🗞️ Weekend Prep

NQ ES GC Prep for week of Dec 29 - Jan 02

⚡️TL;DR

ES, YM, GC making new highs. Indices may continue up with NQ.

More attention on SI, so GC may have an opportunity to pull back

Short week, low volume, so I won’t push for too many points.

🌐 High-level Price

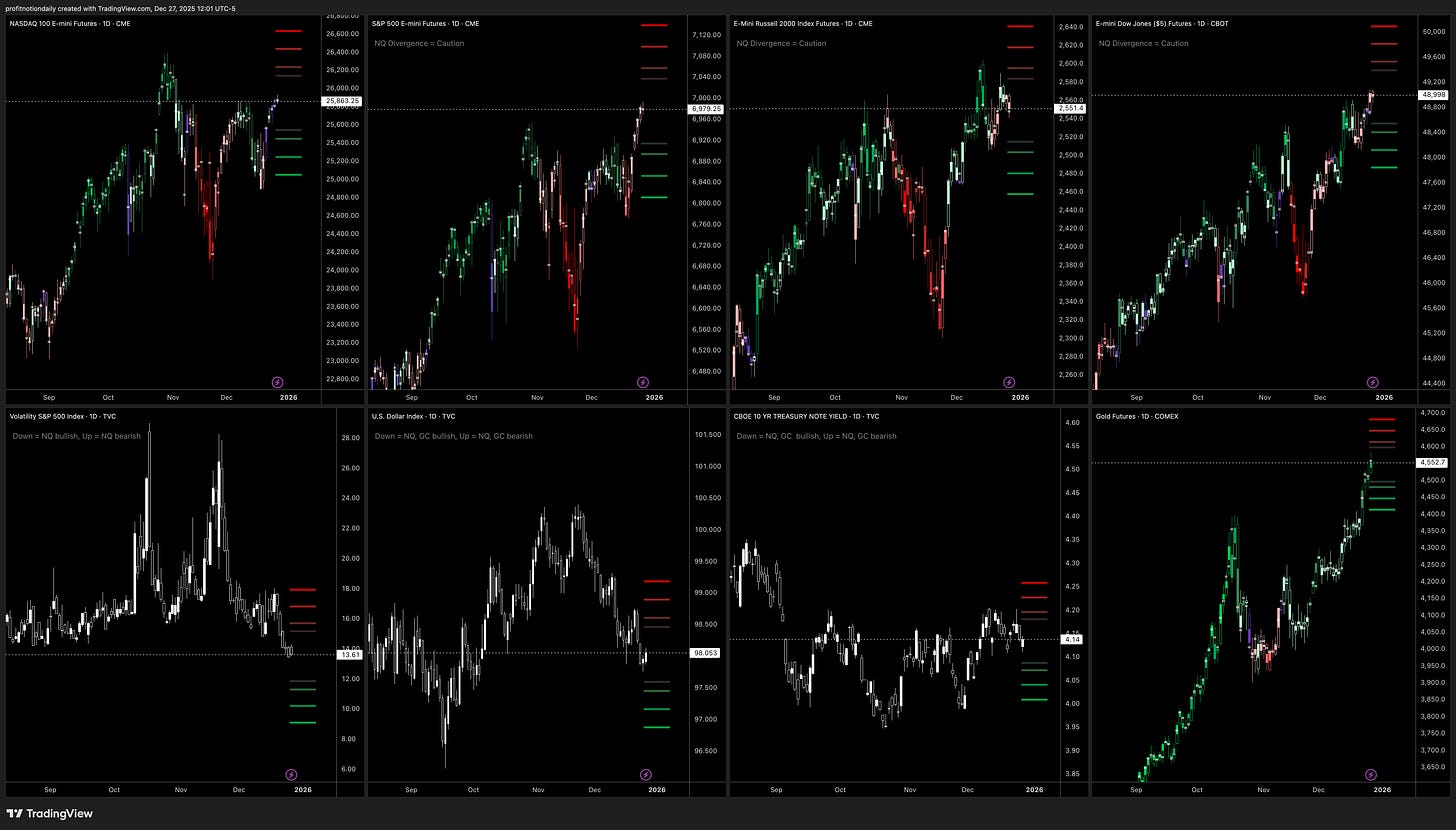

📊 Futures Indices

NQ - Broke above 25880s resistance but could not stay closed above, but price looks bullish. Lets see if we can push convincingly through, or if we fail next week.

ES - Pierced new all-time-highs, but Friday did not close above Wednesday.

RTY - Printing lower lows during the week, and closed down on Friday. Lagging.

YM - Wednesday had a very strong push into new all-time-highs, Friday tried to go higher, but pulled back.

VIX - Hit lowest points of 2025, can we can test the Nov 2024 lows of mid-12s?

DXY - Went lower most of the week with a slight rebound on Friday.

TVC - Bouncing off of 4.10s for the third time in December.

GC - Made new highs every day last week. Strong.

