🗞️ Weekend Price & Flow

NQ ES GC Prep for week of Jan 5 to 9

⚡️TL;DR

The US Venezuela news will be top of mind on Monday

Traders seem to be rotating back into YM and RTY.

Options flow is generally bullish across all markets.

NVDA and GOOG are holding us up, most names had a strong sell-off on Friday.

ES order flow looks the strongest bullish, followed by NQ. GC seems the most bearish, so will be watching that.

🌐 Price & Flow

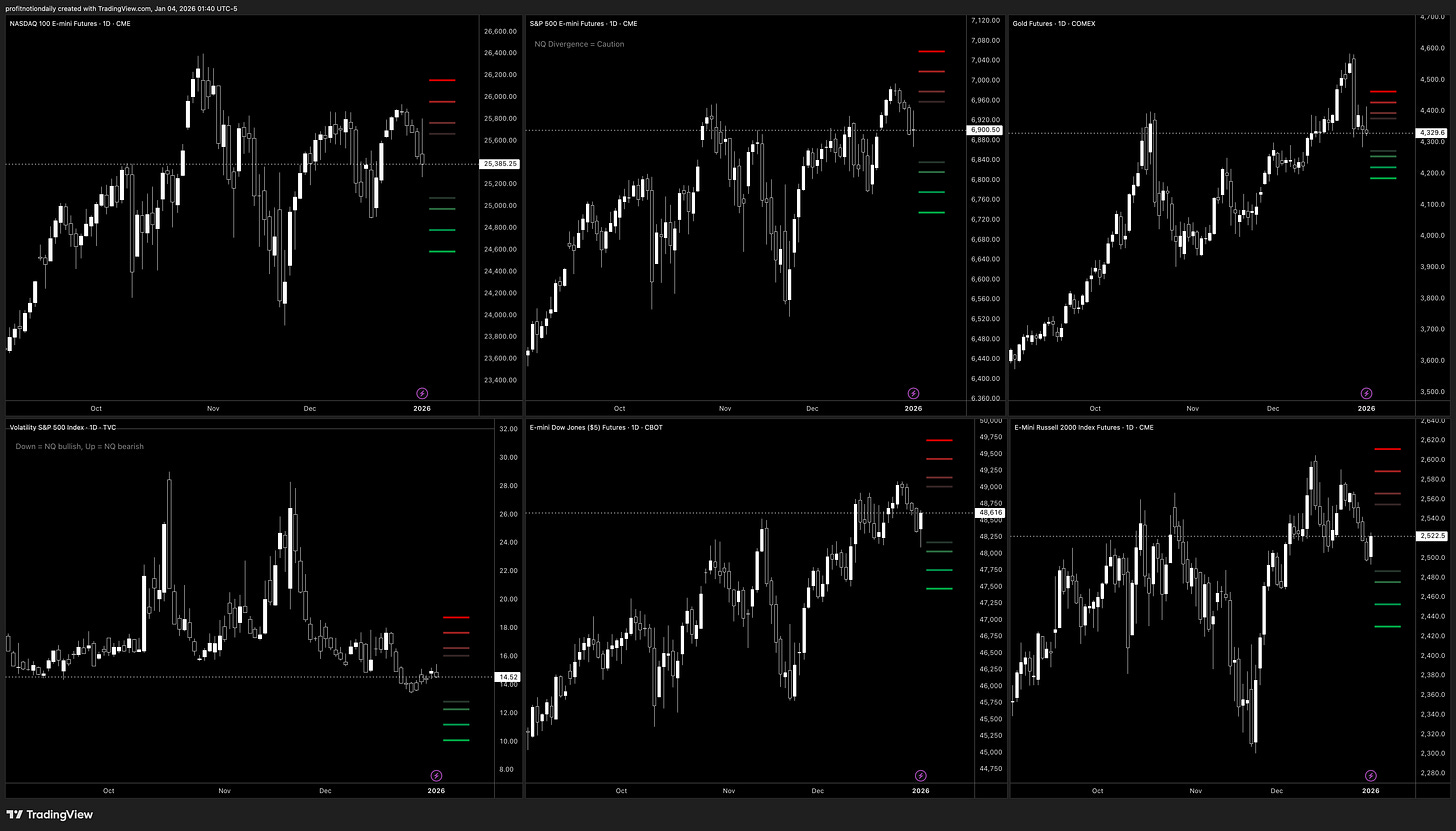

📊 Futures Indices

Price, Options Flow, Order Flow…

NQ (Nasdaq Futures) -

Sold off all of last week, with a big 500 point swing on Friday. Options flow for futures was negative, but for the QQQ options were positive, meaning there is no agreement there. Looking at cumulative order flow, we were negative most of the week, but closed in the green even though price closed red.

ES (S&P Futures) -

Sold off all week, with a doji(+) candle stick patten close on Friday. Futures option flow is positive, but SPY options were negative, no agreement going into next week. cumulative order flow for the week was mostly positive, with only one deep red day.

GC (Gold Futures) -

After the big sell off on Monday, price started to form a flag range on the daily. There was alot of attention on Metals with increases in margin requirements thanks to Silver, and rumors(?) of failing banks. Options flow is negative as of Friday, but looking to rebound. Cumulative order flow started the week really green, but gave into sell side pressure and stayed red for most of the week.

RTY (Russel Futures) & YM (Dow Futures) -

Both started off the week red and continued to sell off. However, on Friday both of these indices rebounded and closed strong green. This signals rotation instead of liquidity leaving the markets. Options flow is bullish for both, while cumulative order flow is neutral to slight bearish on YM, and neutral to slight bullish on RTY.

VIX (S&P Fear Index) -

Slight increase as Indices prices fell, but closed down everyday last week. Options flow is neutral to slight positive, and near-term volatility order flow is neutral while price continues to fall lower. This signals there is less fear in the market to start the year. Lets see if that changes as the US Venezuela news gets absorbed this week.

