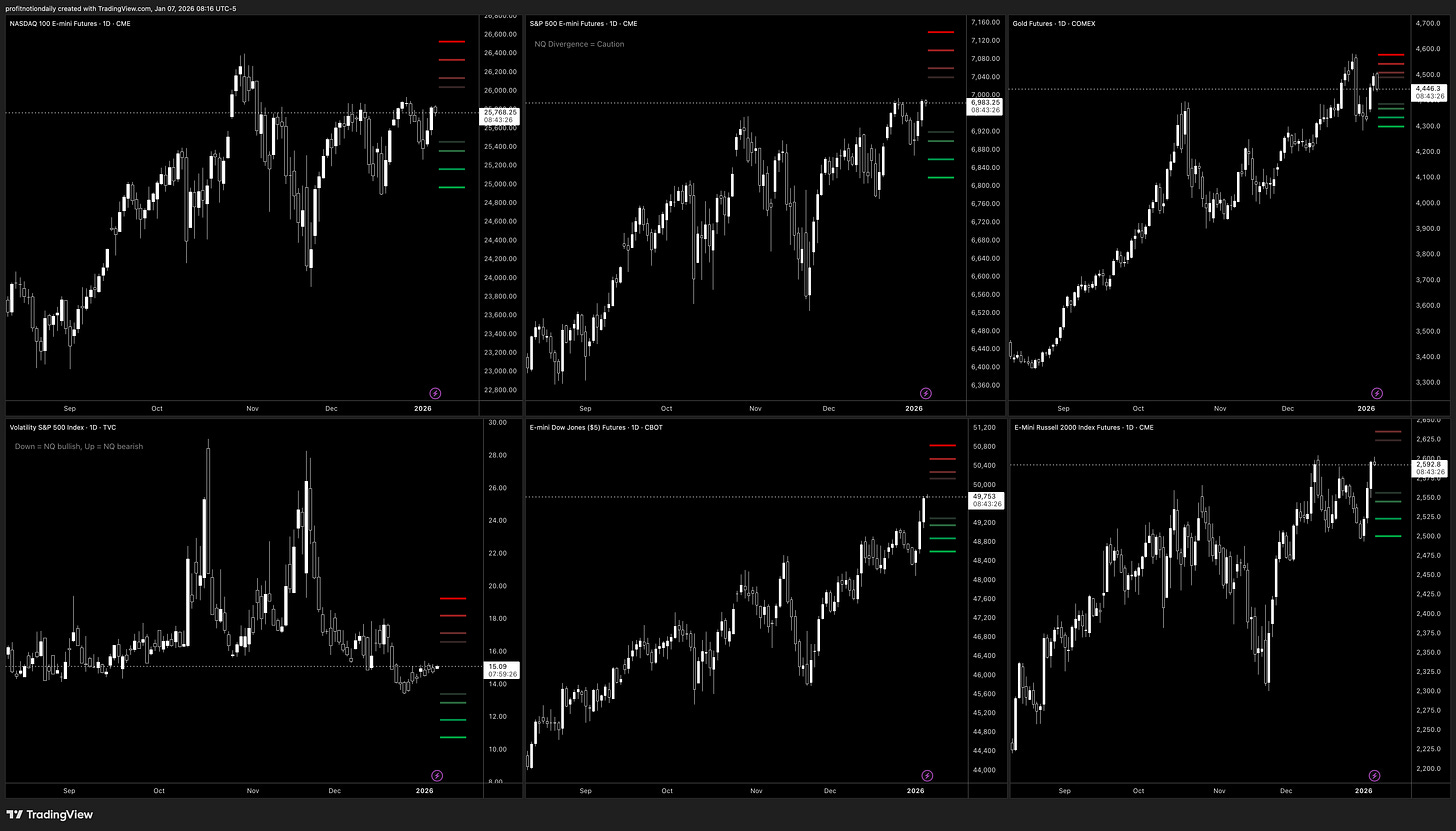

📊 Futures Indices

Price, Options Flow, Order Flow…

YM makes new highs! Interesting that CVD closed red for YM though, so will be watching that. RTY and ES are testing new highs. NQ is lagging but trying higher.