Overall, price looks bullish. Lets see if NQ can push over into new all-time-highs in the couple of days left in the year, which may set the tone for January.

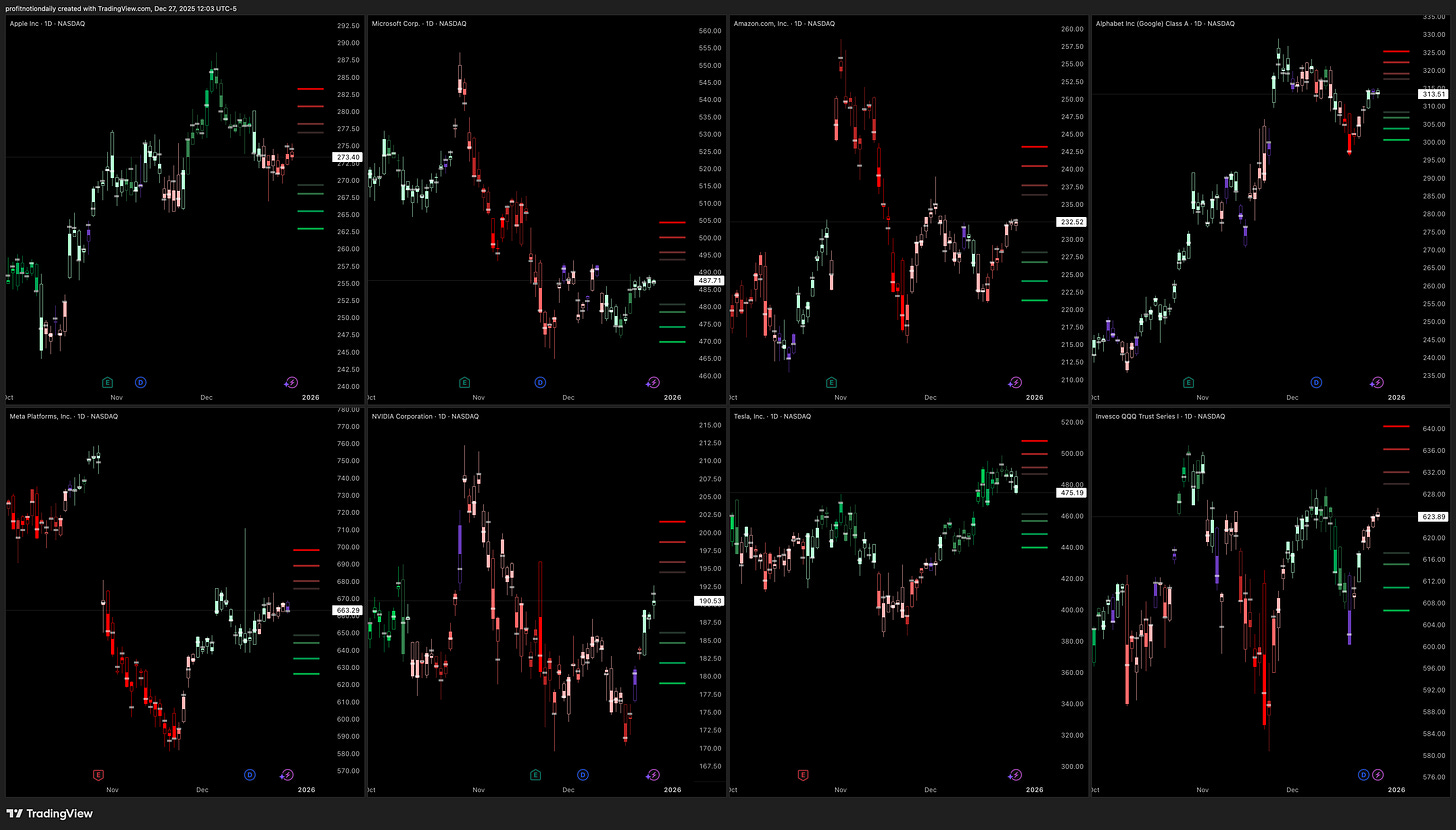

⚡️Review of Top QQQ / NQ Related

APPL - Turning up, with higher highs to end the week

MSFT - Looking bullish with a wedge poised to go upwards.

AMZN - Higher highs and higher lows all week, fighting back up

GOOG - Strength all week, poised to go higher

META - Stair stepping with higher lows, but flag highs.. lets see

NVDA - Pushing straight up with strength

TSLA - Pierced new highs in beginning of week, now pulling back

QQQ - While NQ has broken Dec. resistance, the Qs are still pegged under them, but inching it’s way up to test them.

Overall, most names look bullish. Lets see if that continues for the rest of the year.