Overall, we did see really nice sell-off in NQ, ES, GC… but with a strong close with RTY and YM, along with VIX at lows, makes me think traders and investors are still willing to put money to work, and we just need reasons to rotate back.

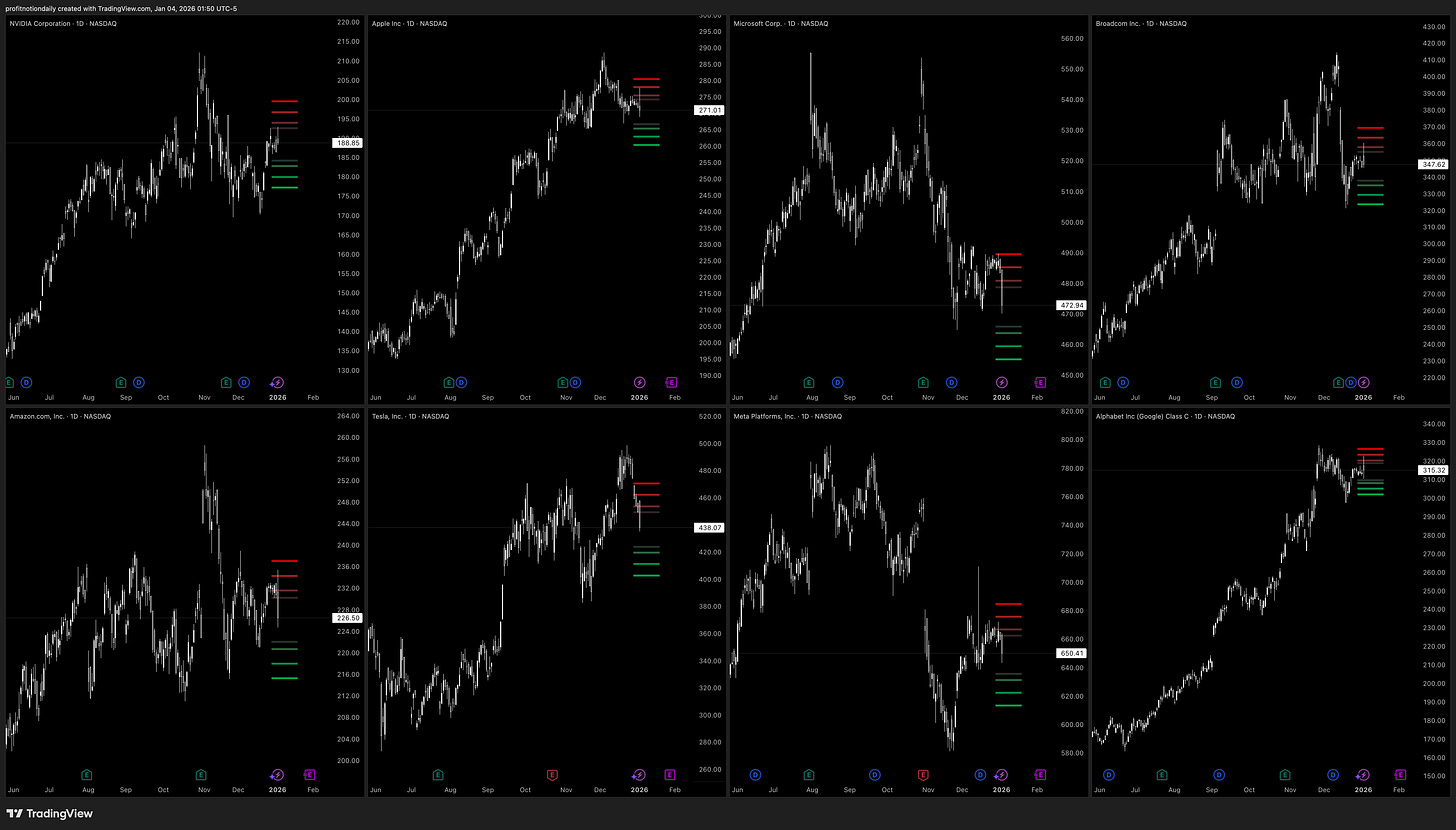

⚡️Review of Top Names QQQ (NQ), SPY (ES)

Price, Options Flow, Order Flow…

NVDA (Nvidia) - Price is strong, breaking out. Options are bullish. Order flow tried to sell off but closed strong on Friday. Strong and leading.

APPL (Apple) - Price was sideways all week, then tried to break-out Friday, but closed back into the range. Options are bullish. Order flow has been consistently bearish, so lets see if we break down.

MSFT (Microsoft) - Price was sideways with a big breakdown on Friday, closing near the daily lows. Options are bearish but trying to rebound. Order flow tried to fight to green most of the week, but broke down to bearish to end the week.

AVGO (Broadcom) - Price was sideways all week, then tried to break-out Friday, but closed back into the range. Options are bullish. Order flow has been consistently bearish, so lets see if we break down.

AMZN (Amazon) - Price was sideways then tired to break out, but broke down and closed near lows on Fridays. Options are bearish but trying to rebound. Last week order flow as really bullish, but this week started neutral and gradually increased bearish into Friday.

TSLA (Tesla) - Price selling off all week, with a big dump on Friday. Options flow bearish, and order flow consistently bearish, but price is hitting an imbalance zone. Lets see how price reacts there this week.

META (Meta) - Price was sideways with a big breakdown on Friday, closing near the daily lows. Options are bullish. Order flow was overall neutral for last week, so lets see if we can rebound this week.

GOOG (Google) - Price was sideways all week, then tried to break-out Friday, but closed back into the range. Options are bullish. Order flow has been consistently bullish, so lets see if we break out. Price still strong near highs.

Overall, NVDA and GOOG are leading us upward, with most names having a strong sell-off on Friday. This makes me cautious for longs on NQ to start the week. Lets see how price develops, and if support and bullish flow holds for all the names.

