☀️ Quick Price & Flow for January 8th

NQ ES GC Prep for Jan 8

⚡️TL;DR

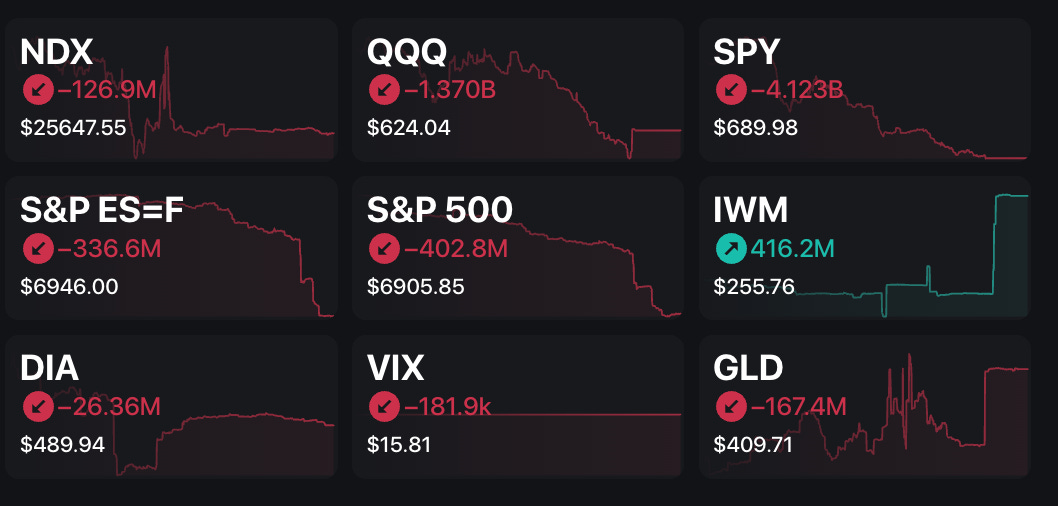

RTY seems like the most bullish Indices while it holds yesterday’s low with green options volume and CVD. Everything else broke low with bearish flow.