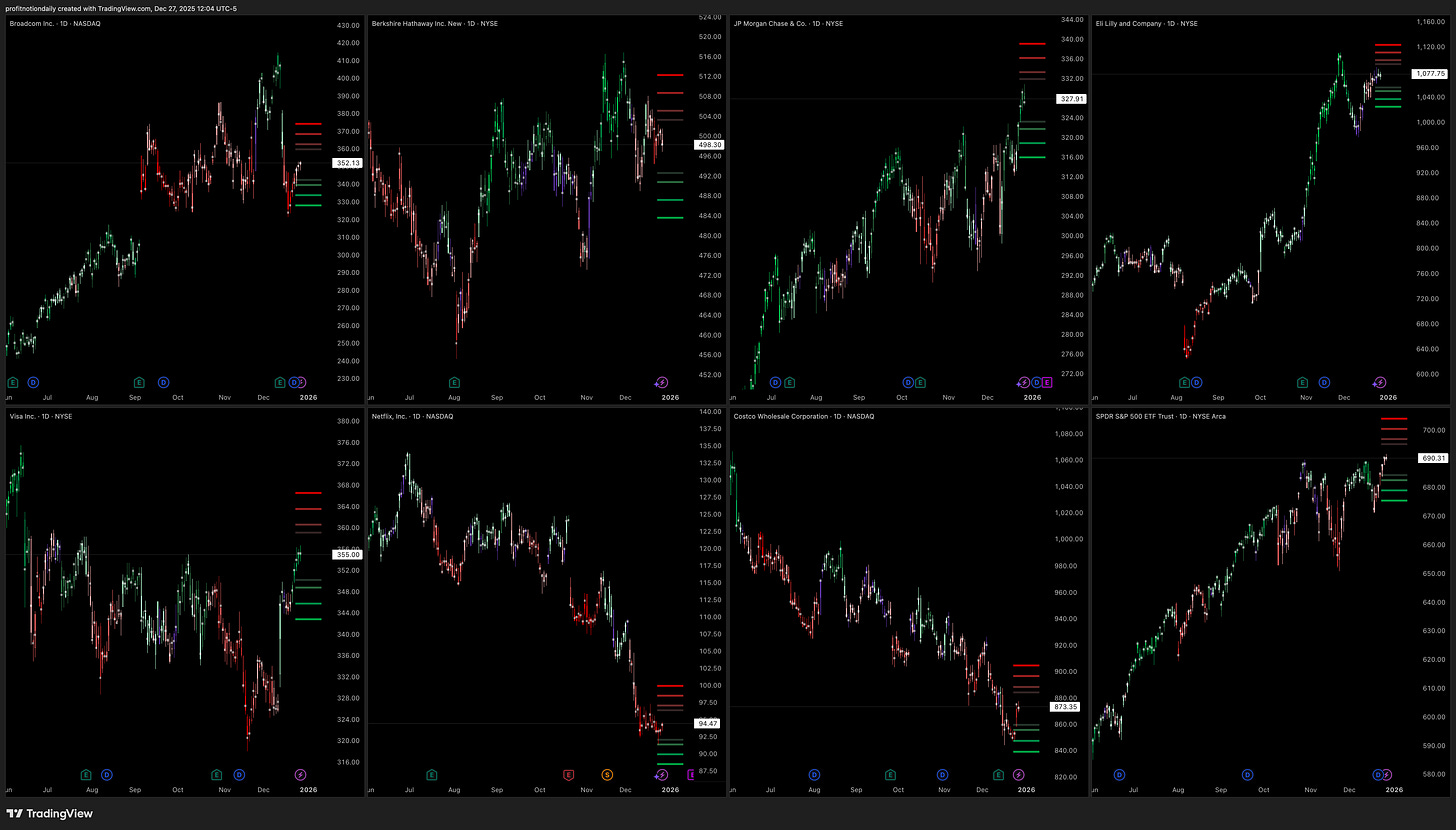

⚡️Review of Top SPY / ES Related

AVGO - Continues recovery after sweeping it’s post earnings support around 324s.

BRK - Consolidating into a wedge.. not much going on.

JPM - Continues with more new highs. Strong.

LLY - Continues with strong recovery. Up we go.

V - Broke resistance from August, breaking out of it’s downward channel. Strong.

NFLX - Continues to be weak, but starting to consolidate. Relative weakness. If SPY turns down, this may go further.

COST - Nice bounce after breaking support. Currently retesting previous support.

SPY - Yep, more highs.

Overall, some really strong names but if JPM and V can’t keep it up, then it may be time for things to turn down. Lets see.