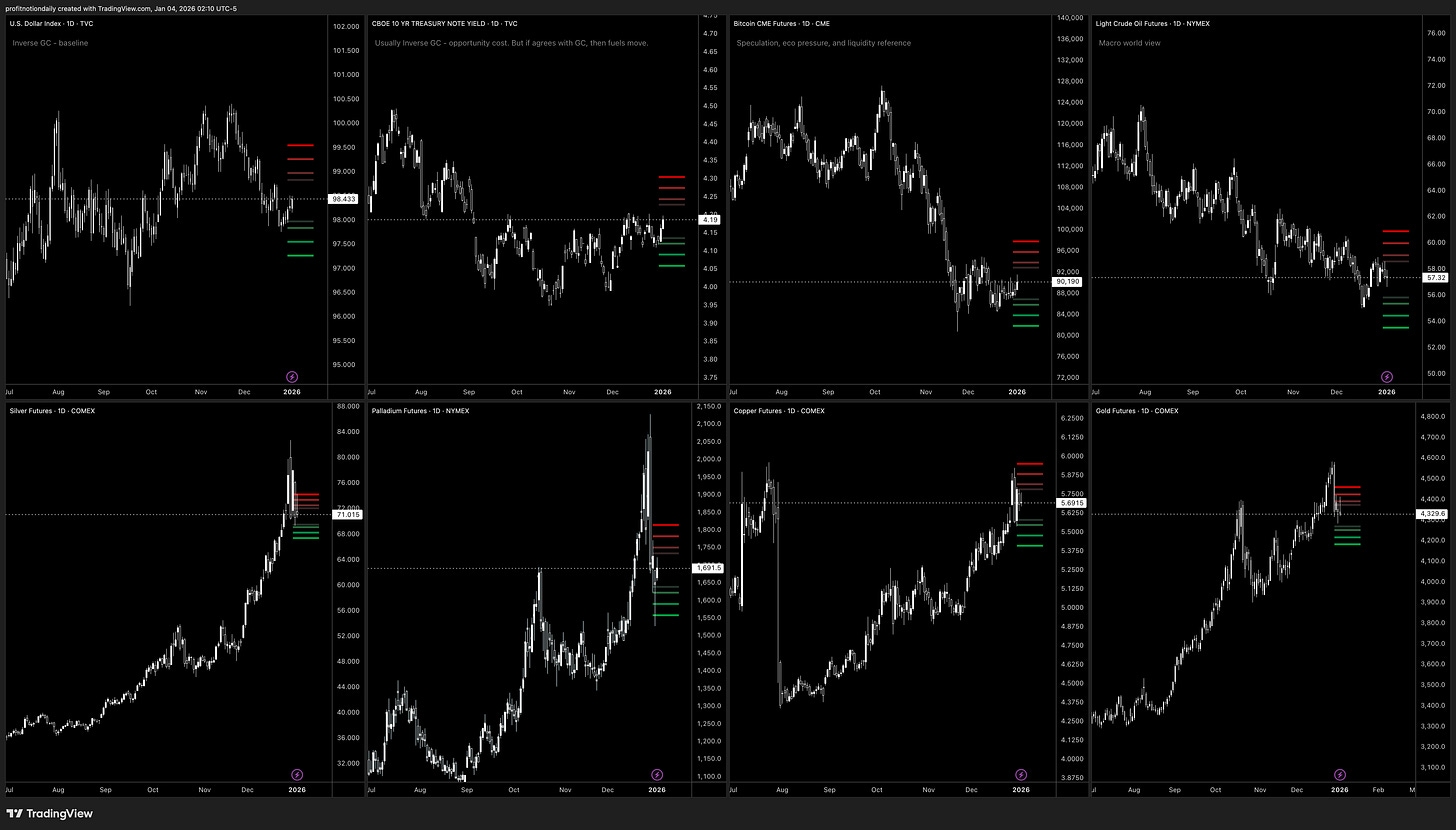

⚡️Review of Gold / Macro

Price, Options Flow…

DXY (Dollar) - Minimal movement this week, but has been moving down the last couple of weeks. Now trading back in the range since June.

TNX -(Treasury Note) - Continues to trade near late Sept highs.

BTC - (Bitcoin) - Continues to coil in a flag pattern and options flow is bearish.

CL (Crude Oil) - In downtrend, near Aug lows. Options flow is bullish though.

Lets see if the US Venezuela news creates any changes here.

SI (Silver) - Price holding above the 69 support level after the crazy run up. Options flow is bearish, so lets see what this week brings.

PA (Palladium) - Came all the way back to begging of Dec prices. It will be in a wide range for a while.

HG (Copper) - Price is holding up, forming a wedge, looking its move.

Overall, Silver looks to be the chart to watch to see if volatility will continue, but keeping an eye on Crude Oil given the recent news.

