🗞️ Weekend Price & Flow Analysis

NQ ES GC Prep for week of January 19th

⚡️TL;DR

Indices still look mostly bullish, but overall things look mixed.

Options flow was put-heavy across QQQ/SPY, and futures orderflow looks more bearish than the ETF proxies, so I expect some chop + fast moves around key levels (especially with Monday holiday/short session).

NQ Levels: 26000, 25950, 25840, 25425, 25400

ES Levels: 7030s, 7000, 6970, 6920, 7030s

GC Levels: 4610, 4580, 4570, 4545

Rotation: RTY made new highs (rotation still alive), YM is bull-flagging, and VIX cooled but calls picked up (stay alert for shakeouts).

Top stocks: Most megacaps look slightly bearish / breaking down (GOOG was strongest but faded), so I’m open to two-way trade until support levels firm up.

Macro/metals: Metals still strong, but DXY and TNX rising could cap gold;

SI leading, copper strong but choppy; BTC/oil are mixed.Sectors: Leaders are XLI/XLP/XLE, while XLK is stuck, XLY is cracking, and defensives are mixed → bullish trend, but traders are cautious.

🌐 Price & Flow

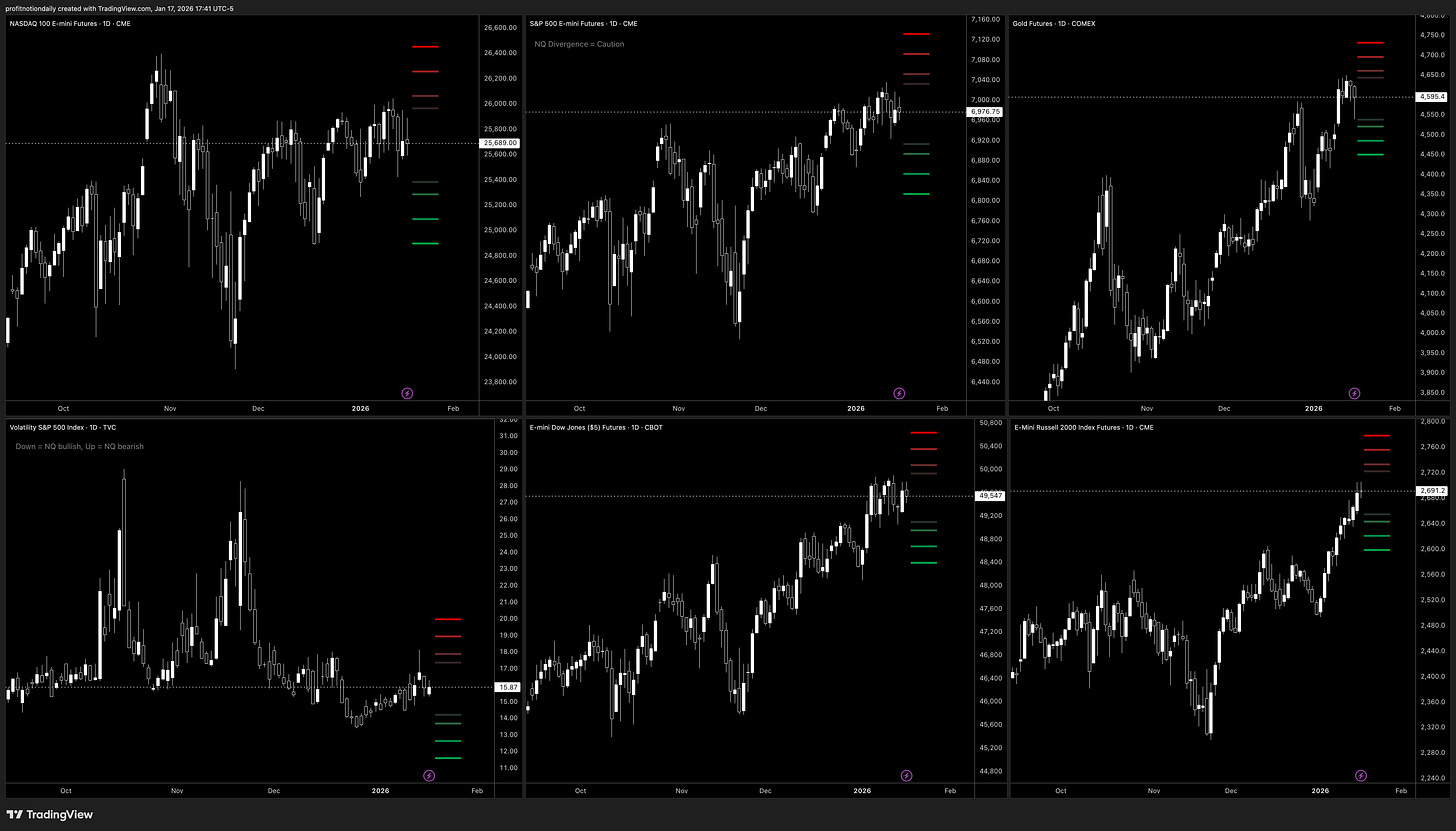

📊 Futures Indices

Price, Options Flow, Order Flow…

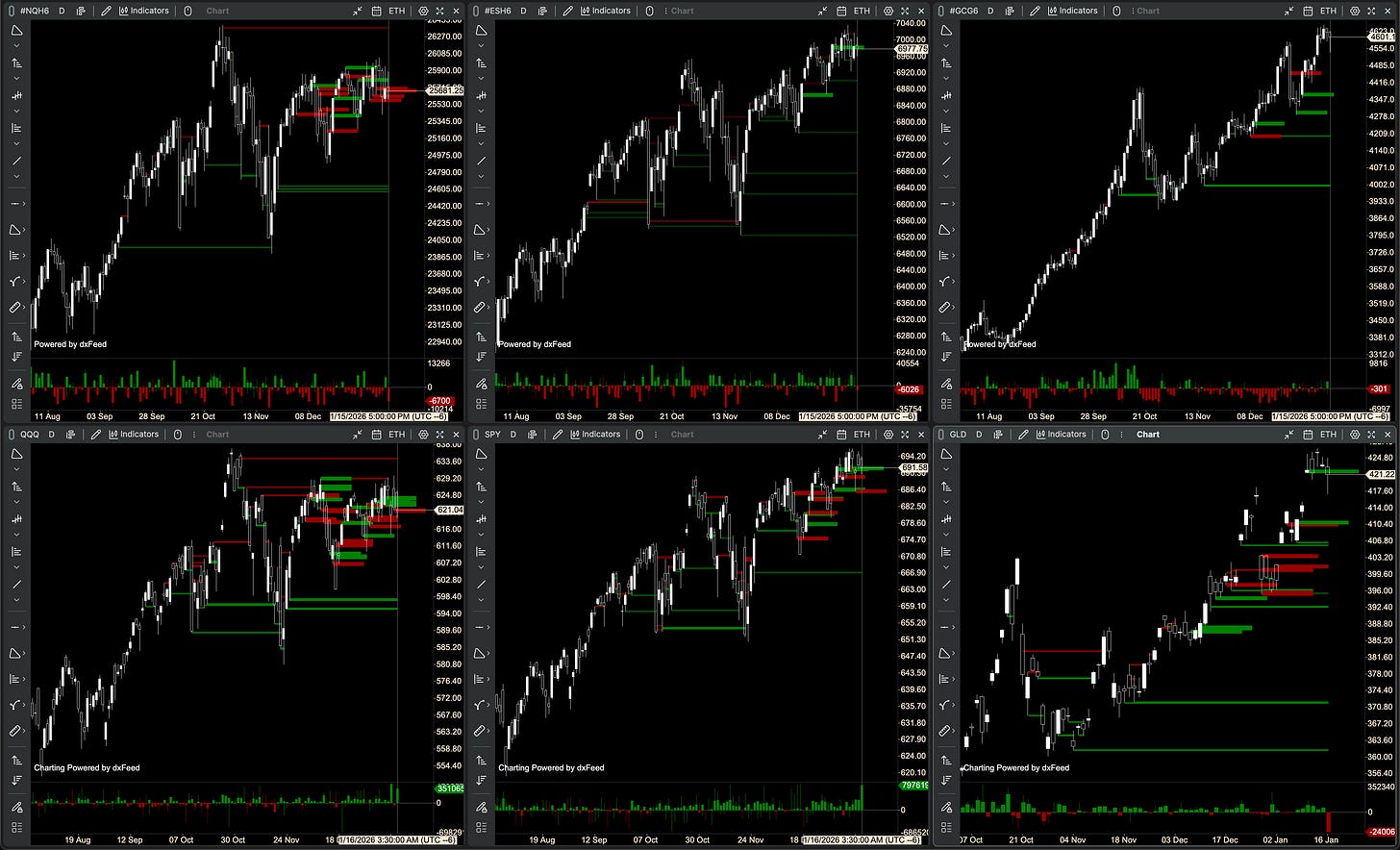

NQ (Nasdaq Futures) -

📈 Price / Levels (NQ):

Moving into an upward wedge on the Daily chart. Watching if we can break through 26000s zone to then try for new highs, or if we break below 25400s for downside. Until then will play the in between.