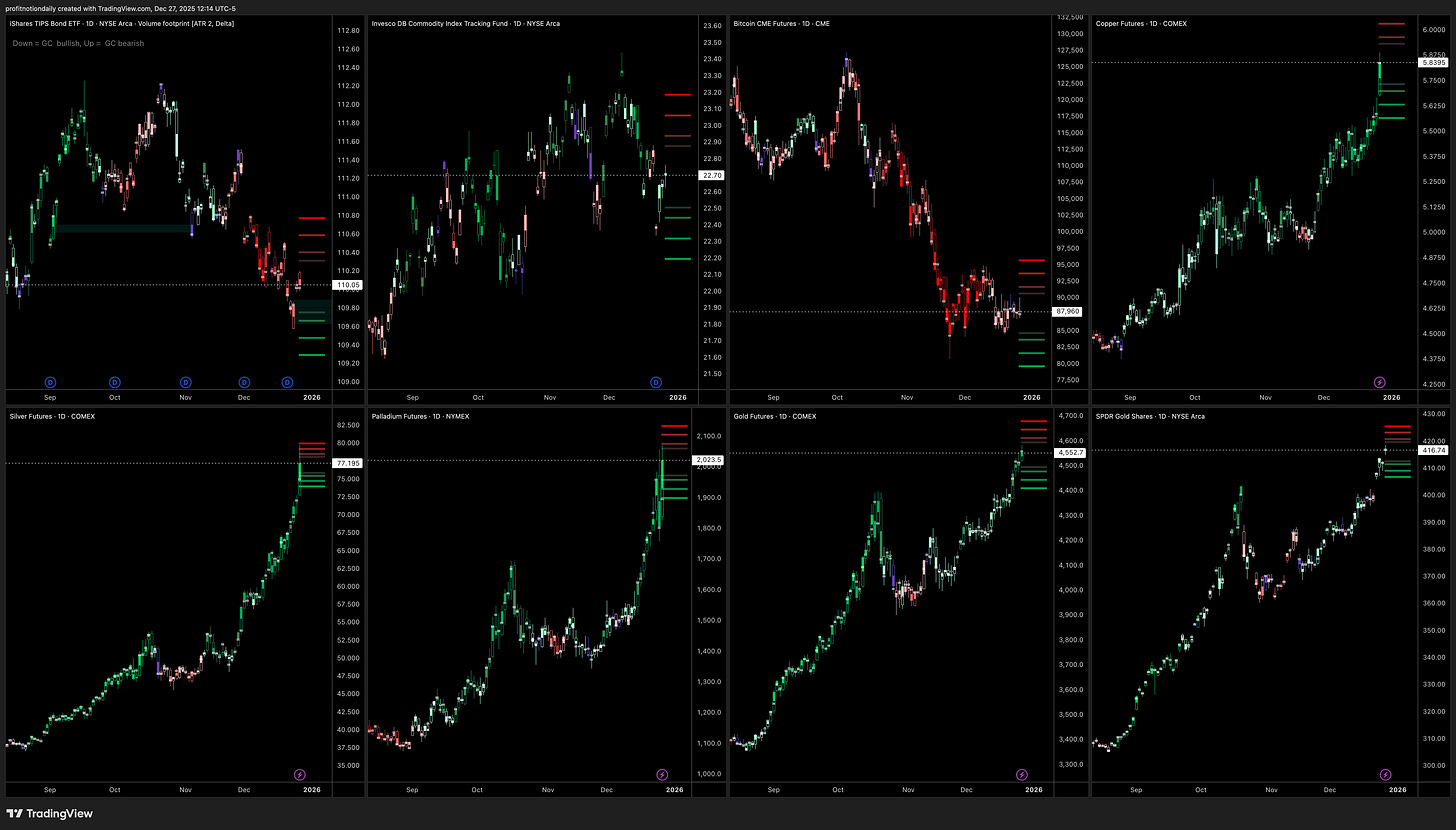

⚡️Review of Gold / GC / GLD Related Tickers

TIPS (Inflation Protection) - Continues in direction of gap-up.

DBC -(Broad commodities) - Gapped down, but closed the gap of end of week.

BTC - (Bitcoin) - Just down and consolidating… waiting.

HG (Copper) - New highs, looking to test all-time highs

SI (Silver) - New highs. Strong.

PA (Palladium) - New highs. Strong.

GLD/GC - New highs. Strong.

Overall, metals are killing it. More and more people are talking about Silver. There could be more room to go up.

🌊 Flow Insights (Options & Order flow)