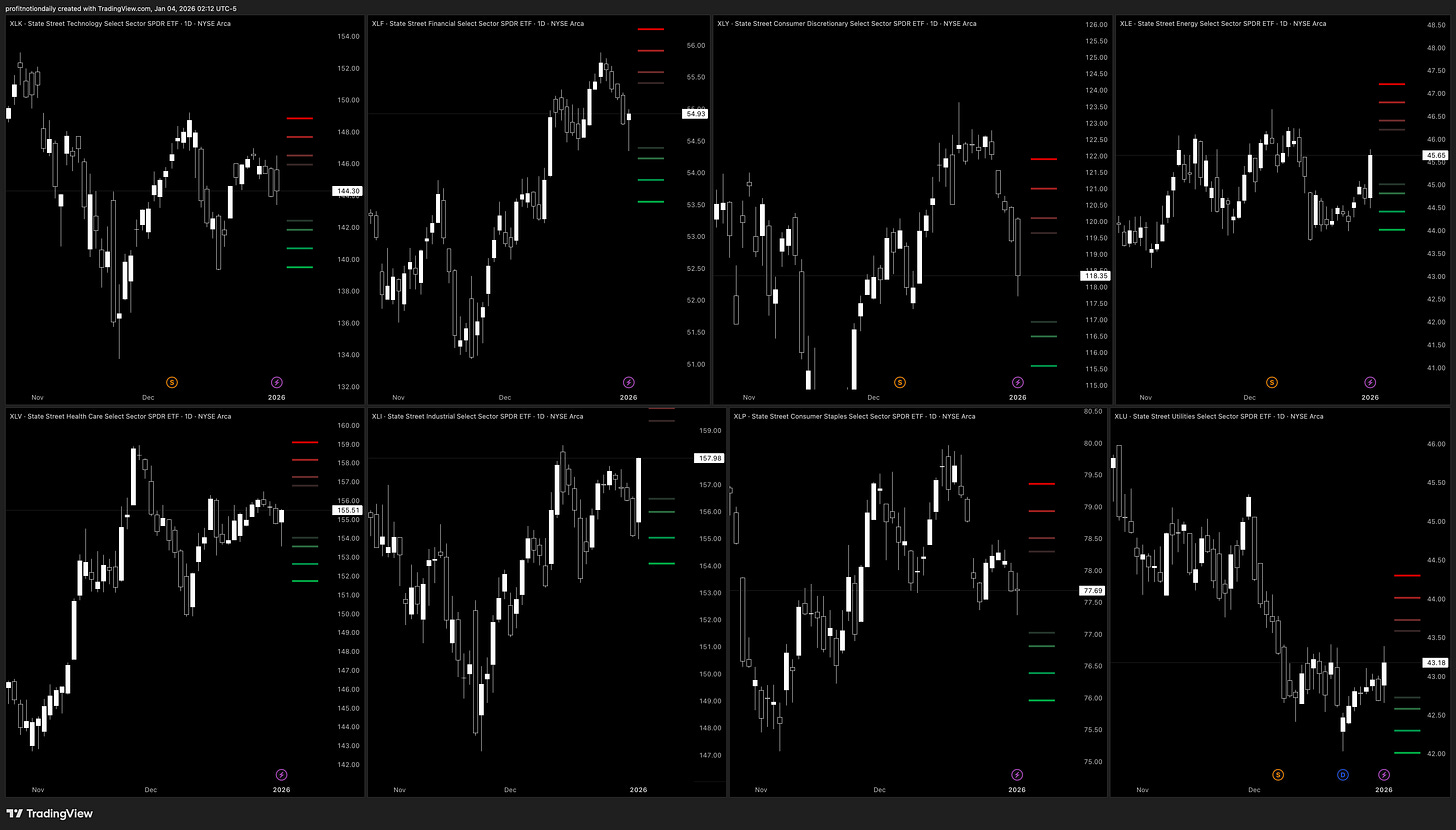

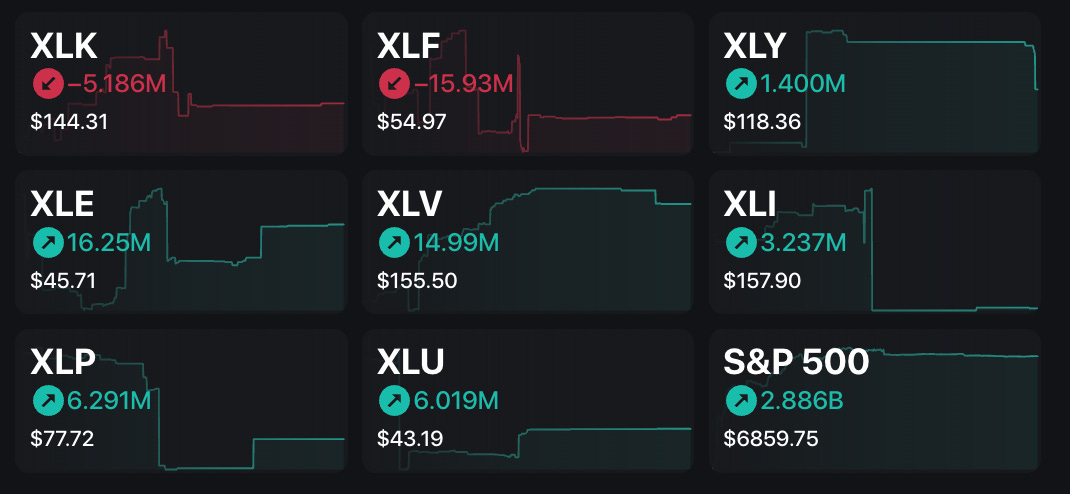

⚡️Review of Sectors

Price, Options Flow…

XLK (Technology) - Price is up, but trying to breakdown. Options bearish.

XLF -(Finance) - Price run up with correction, rebound Friday. Options bearish

XLY - (Consumer) - Price sell-off from recent highs. Options bullish.

XLE (Energy) - Price breaking out, strong close Friday. Options bullish.

XLV (Healthcare) - Price sideways, breakdown but rebound Friday. Options bullish.

XLI (Industrial) - Price is up and looking to break highs. Options bullish.

XLP (Staples) - Price continues to break down, support holding. Options bullish.

XLU (Utilities) - Price down, but testing resistance. Options bullish.

Overall, Options is mostly bullish across the sectors, with tech and finance being the laggards. Consumer discretionary and staples seem to be the weakest though.