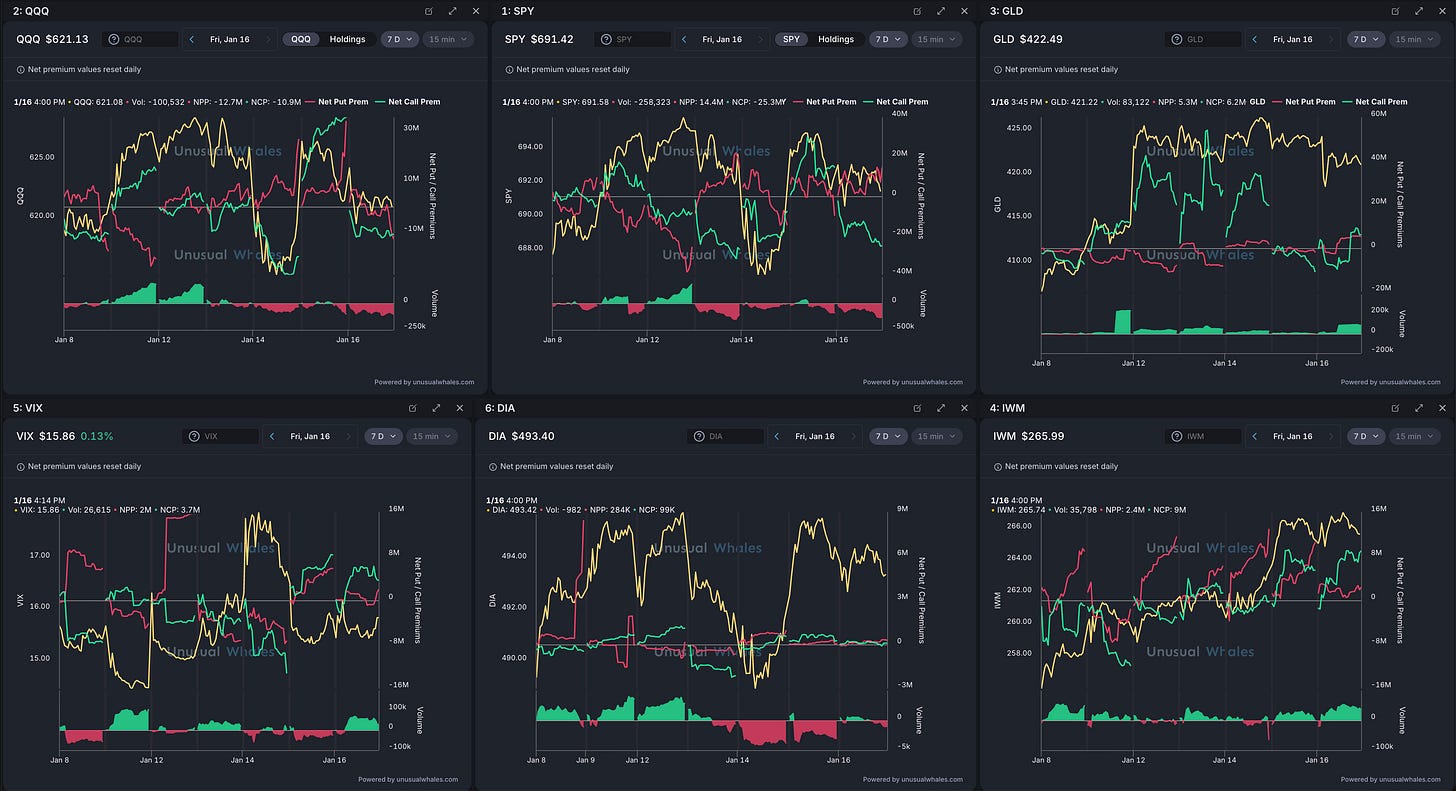

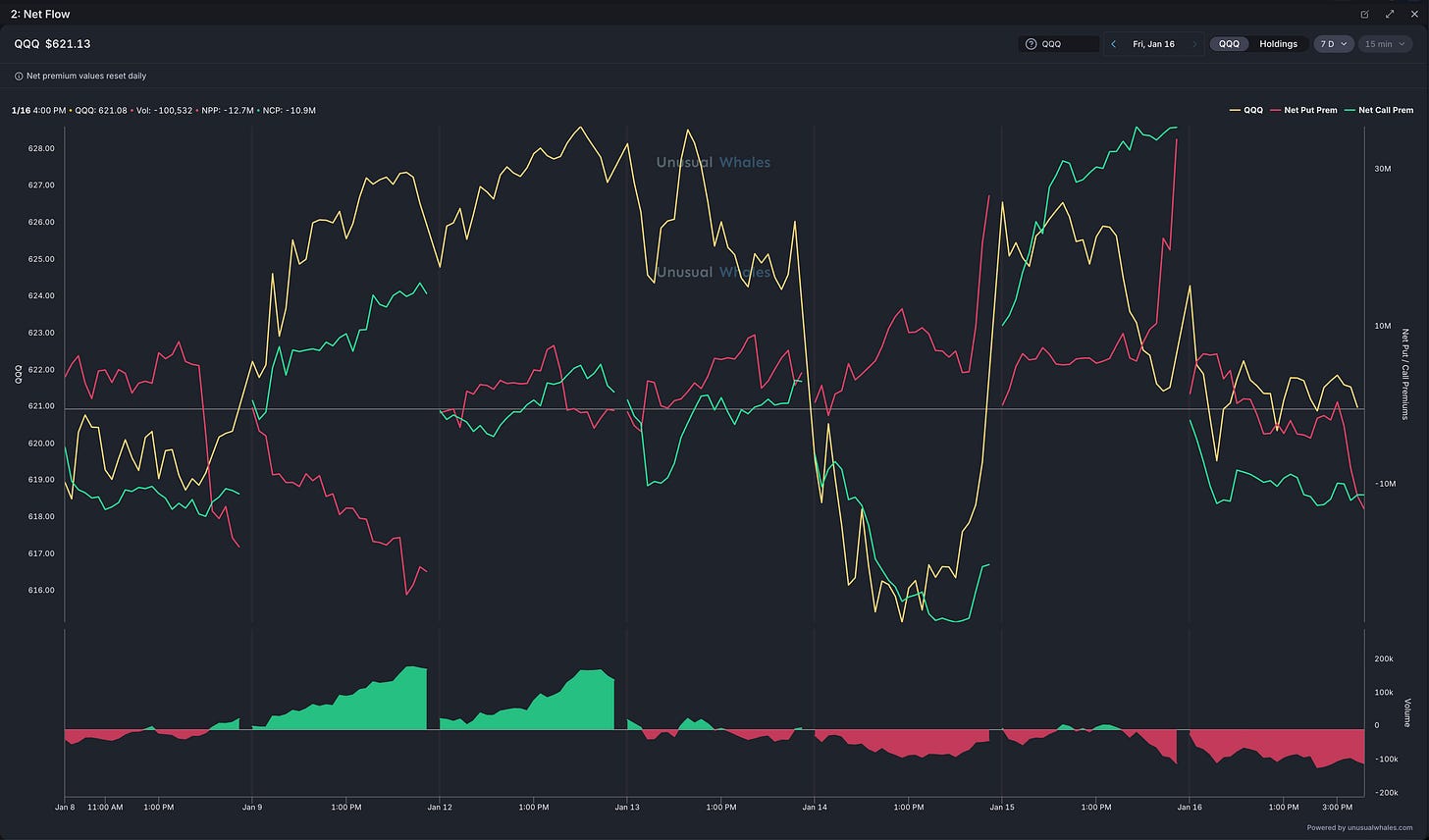

🌊 Options flow (QQQ):

More puts being bought all week, but calls did have a strong push on Thursday, but the week ended mix.