NQ Levels: 25900s, 25825s, 25700s, 25625s

ES Levels: 7000s, 6980s, 6930s

GC Levels: 4480s, 4450s, 4430s, 4410s

🌐 Price & Flow

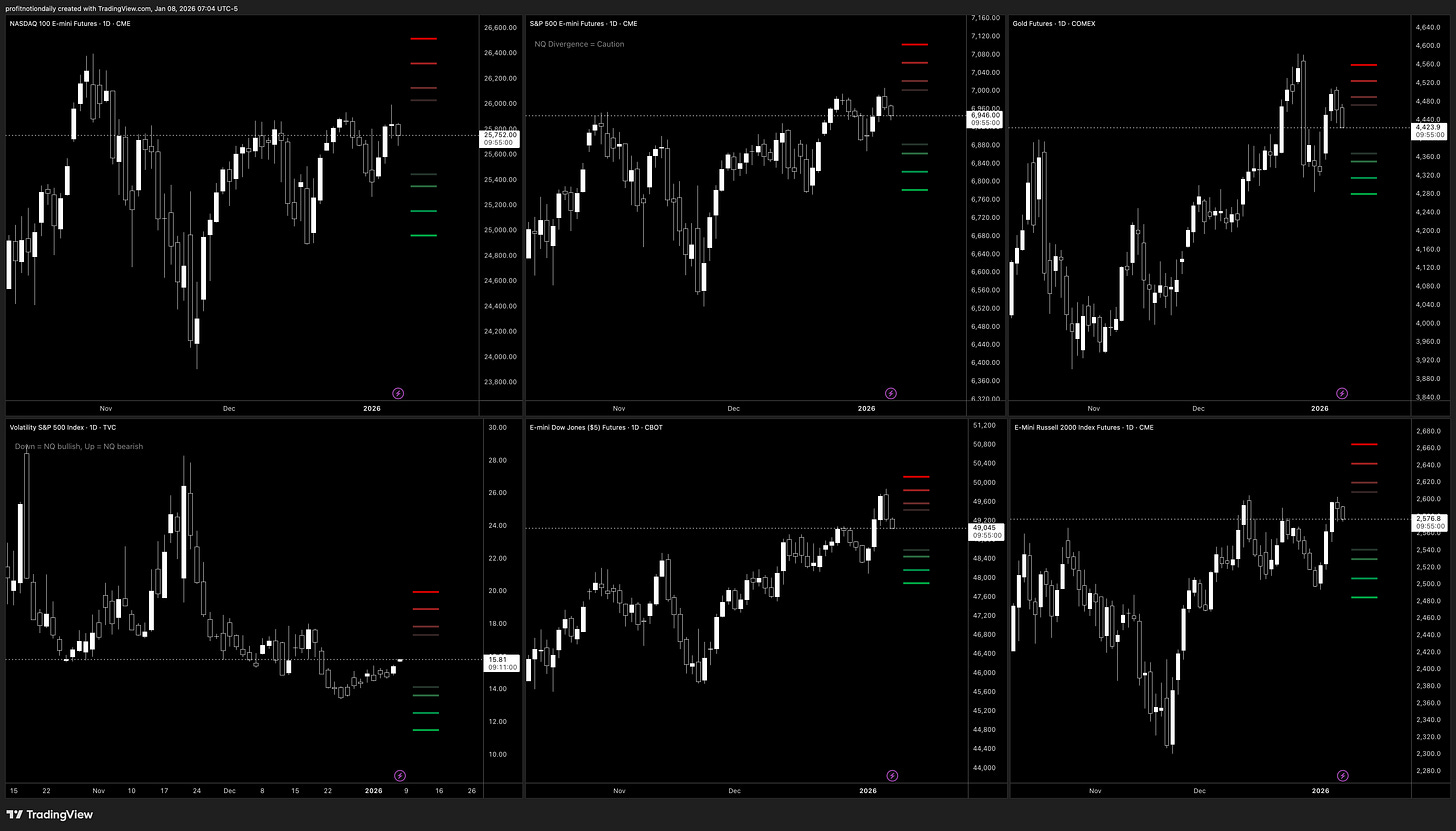

📊 Futures Indices

Price, Options Flow, Order Flow…

All indices pulled back and most broke yesterday’s low, except for RTY.

Longterm trend is up, but price is dealing with resistance right now. Options flow ended bearish yesterday except for IWM/RTY.

Looking at CVD, ES and YM had some major selling, while NQ and GC were neutral to slight bearish. RTY was strong bullish on volume, lets see if we push higher there since yesterday’s low held.

⚡️AI Powered Price Score Matrix

Proprietary matrix powered by AI that provides market breadth and what it means for NQ, ES, and GC futures.

On the daily timeframe, everything has moved to slight bullish to neutral. Top 8 equities are weighing us down, but Sectors are holding us up. Lets see how that turns at the end of today.