Looking at the last 5 trading days

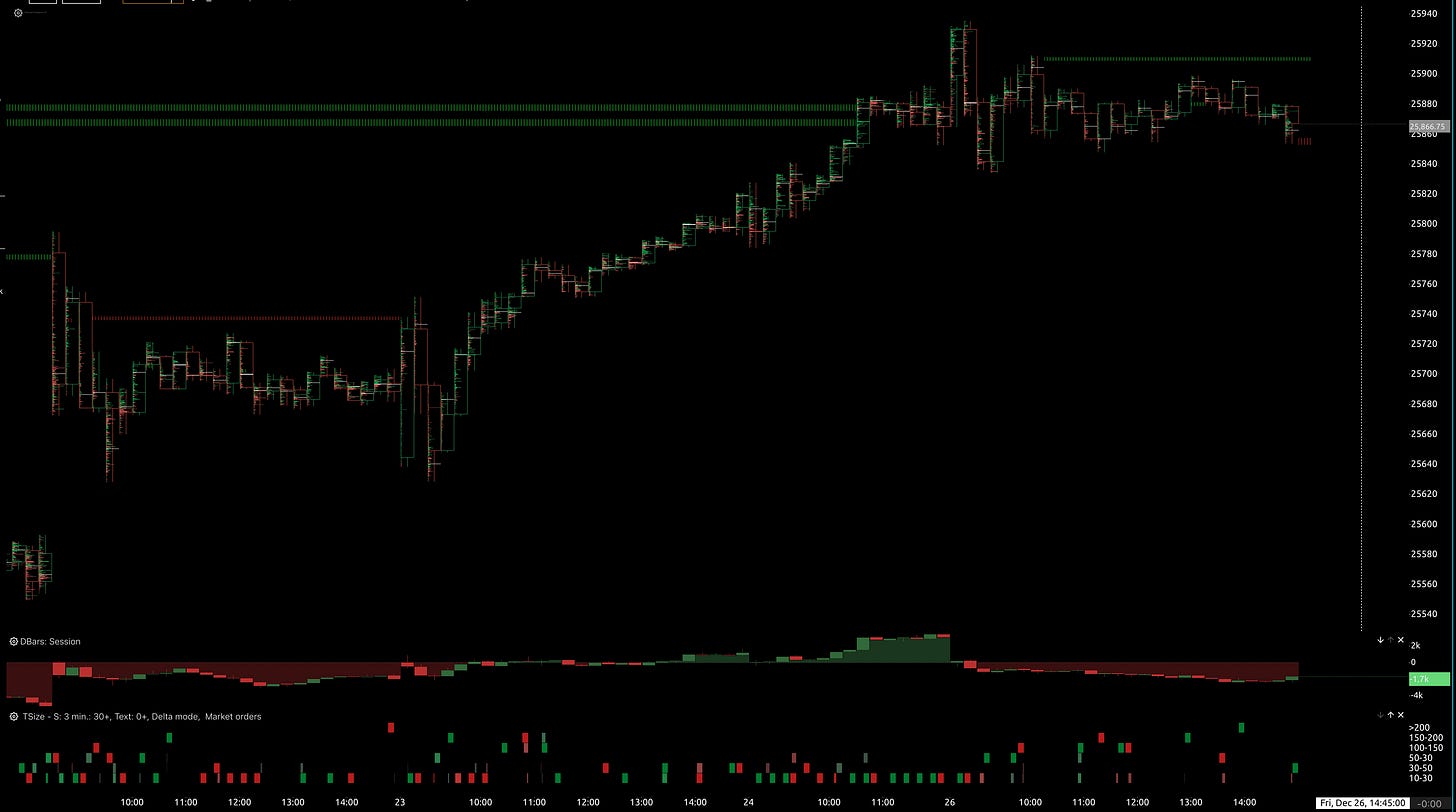

⚡️NQ Review

*NDX for options flow

Options flow was largely bullish all week, and we saw price follow.

Have to see how price reacts at 25700s this week.

Friday ended with more selling pressure in CVD, but we had more big bullish trades towards the end of the day. 25900s has some buying imbalance, if we can clear that perhaps we push higher. However, need to watch the selling imbalance around 25860s.