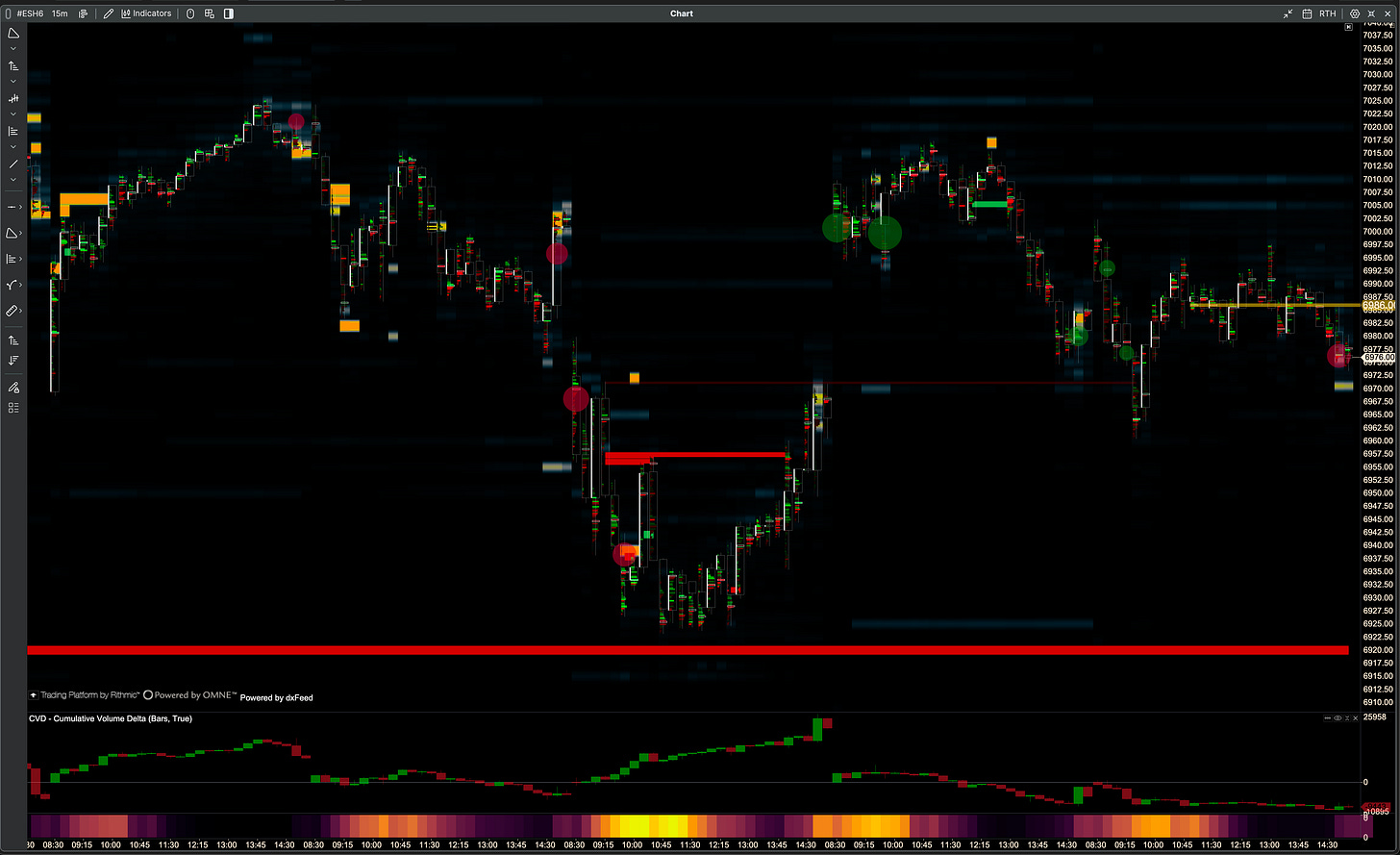

🔀 Order flow (NQ vs QQQ):

More selling imbalance and red CVD on NQ, but QQQ has more buying imbalance and green CVD. Since NQ is the “futures”, I wonder if there is downside to come?

ES (S&P Futures) -

📈 Price / Levels (ES):

Strong uptrend. Friday was an inside day, but Thursday did make a higher high and higher low. Watching 7030s for more highs. Expecting 6940s to hold for a bit.