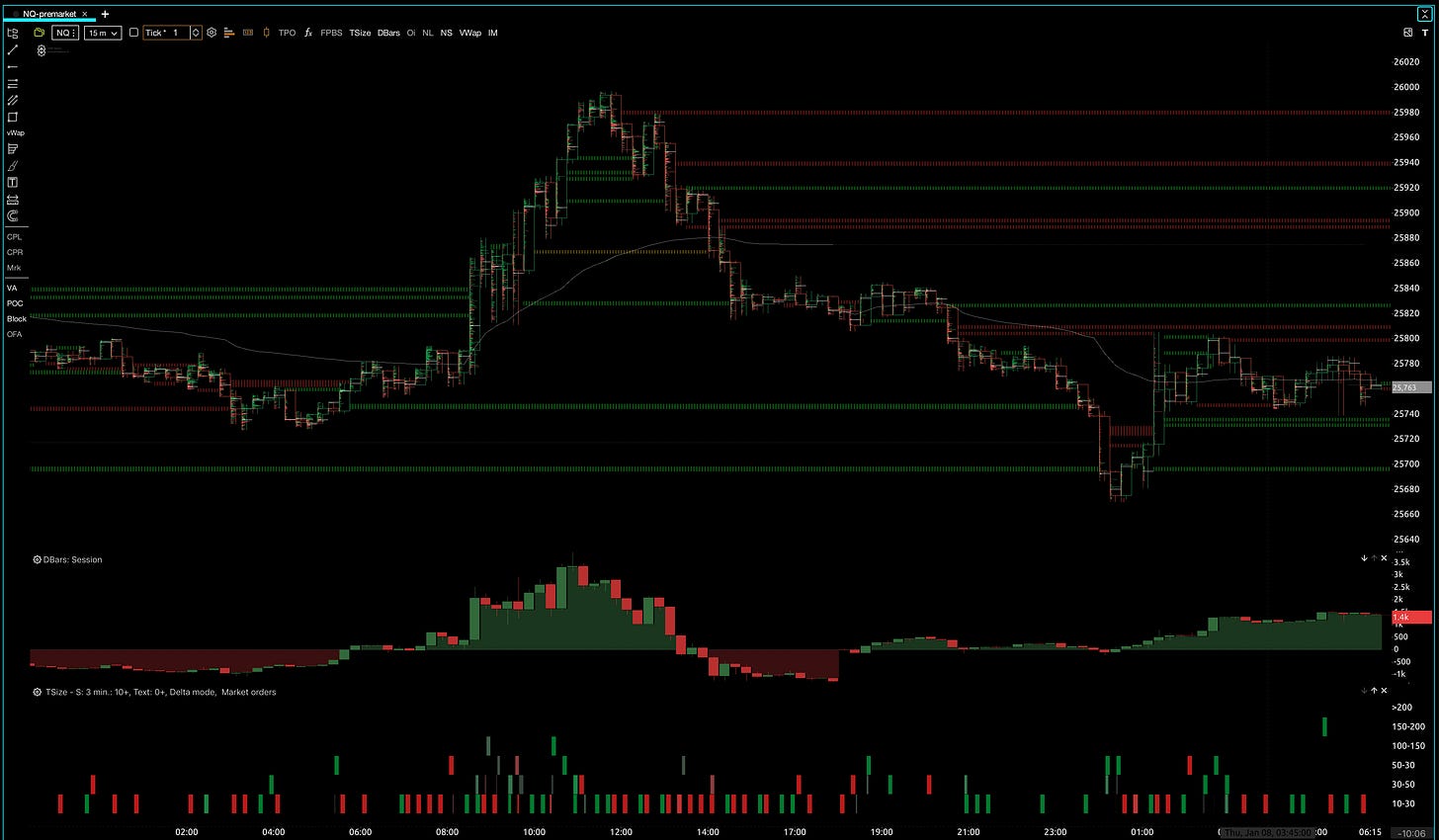

🎟️ Pre-Market Flow & Key Levels

Yesterday and Pre-market Order/Options flow using Exocharts and SpotGamma.

Bright yellow is short dated / ODTE options, while dim yellow is longer dated options.