GC had a nice pull back over night, lets see if that signals a rotation out of metals into equities? YM and GC are the only indices with red CVD, the rest closed yesterday with bullish volume. Options flow ended bullish for all the indices.

Lets see if we continue upward, or sell-off at key resistance levels today.

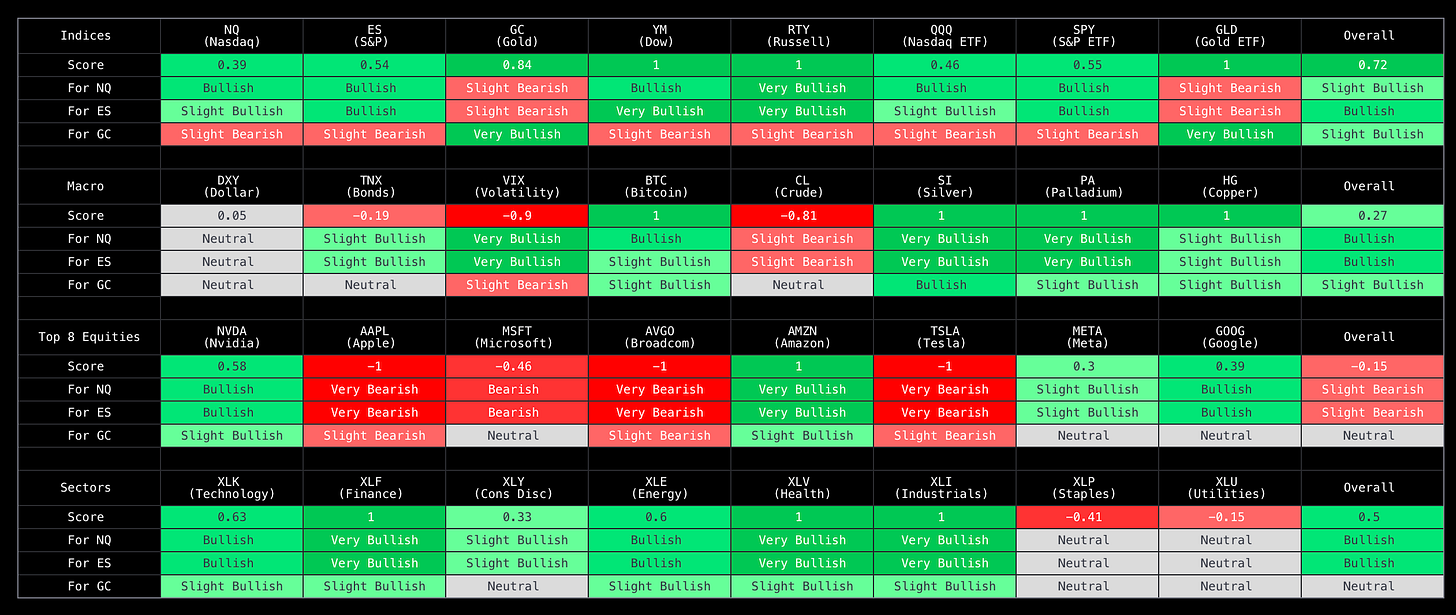

⚡️AI Powered Price Score Matrix

Proprietary matrix powered by AI that provides market breadth and what it means for NQ, ES, and GC futures.

Overall, we are bullish, with AAPL, MSFT, AVGO holding us back in the Top 8 equities. This is why NQ is lagging, but sectors, macro, and indices look bullish.