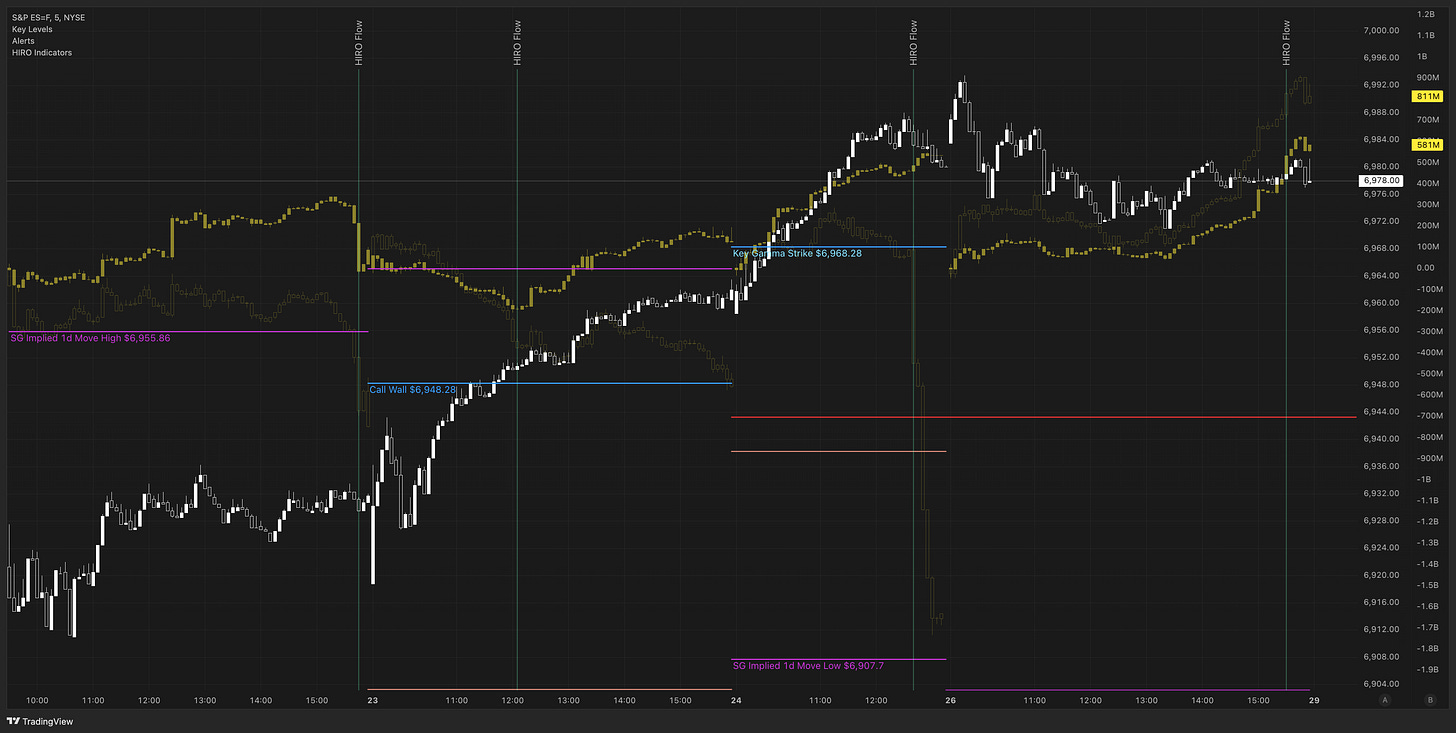

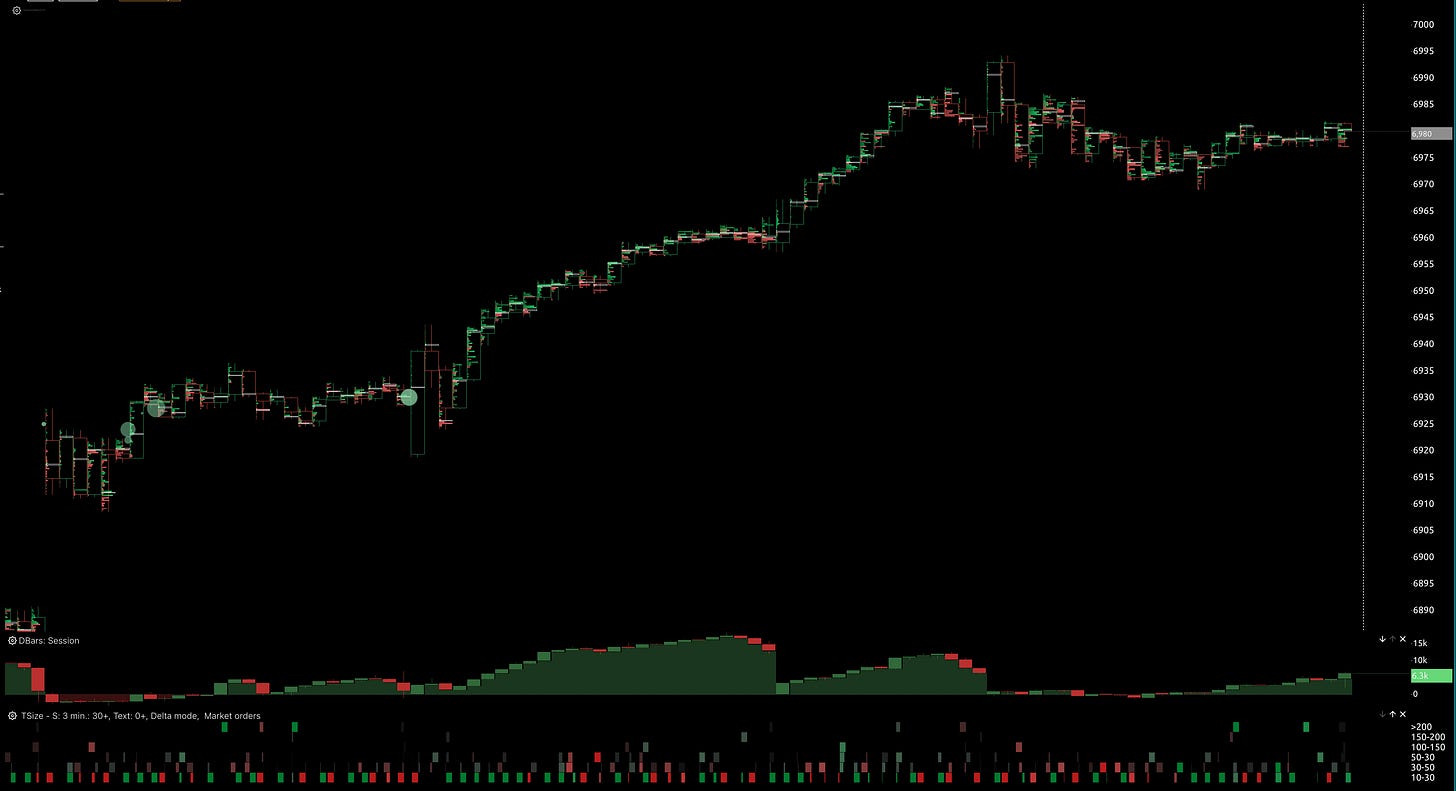

⚡️ES Review

This week the options flow between 0DTE and longer dated diverged a bit. Early int he week 0DTE was more bullish, and longer date as bearish. By the end of the week all flow turned bullish. Lets see how that plays going into next week.