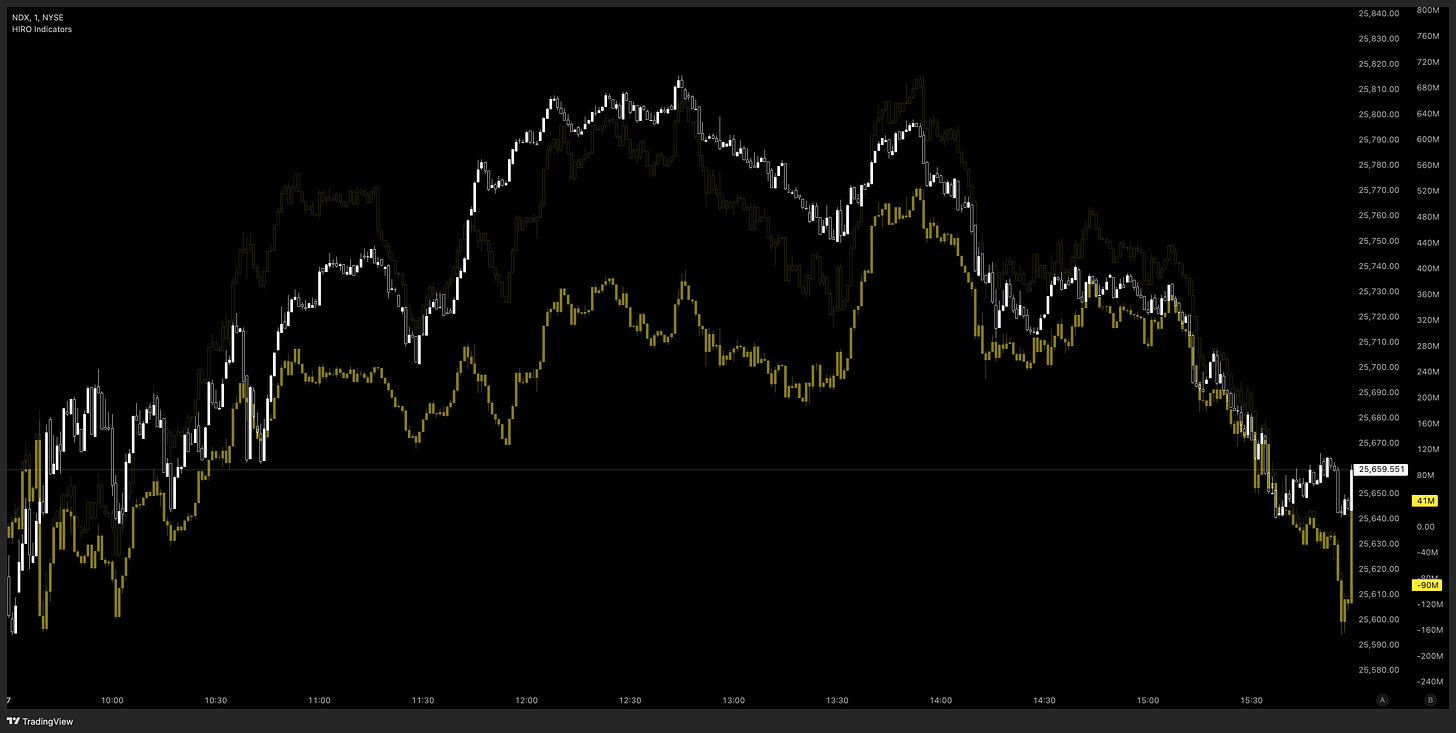

⚡️NQ Review

*NDX is proxy

Options flow was increasing first half of the day, and then turned sharply down to end the session. Price followed.

CVD followed options flow, with a bullish start and bearish close. Pre-market looks to be bullish, with a very large market order (150+ contracts) recently.