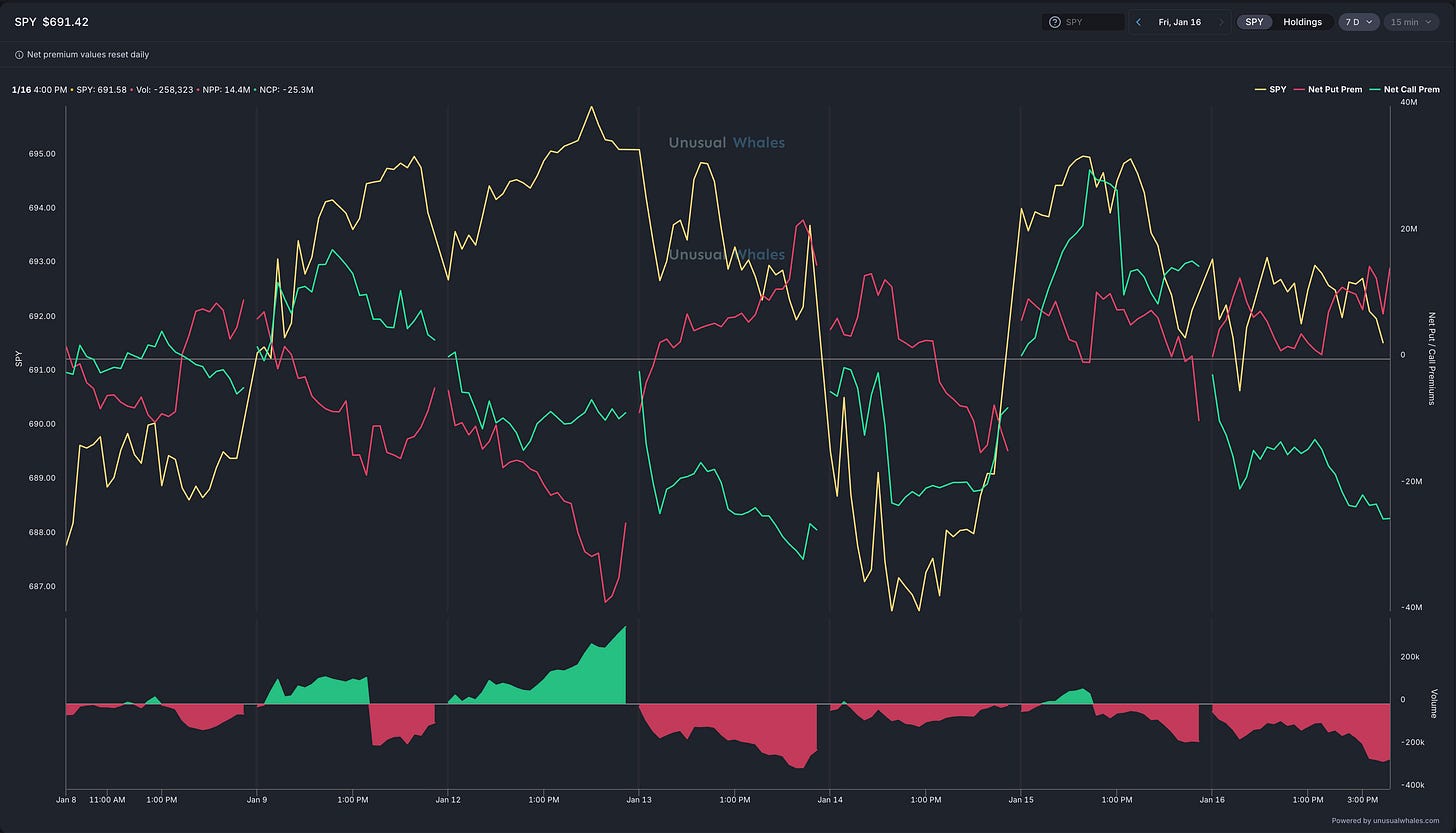

🌊 Options flow (SPY):

Overall looks a bit more bearish with put volume outpacing calls, however, we did have that push in calls on Thursday, the week ended more put heavy.

🔀 Order flow (ES vs SPY):

Strong bullish imbalance pushing us up on both charts. Strong green CVD on SPY, and only slight red CVD on ES. Looks strong for bulls going into Monday.