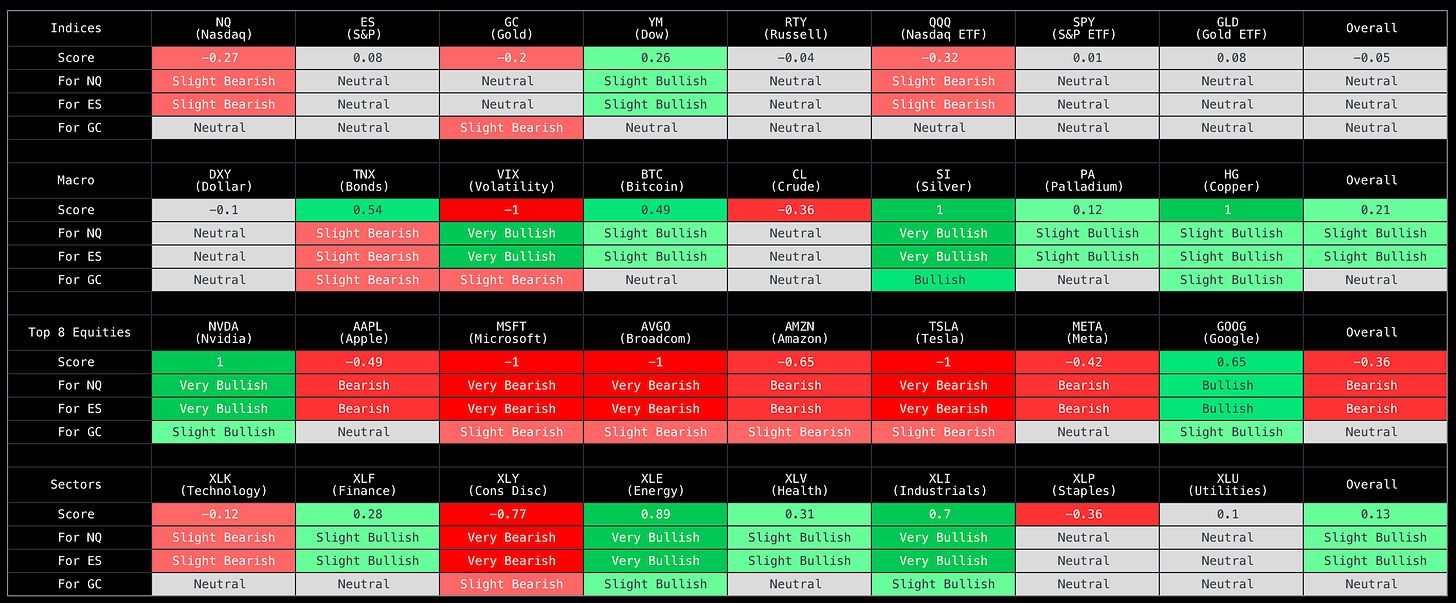

⚡️AI Powered Price Score Matrix

Proprietary matrix powered by AI that provides market breadth and what it means for NQ, ES, and GC futures.

For NQ, ES, GC - Sectors and Macro support more bullish price action, while the Top 8 equities are weighing us down with more bearish action. NVDA, GOOG keeping equities up though.

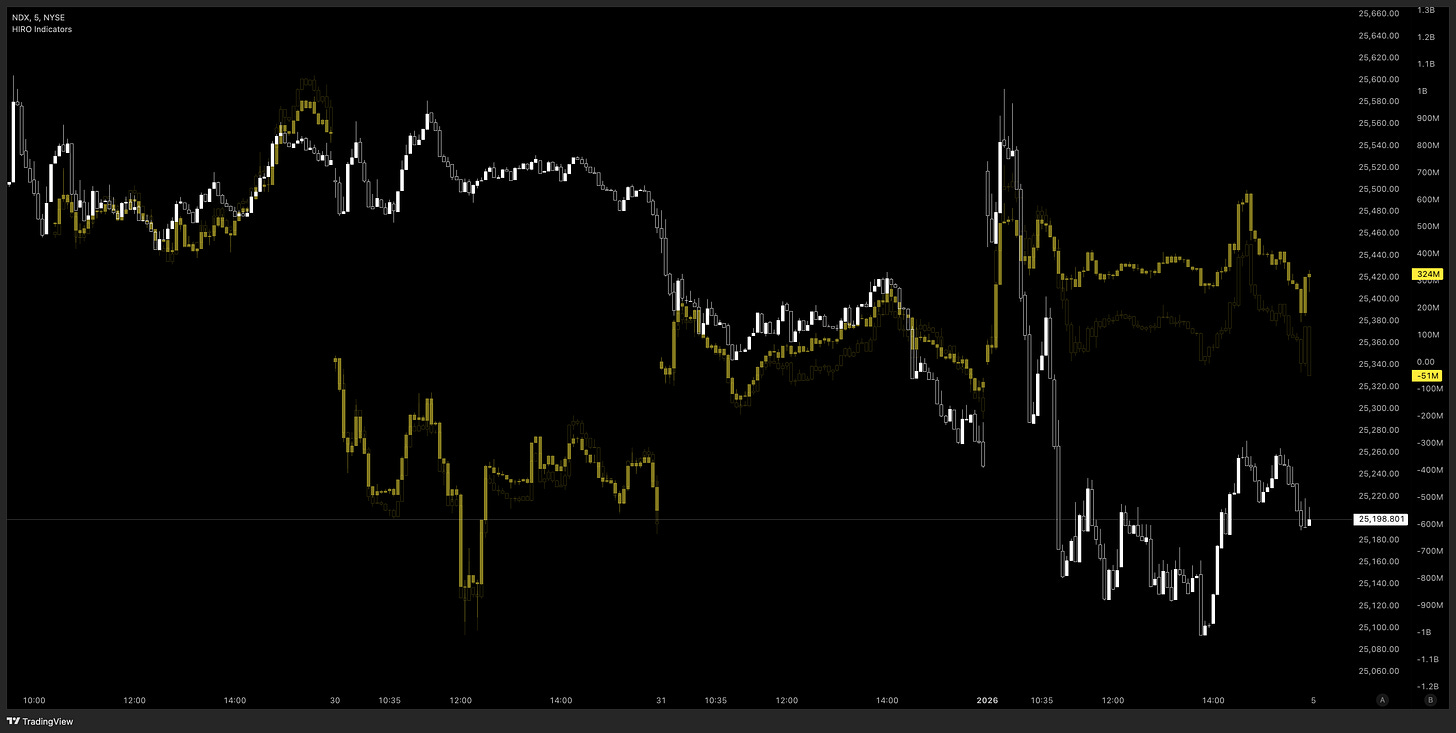

🌊 Options Flow

Looking at the last 5 trading days, using SpotGamma’s HIRO and TRACE insights.