Bullish. Strong positive CVD all week, with lots of big buy trades all week, including some big shorts that were liquidated (green bubbles on chart).

Order flow looks long going into next week.

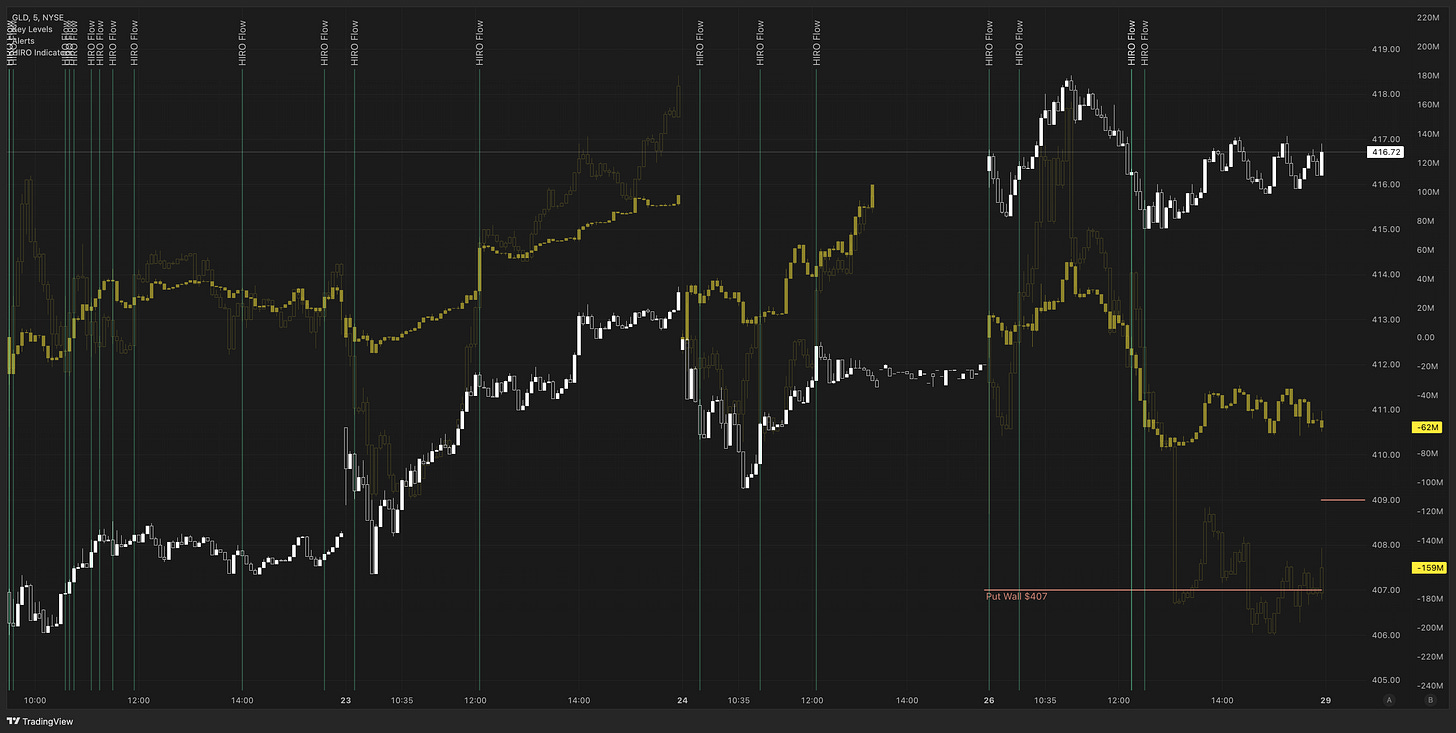

⚡️GC Review

*GLD for options flow

In the beginning of the week, the bias for options flow was clearly bullish.

Friday afternoon saw things turn around as short and long dated options started to go bearish. Lets see if that plays out next week. Will everyone rotate into Silver?

For most of the week CVD was bearish, and Friday was defilingly bearish, even with the gap up. Maybe an exhaustion pullback is coming? We also had 3 really big sell trades get placed on Friday (over 150 GC contract trades).

I’ll be open to a sell off next week, as we perhaps rotate into Indices and Silver (?)