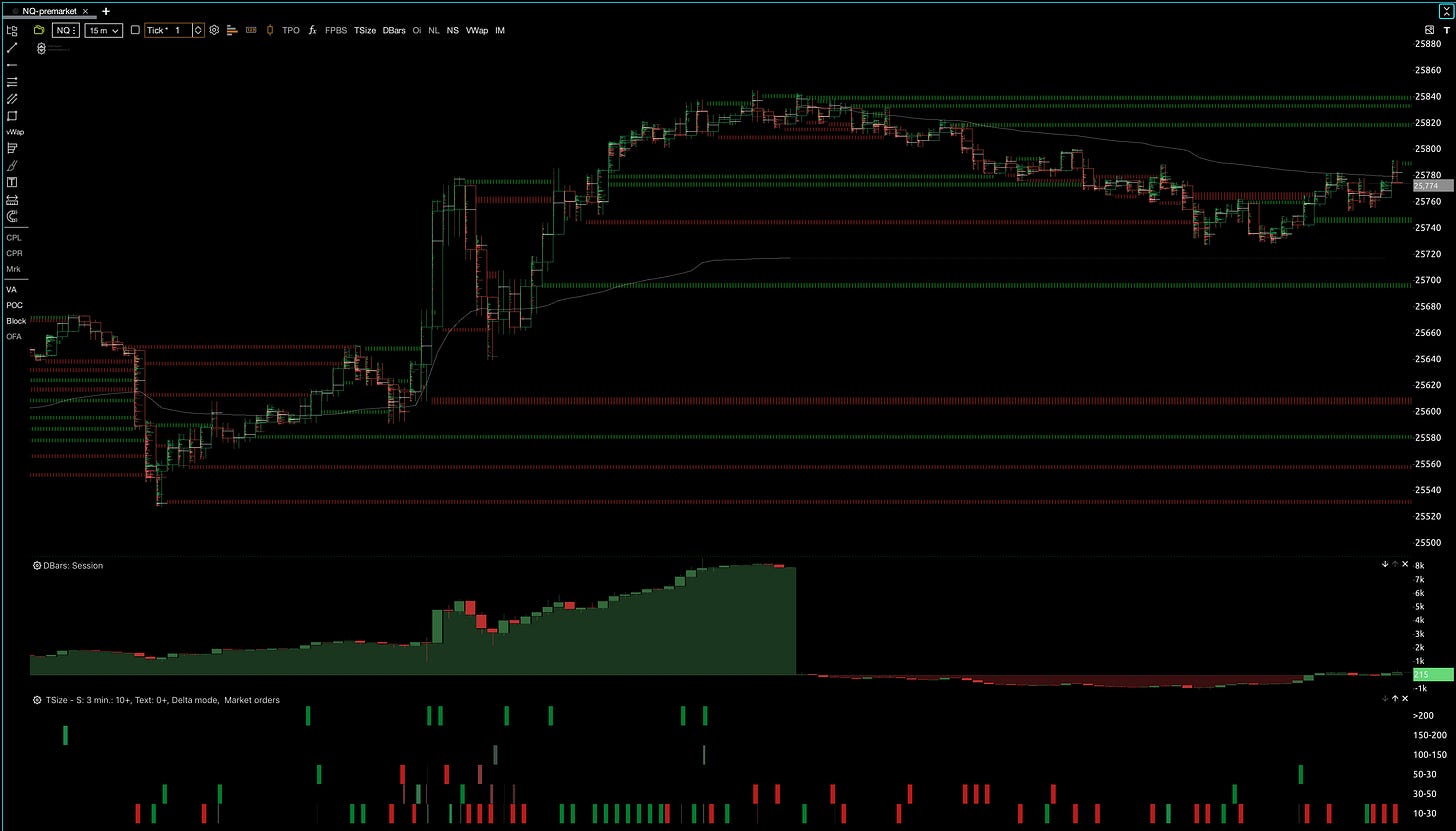

🎟️ Pre-Market Flow & Key Levels

Yesterday and Pre-market Order/Options flow using Exocharts and SpotGamma.

For options flow, bright yellow is 0DTE/short dated, dim yellow is longer dated options.