NQ Levels: 25900s, 25825s, 25700s, 25625s

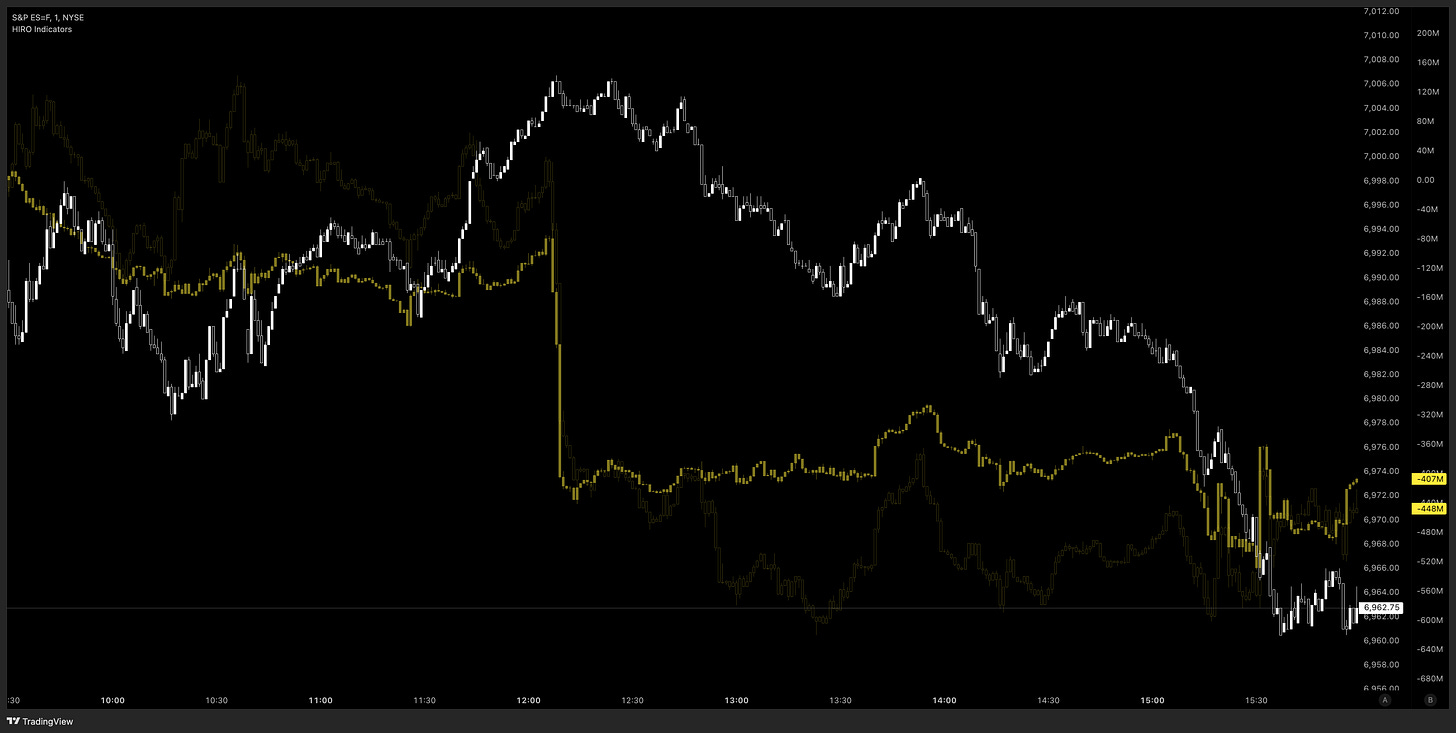

⚡️ES Review

Options flow was neutral in the morning with a big sell off mid-day, and staying down through the close.

CVD tried to fight bullish and price increased, but turned bearish, brining price with it.

There was some very large 200+ contract market orders which supported more downside. However, pre-market we do see multiple large 200+ contract trades building up, while CVD is slight red.