Light yellow indicated 0DTE flow, while dim yellow indicates longer dated flow.

⚡️NQ Review

*NDX is our proxy for options flow

Options flow supported the sell-off going into new years, and the flipped back positive at beginning of the year, but price has yet to follow suite. However, it is a positive sign that flow is turning more positive even with the weak close on Friday.

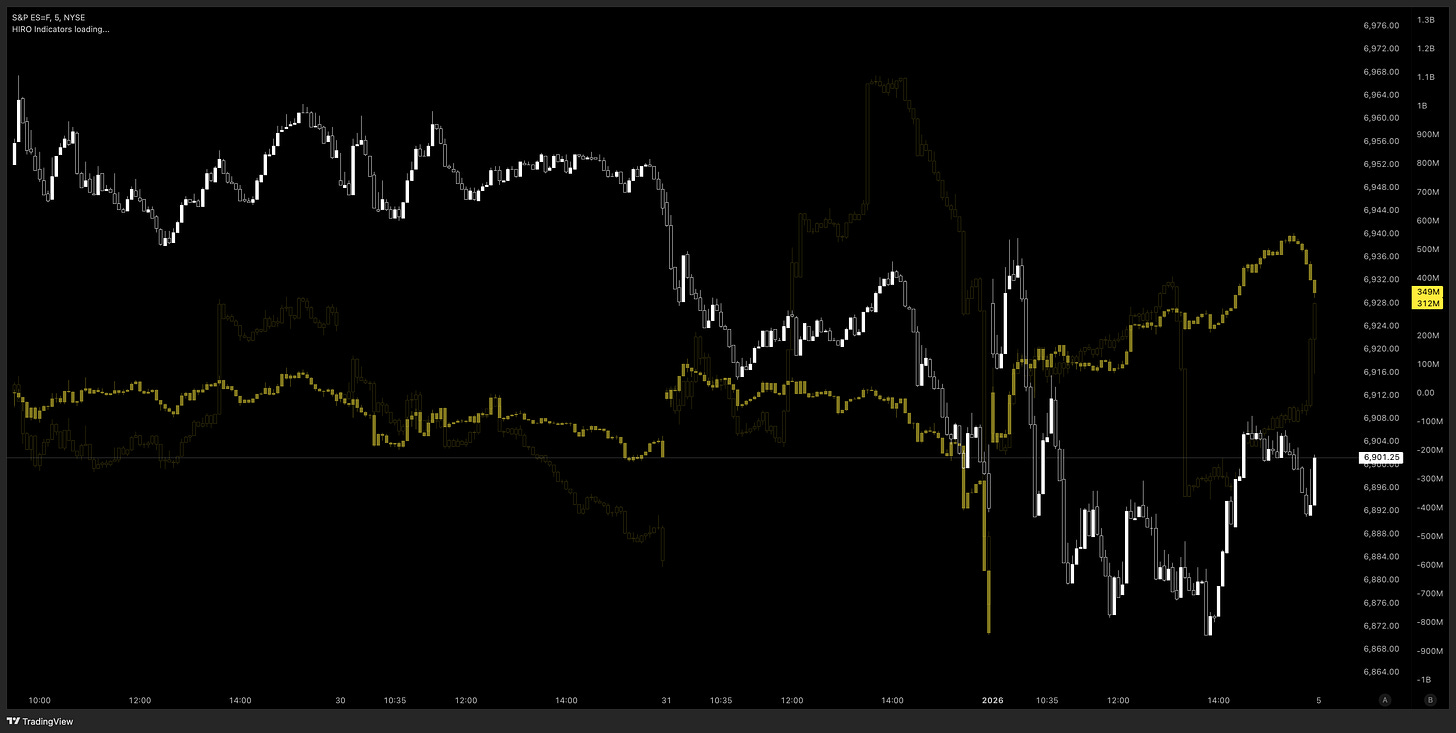

⚡️ES Review

ODTE options flow relatively neutral most of last week, and has started to pick up.

Longer dated options did see a spike on Dec 31st, so lets see if price follows suite going into next week. Overall options flow does point upwards.