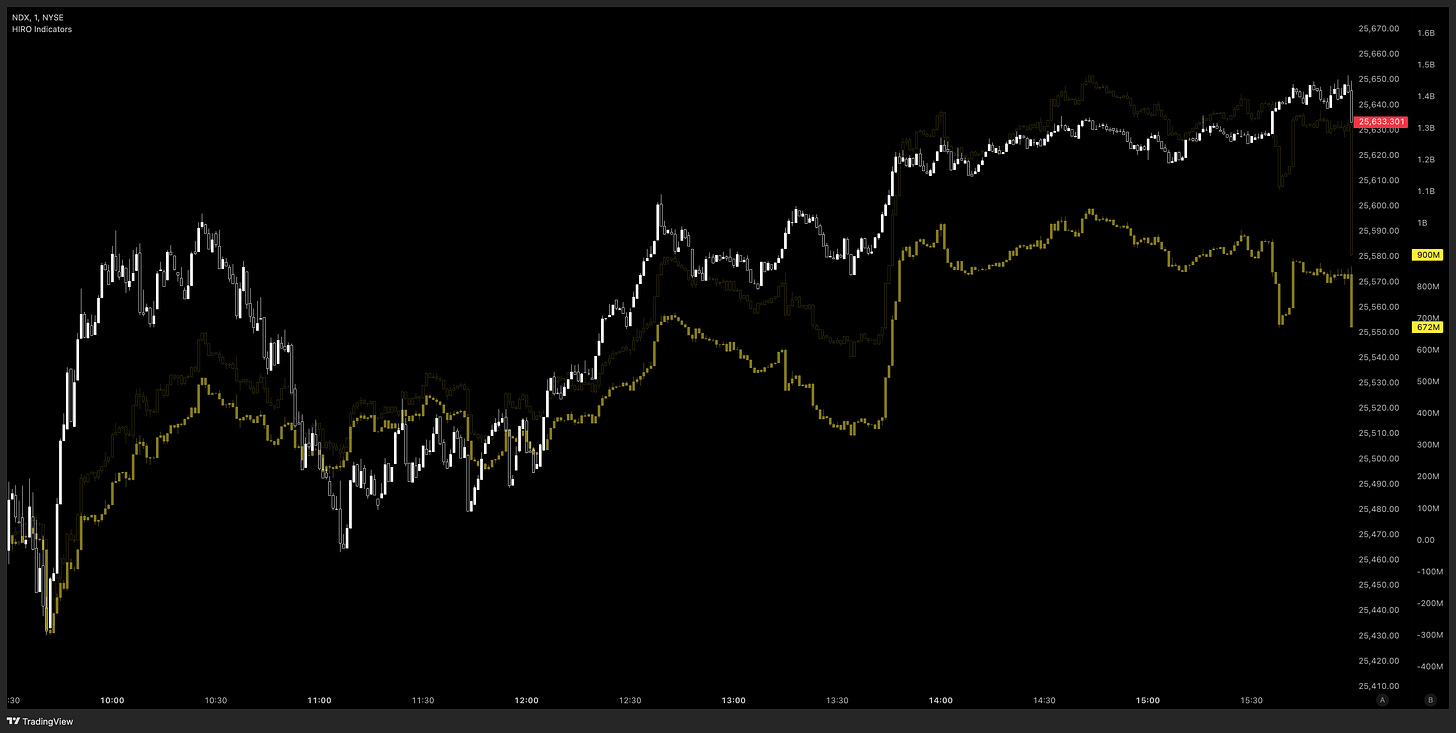

⚡️NQ Review

*NDX is proxy for options

Options flow steadily rose yesterday through the session, with longer dated options taking the lead. This signals a more bullish outlook in the coming weeks.

CVD built up very bullish yesterday, with large 200+ contract trades brining multiple times.

Overnight, CVD went red, with some medium sizable trades (30+ contracts) were consistently hitting the tape, however, CVD is neutral now. Lets see how we open.