ES Levels: 7000s, 6980s, 6930s

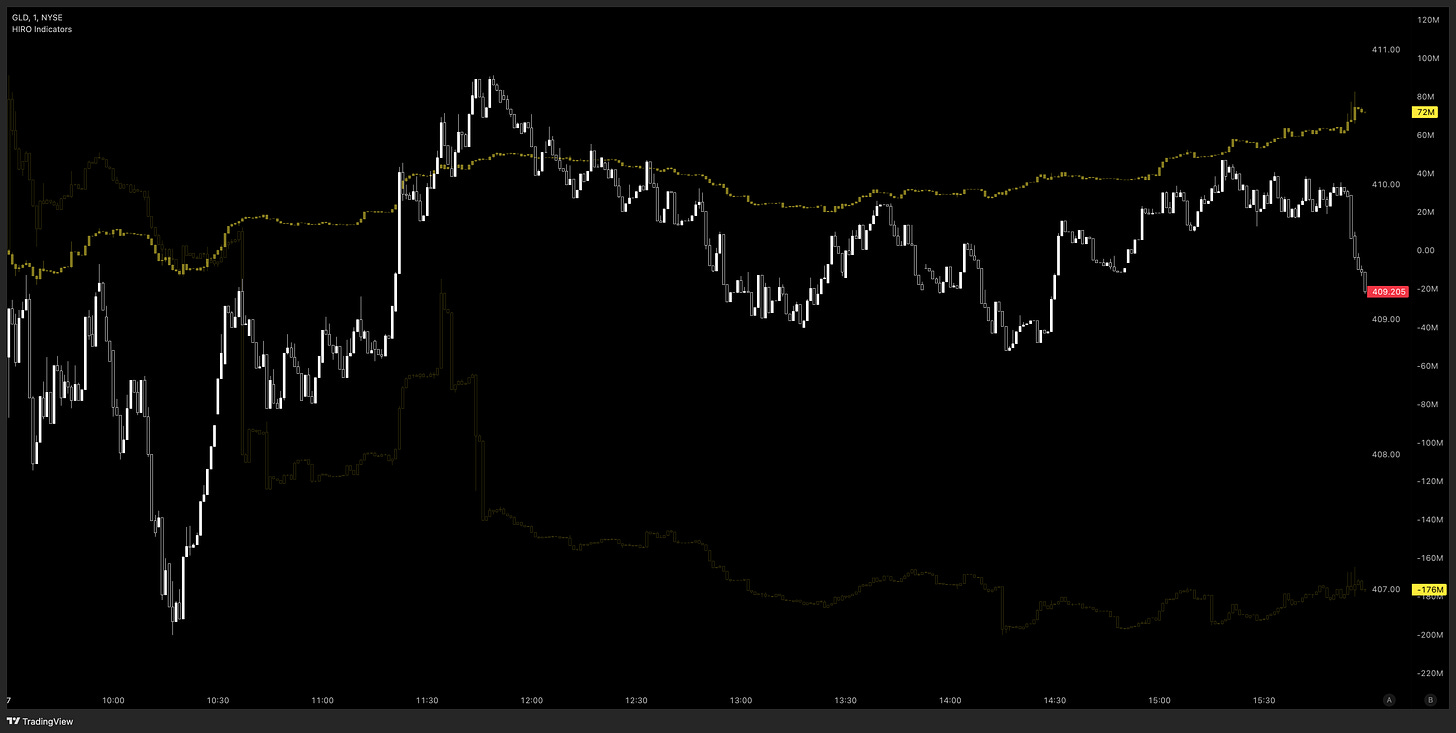

⚡️GC Review

*GLD is proxy

Short-term options flow slight increase throughout the day, while longer-dated flow increased in the morning and then fell lower into the close.

CVD was bearish all day, but price stayed elevated, and pre-market we seem to be fighting lower, with multiple 10+ contract trades hitting the tape leading into the open.