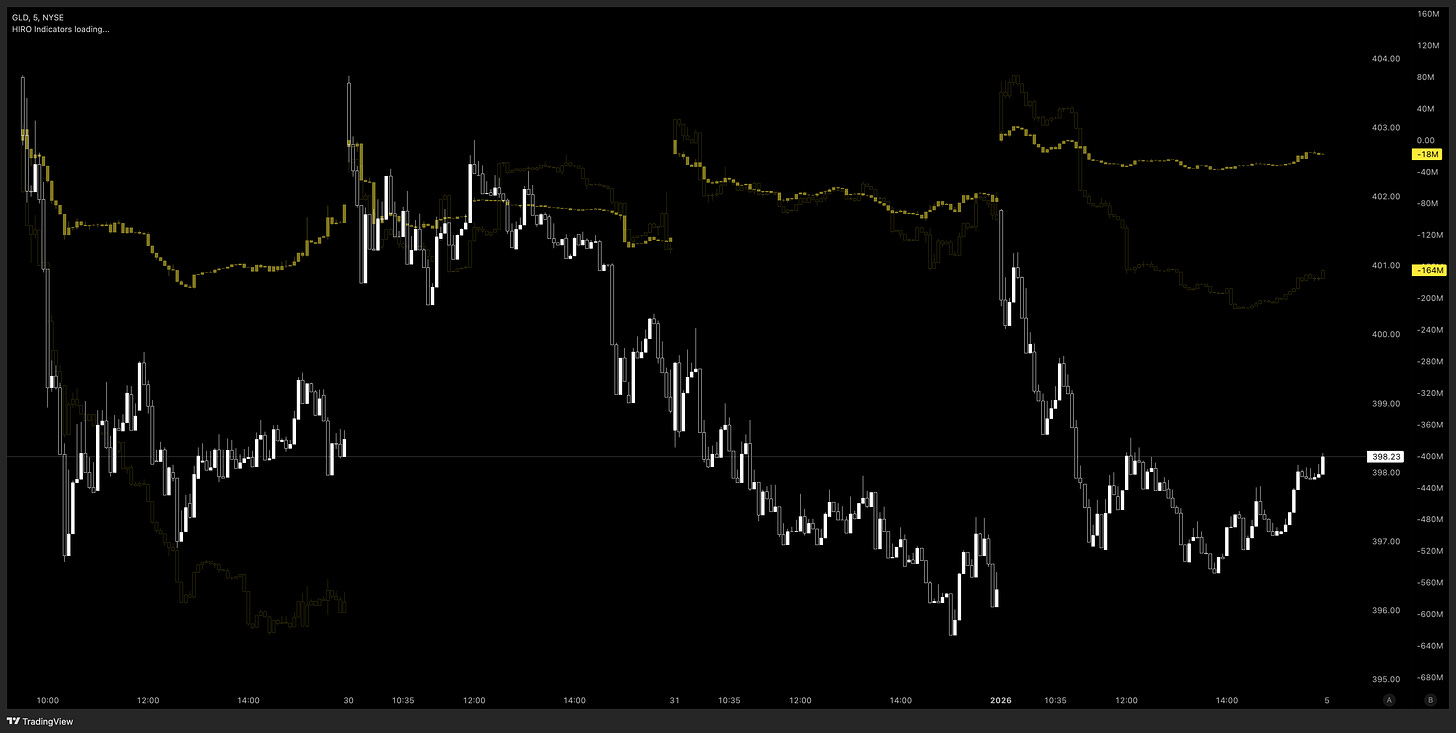

⚡️GC Review

*GLD for options flow'

Short date options flow has been relative flat, but slowly moving upward. In the short term looks like most are betting for a bounce. However, we do see some nice sell-offs in longer dated options flow, which signals more downside bets in the future.

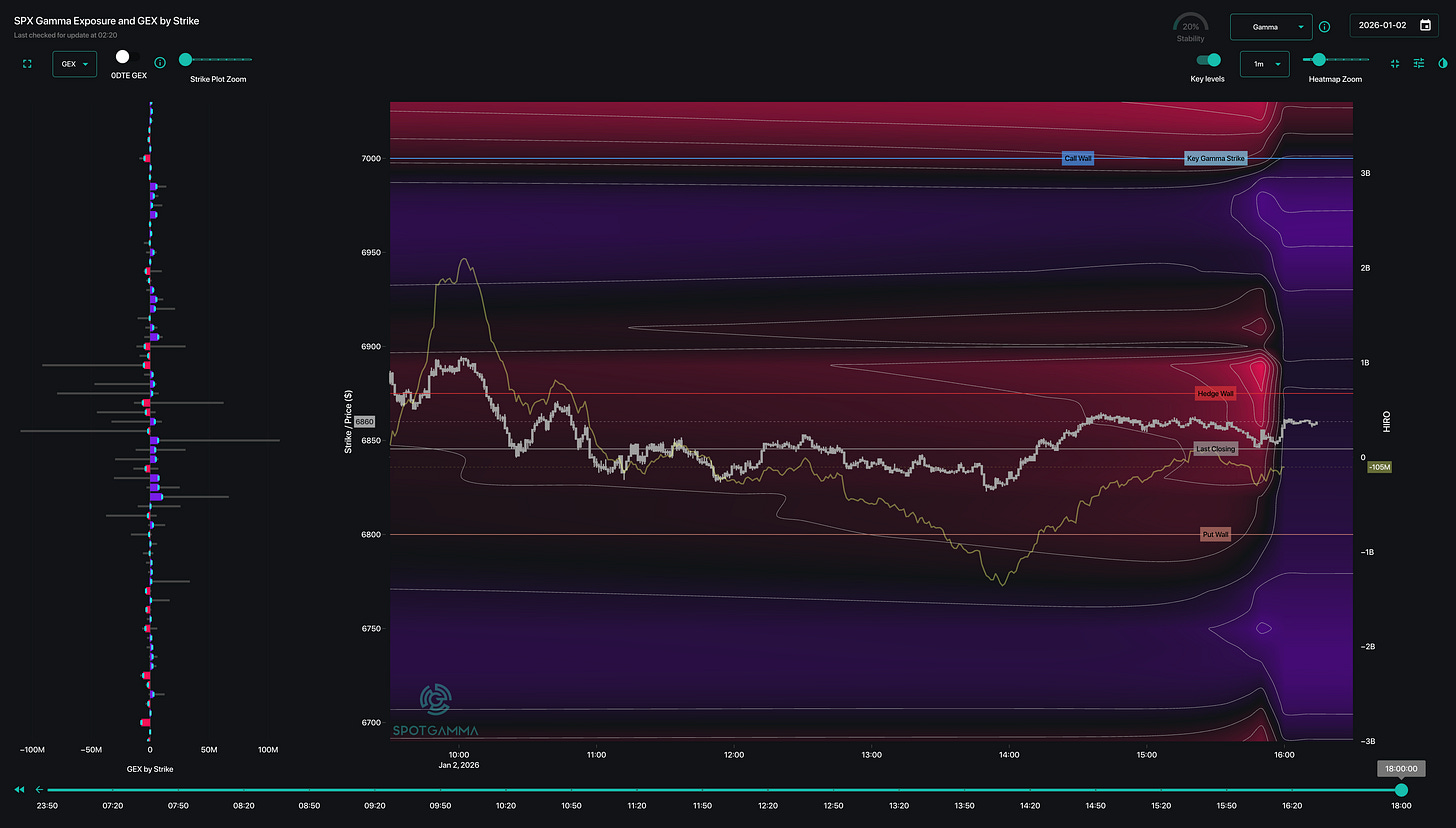

⚡️SPX - Gamma Heat map on Friday

Options flow was very bullish to start the day, but then turned bearish. The majority of trades were ODTE, which very few carrying over into next week. price stayed in negative gamma territory as we bounced between 6900 and 6800.