NQ Levels: 25950s, 25900s, 25850s, 25690s, 25600s

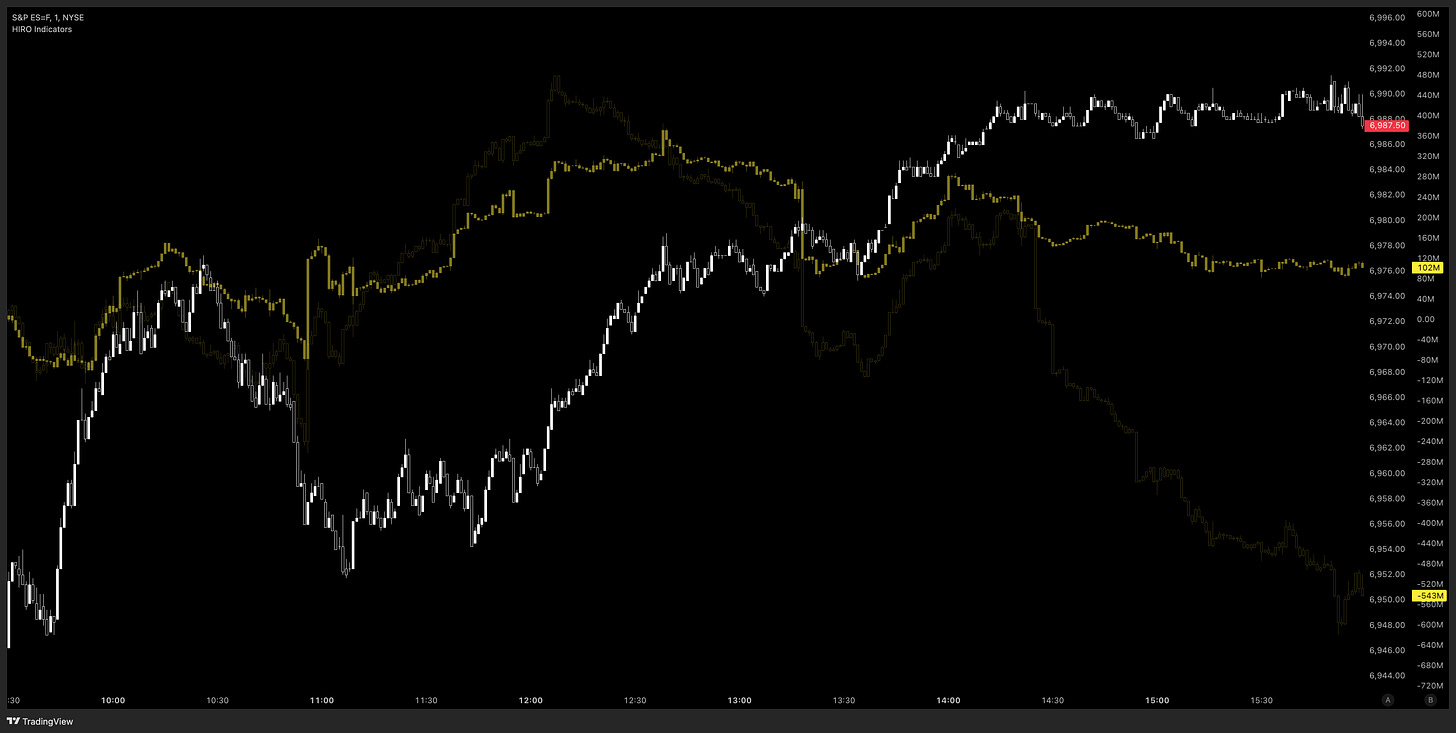

⚡️ES Review

ODTE options were elevated most of the day, but closed slight down. Longer dated options did sell off into the afternoon, signaling an expectation for lower price.

Similar to NQ, CVD built up very bullish yesterday, with large 200+ contract trades brining multiple times, but we did have a big 200+ sell trade before the RTH close.

Overnight, CVD went red, however, CVD is neutral now. Lets see how we open as we have a 30+ contract trade to the sell side.