GC Levels: 4480s, 4450s, 4430s, 4410s

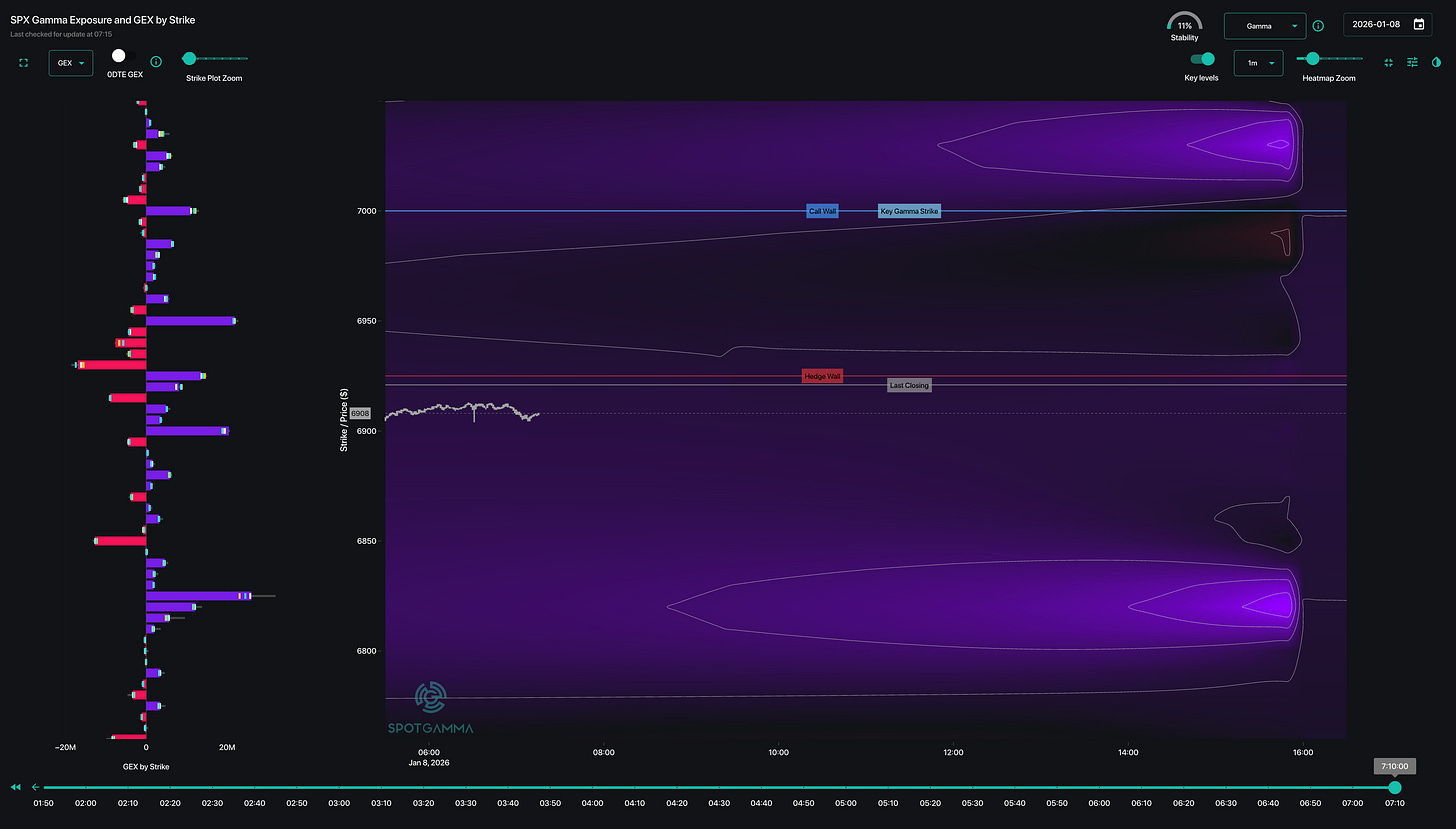

⚡️SPX TRACE

Watching the support and resistance at 6900s and 6925s. maybe we can push to 6950s and stick, if not, we may just hang around 6900s

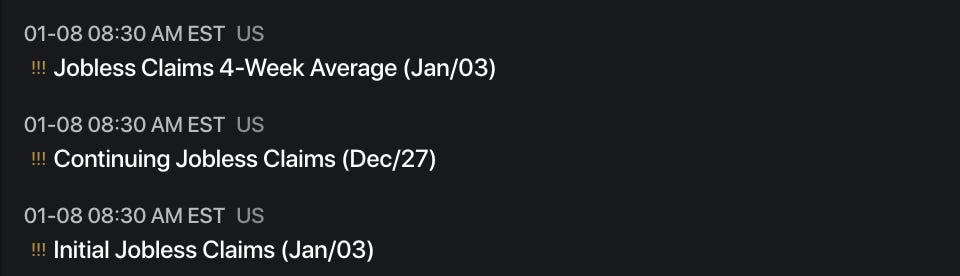

📅 Important Events

Trump: US oversight of Venezuela could last for years - NYT

Trump: We will rebuild Venezuela in a 'very profitable' way - NYT