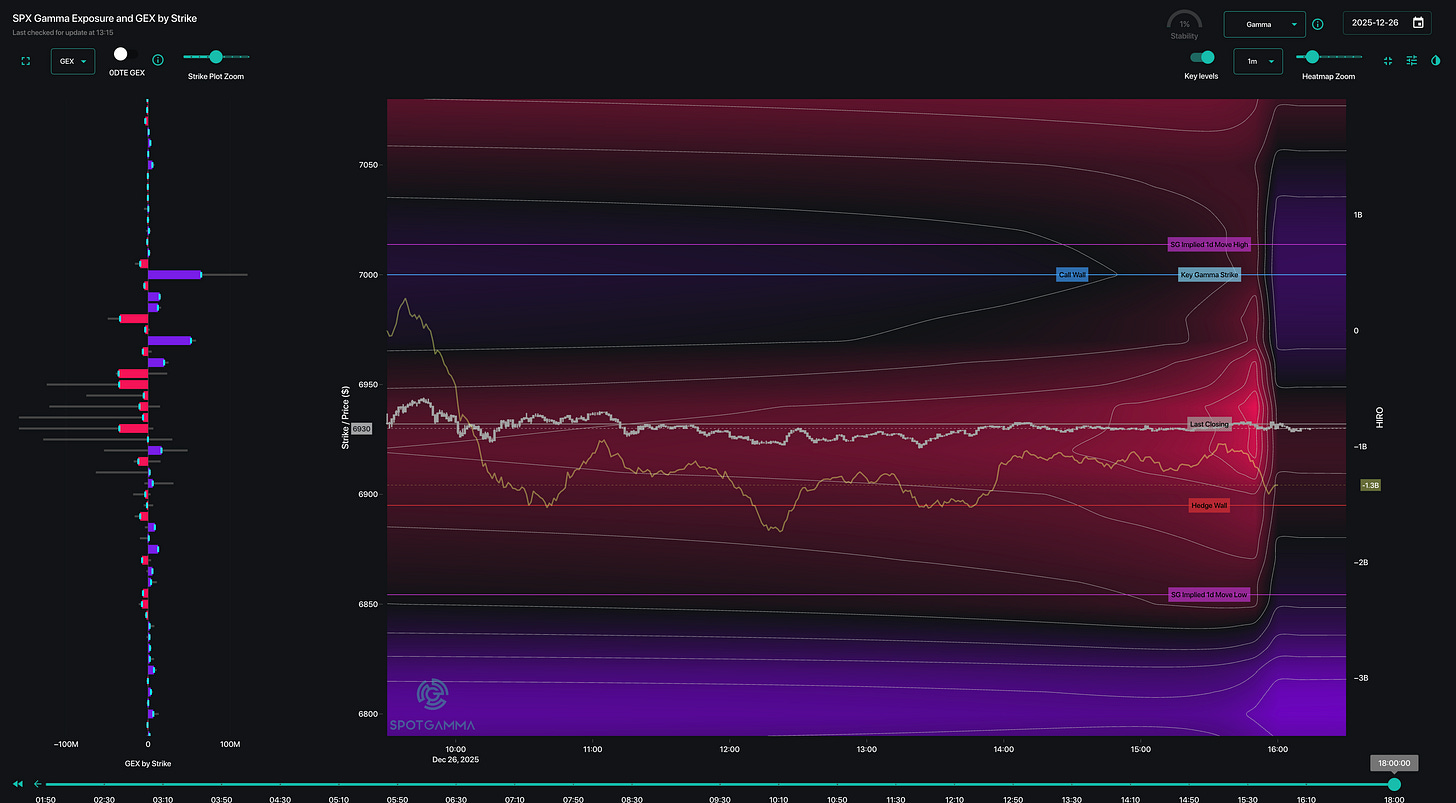

⚡️SPX - Gamma Heat map on Friday.

Price hung out in negative gamma territory all day, and some positions will still be carried over into next week. If price gets up to 6950 maybe a nice grind up to 7000s, but if we break below 6900 then will be watching for 6800s to pull us in.

📅 Upcoming Events

⚡️On The Calendar

Dec 29 - Pending home sales, Crude Oil, US 3-Month Bill Yield

Dec 30 - ADP Employment Change, FOMC meeting minutes

Dec 31 - US Initial Jobless Claims, Chicago PMI, New Years Eve

Jan 02 - US S&P Manufacturing PMI Final

⚡️Asking AI - Sentiment & Outlook:

NQ: Neutral-bearish (thin holiday vol, potential small correction into Jan amid overbought signals).

ES: Neutral (ATH push but retracement risks to key levels like 6,877).

GC: Bullish (new ATH above $4,500, safe-haven demand amid market caution).

Summary: Light econ calendar (no major events), favoring volatility spikes; equity caution post-Christmas, gold outpacing indices on liquidity/inflation fears

🪙 Final Two Cents

Overall, Indices price looks like we want to continue grinding higher, so lets see if NQ and RTY can join the others at new highs. Metals are strong, and seems like attention is turning to Silver, which may give Gold an opportunity to pullback. Also, can’t count Bitcoin out yet, we could have some move out of the blue.

Short week, low volume, so won’t push for too many points.