ES Levels: 6995s, 6980s, 6965s

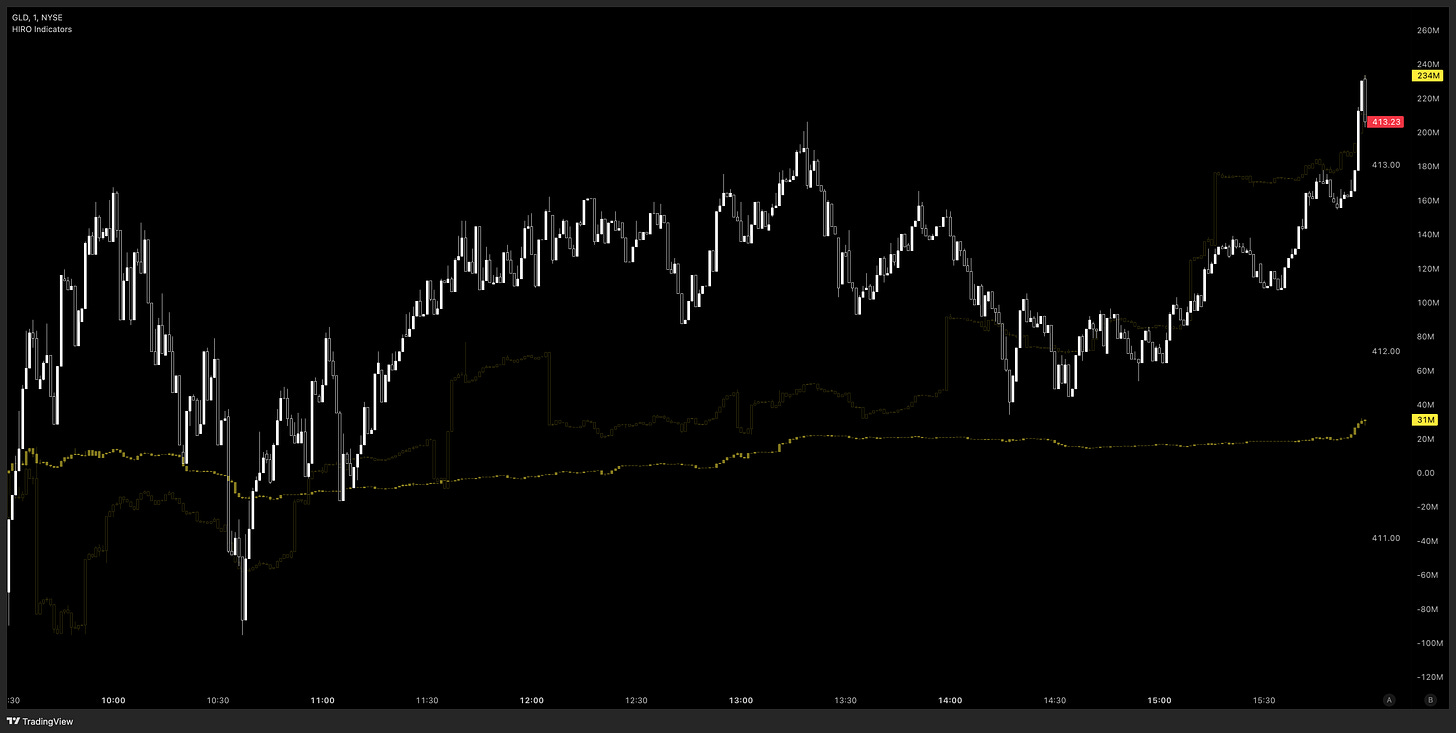

⚡️GC Review

*GLD is proxy for options

Shorted dated options flow was relatively flat, but longer dated did increase in the afternoon. This signals more upside expectations in the coming weeks.

CVD started the session green, and we’ve steadily decreased over the RTH session. Overnight CVD has turned convincingly bearish. Nice big 50+ contract sell trade in the chart below as we head into the open.