Those are the levels to watch for next week.

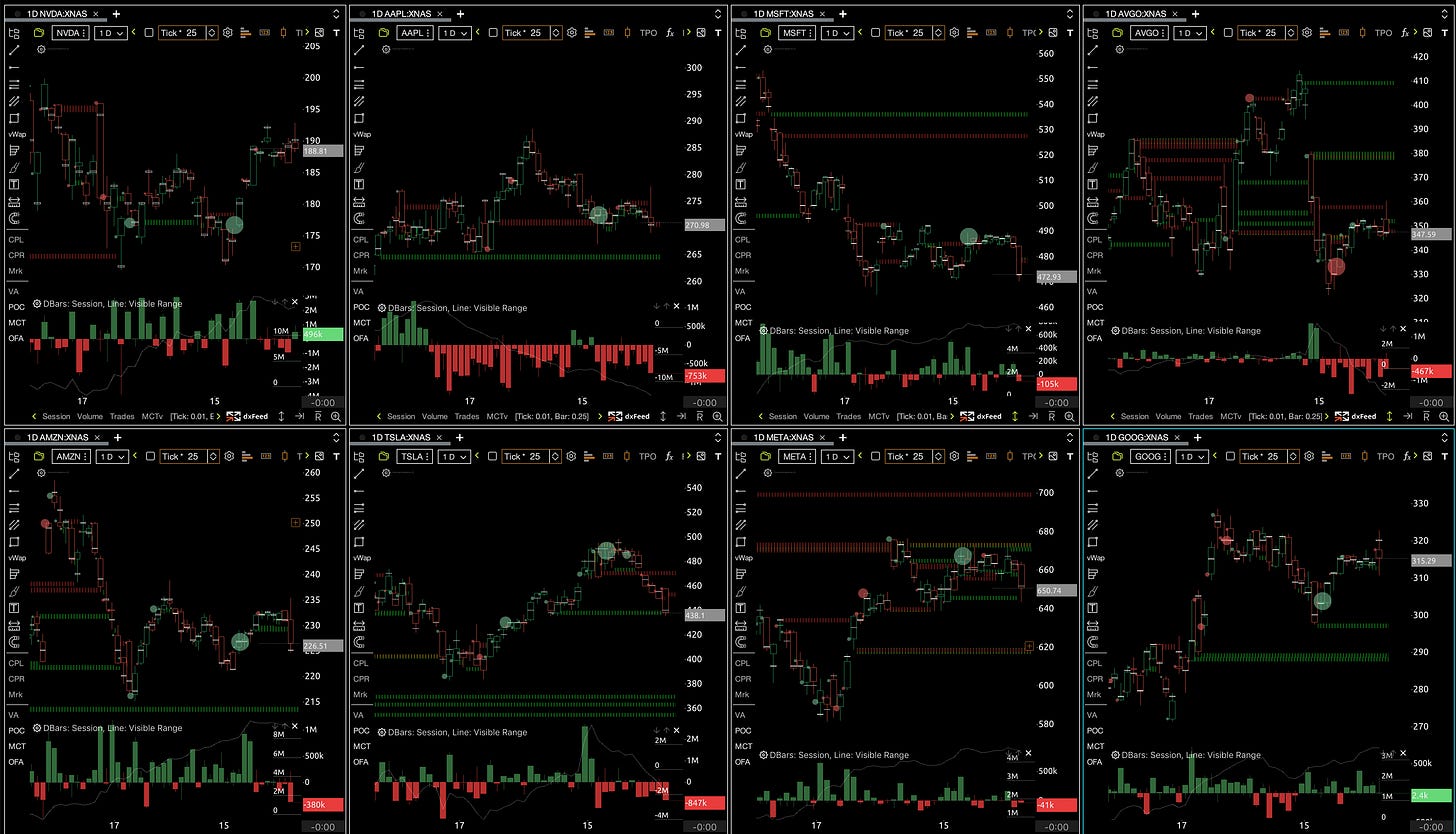

🎟️ Order Flow

Looking at the last 5 trading days of Order flow using Exocharts and DxFeed

⚡️NQ Review

CVD was red most of the week, while trying to go green on Friday - there was some big 150+ contract trades to start the day, but could not push us up.

Imbalance levels to watch: 25320s, 25640s, 25850s

⚡️ES Review

CVD was green most of the week, with only Weds afternoon showing weakness.

however, end of Weds to Friday we saw alot of 200+ contract sell trades, which seemed to keep price suppressed.

Imbalance levels to watch: 6865s, 6880s, 6920s

⚡️GC Review

CVD staying bearish for the week, with more clusters of big trades (10 to 50+ contracts).

Imbalance levels to watch: 4350s, 4385s, 4400s

📅 Upcoming Events

January 04 - FED speakers

January 05 - US ISM PMI

January 06 - FED speakers, US S&P / Composite / Services PMI and Employment

January 07 - ADP Employment change, Job Openings, Services PMI, US factory orders, Crude Oil inventories

January 08 - US Trade balance, Jobless claims, Labor cost, US productivity, Inventories MoM Rev, NY fed 1yr Inflation expectations, US consumer credit

January 09 - US unemployment rate, US Non-Farm Payroll, US Private Payroll,

US Average earnings YoY/MoM, US Housing, US Building permits, US average work hours, Uni Michigan Sentiment and 5 year inflation prelims, FED speaker

Looks like we have some opportunity for volatility towards end of the week,

but we have to see how Futures react to the US Venezuela news, where Maduro is in US custody now. This may provide uncertainty to start off the week.

🪙 Final Two Cents

The US Venezuela news will be top of mind on Monday to see how the world and markets reacts. Aside from that, looks like Indices are rotating back into RTY and YM, while options flow is generally more bullish. ES order flow looks the strongest bullish, followed by NQ. GC seems the most bearish, so will be watching that.

Preparation over prediction. Lets see how we open on Monday.