☀️ Quick Price & Flow [ Pre-Market ] Jan 12

NQ ES GC Pre-market review for Monday, January 12

⚡️TL;DR

Check out the weekend prep for week of January 12 for deeper review of price & flow.

Last week was mostly bullish, and options flow supports more upside, but we are seeing divergence in cumulative volume delta (CVD), and the top eight equities that drive NQ and ES are mixed.

The divergence in price and order flow will be what I’m watching next week, especially with the CPI, PPI, Jobless claims on deck.

NQ Levels: 26000s, 25,900s, 25,880s, 25,800s, 25720s, 25600s

ES Levels: 7019s, 7000s, 6980s, 6950s, 6900s

GC Levels: 4540s, 4515s, 4490s, 4460s

🎟️ Pre-Market Flow & Key Levels

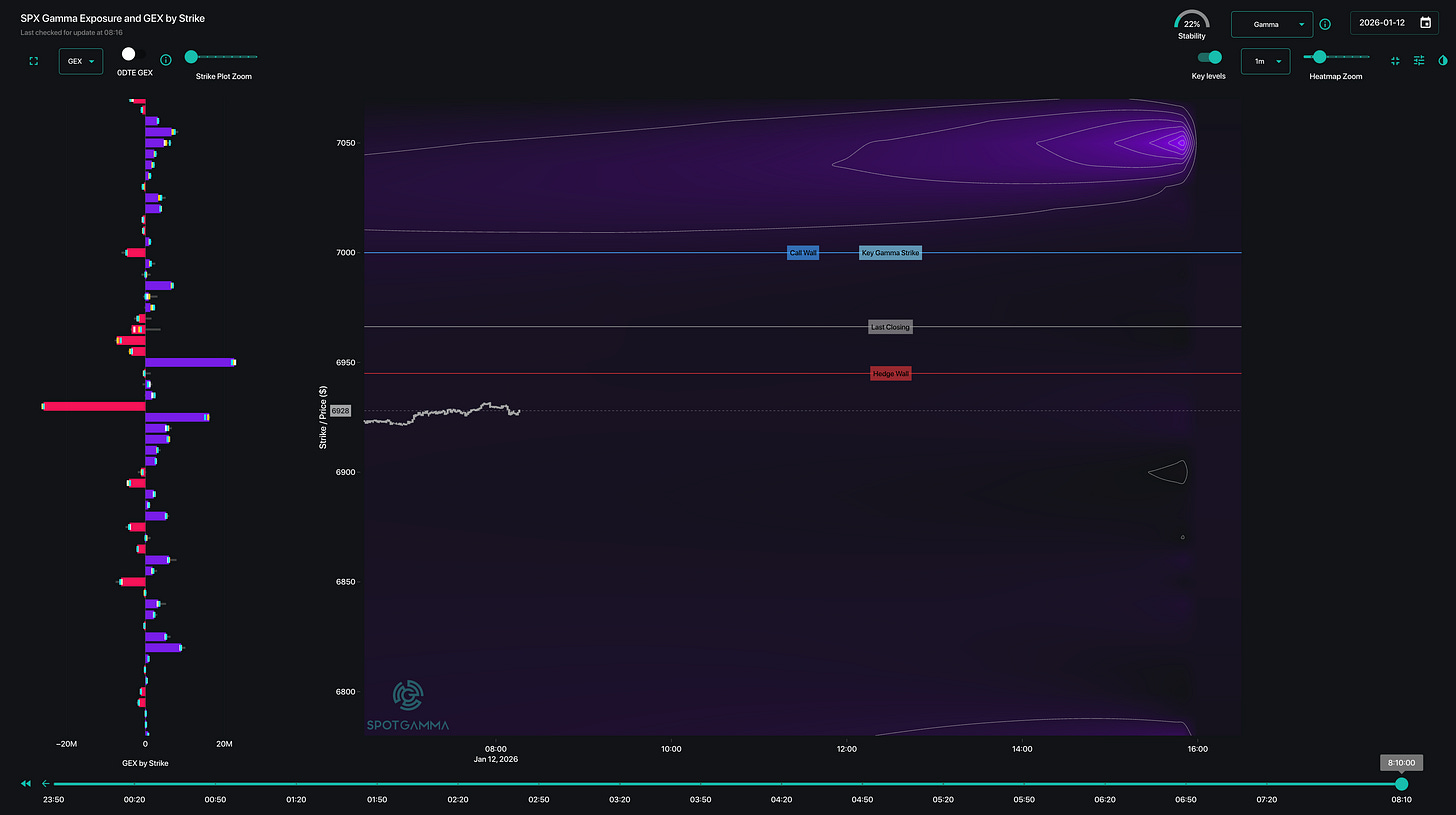

Pre-market Order flow using Exocharts and SpotGamma

⚡️NQ Review

~200 point sell off.

Big orders around at the bid around 25720s as price pushes above VWAP.

Cluster of big trades recently pushing CVD towards 0.

⚡️ES Review

~50 point sell off.

Big contract limit orders on both sides of the order book (6960s, 6975s)

Cluster of medium trades from green to red, but price pushing passed VWAP

⚡️GC Review

Price pushing up at the open and continuing higher as we approach RTH

Stacked 300+ contract orders on the ask, and price is just running towards them.

Lets see how price reacts and closes around 4620s

CVD turning green with a couple of big orders recently.

⚡️SPX TRACE

There is a lot of price stickiness (positive gamma) around 6930s.

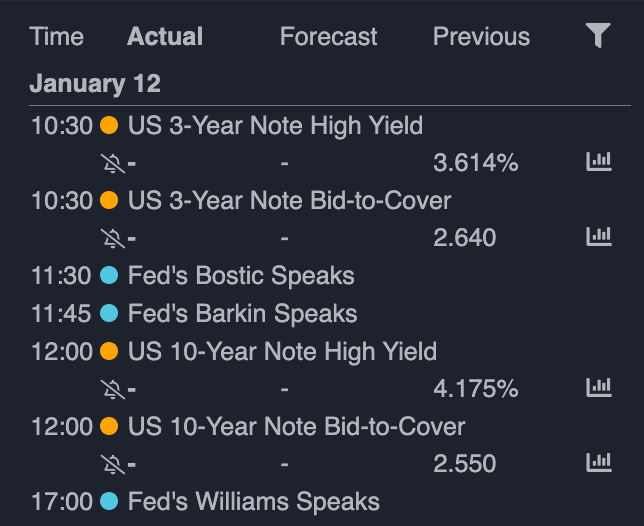

📅 Important Events

CPI, PPI, Jobless claims later this week…