GC Levels: 4900s, 4885s, 4435s, 4405s

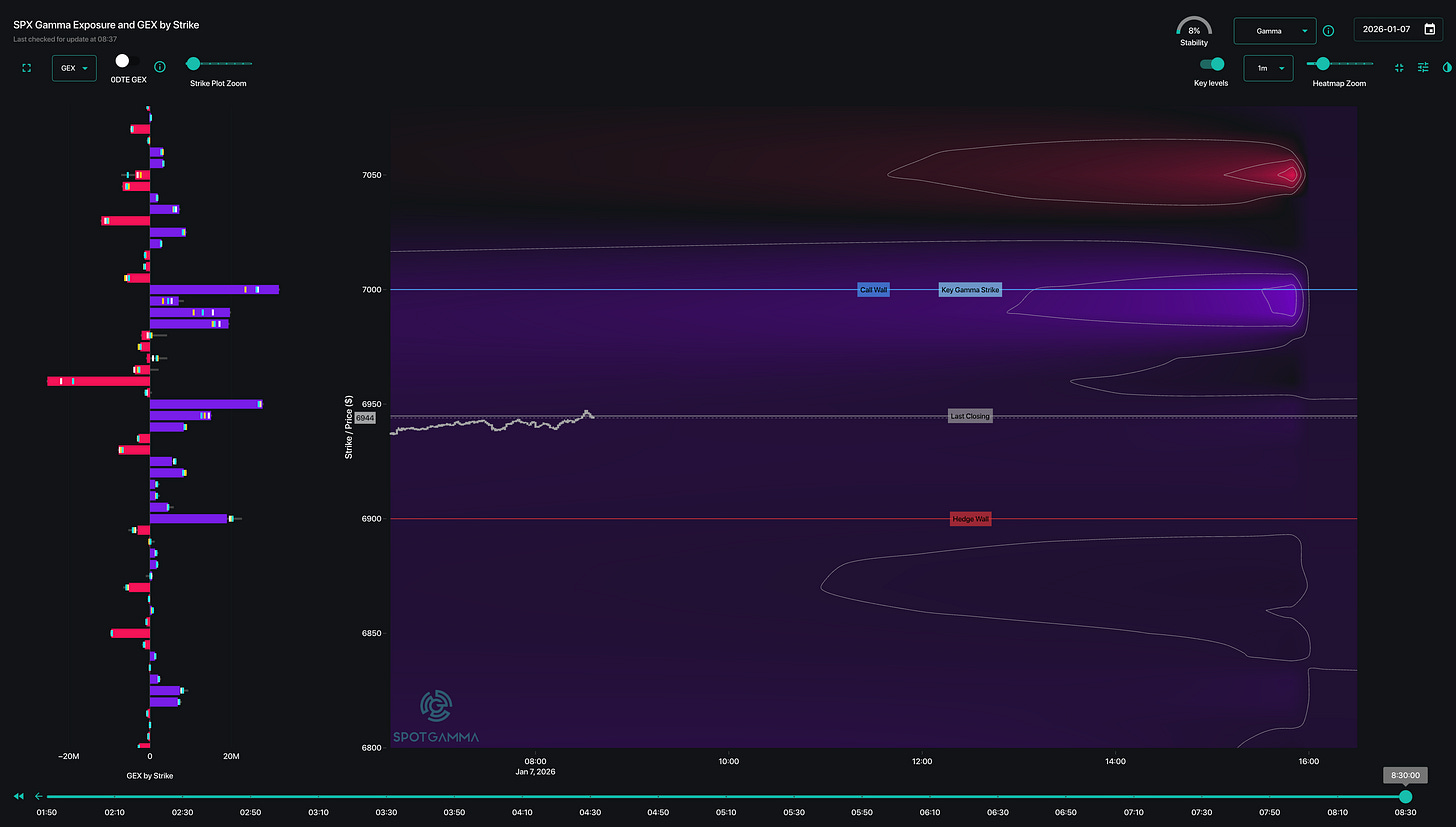

⚡️SPX TRACE

Price currently trading at a big positive gamma level 6940s to 6950s, if we can break passed that, maybe we push up to 6980s through that negative gamma pocket, or hit our next support levels around 6925 to 6900s. We could have a quick move up, or a slow grind lower into support.

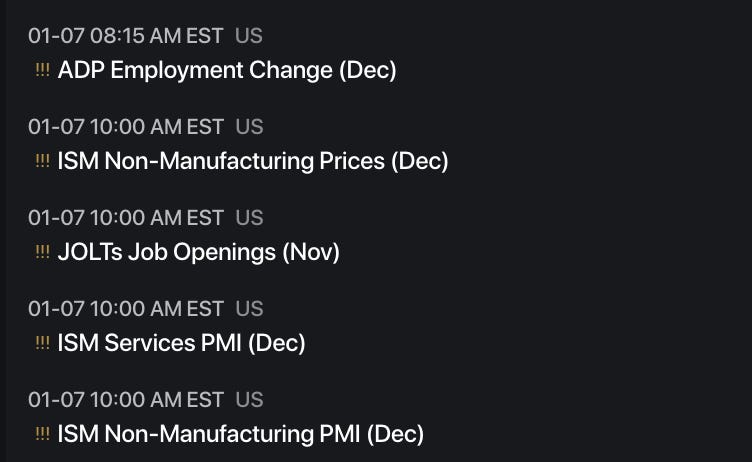

📅 Important Events

US Energy Secretary Wright: The US wants to import parts, equipment, and services to rebuild the Venezuelan oil industry