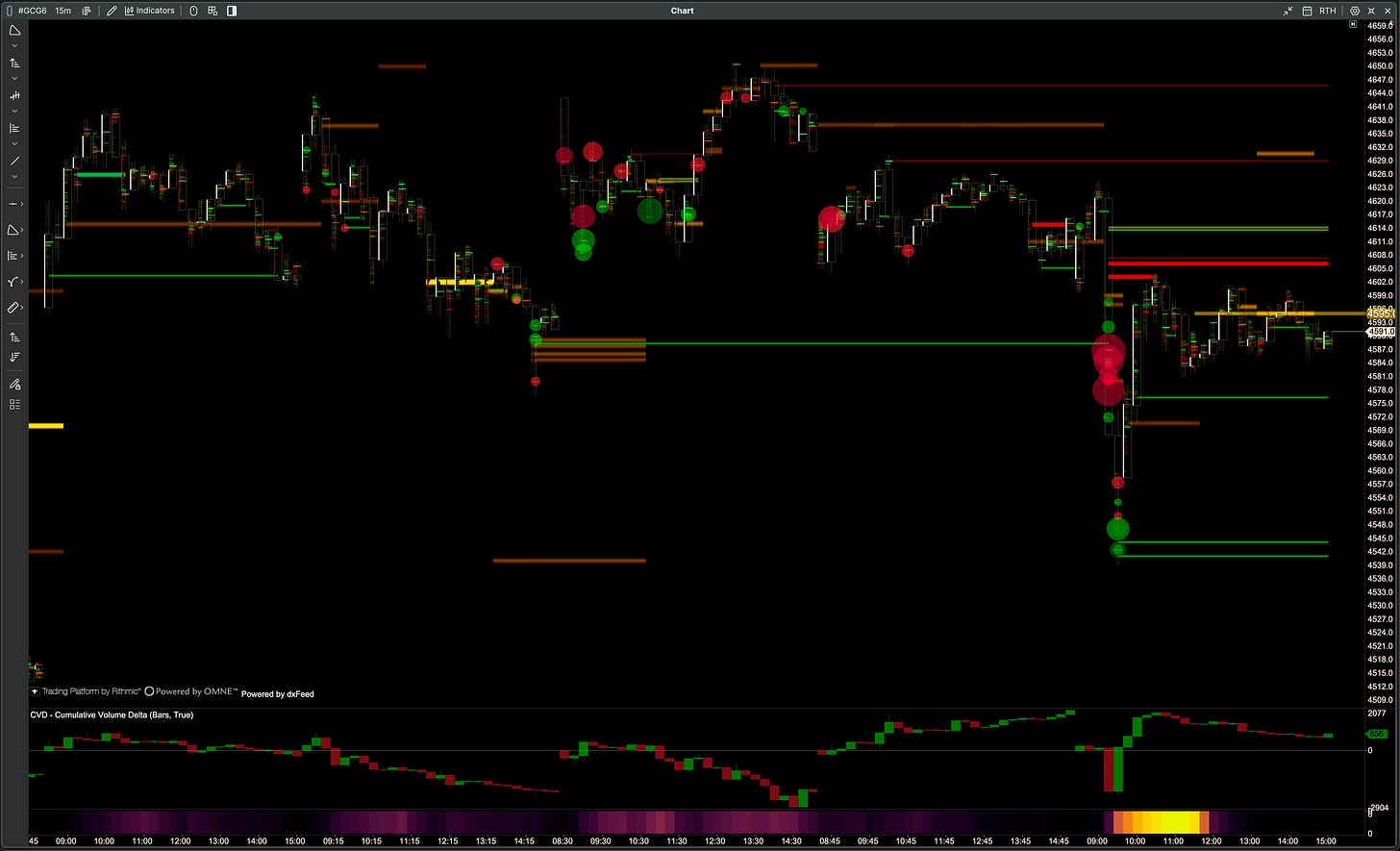

GC(Gold Futures) -

📈 Price / Levels (GC):

Broke down but Monday’s support held, and we closed back at Thursday lows. This suggest sellers really tried, but bulls are still strong. Watching how price behaves at 4580s to see if gear up to take out highs or last weeks lows.

🌊 Options flow (GLD):

Lots of call flow in the beginning of the week, but ending the week mixed. Volume was steadily bullish though.

🔀 Order flow (GC vs GLD):

CVD is green on GC as price held up on Friday, and we see big buying imbalance on GLD, but with a big red CVD candle to end the week.

Will be watching this divergence.

VIX (S&P Fear Index) - Pushed into 18s on Weds, but has cooled off again, but we did end the week with more call volume. Will be watching this closely next week.

YM (Dow Futures) - Price is up, starting to channel or even ‘bull flag’ on daily. Options flow is more mixed, but volume was more bearish middle of last week. Watching if high or low of the channel breaks first.

RTY (Russel Futures) - Broke new highs las week, with a nice doji on Friday.

This signals that traders are still rotating money into indices. More puts on options flow at the beginning of week, but as price broke out, calls have picked up. Volume is green.

Overall, price still looks strong across the board. We did have more put volume, but unsure if that is hedging or directional bets, but definitely worth noting. Futures order flow is signaling more bearishness compared to ETF proxies, but we have to see how Tuesday opens (Monday is a Holiday / short day for futures).

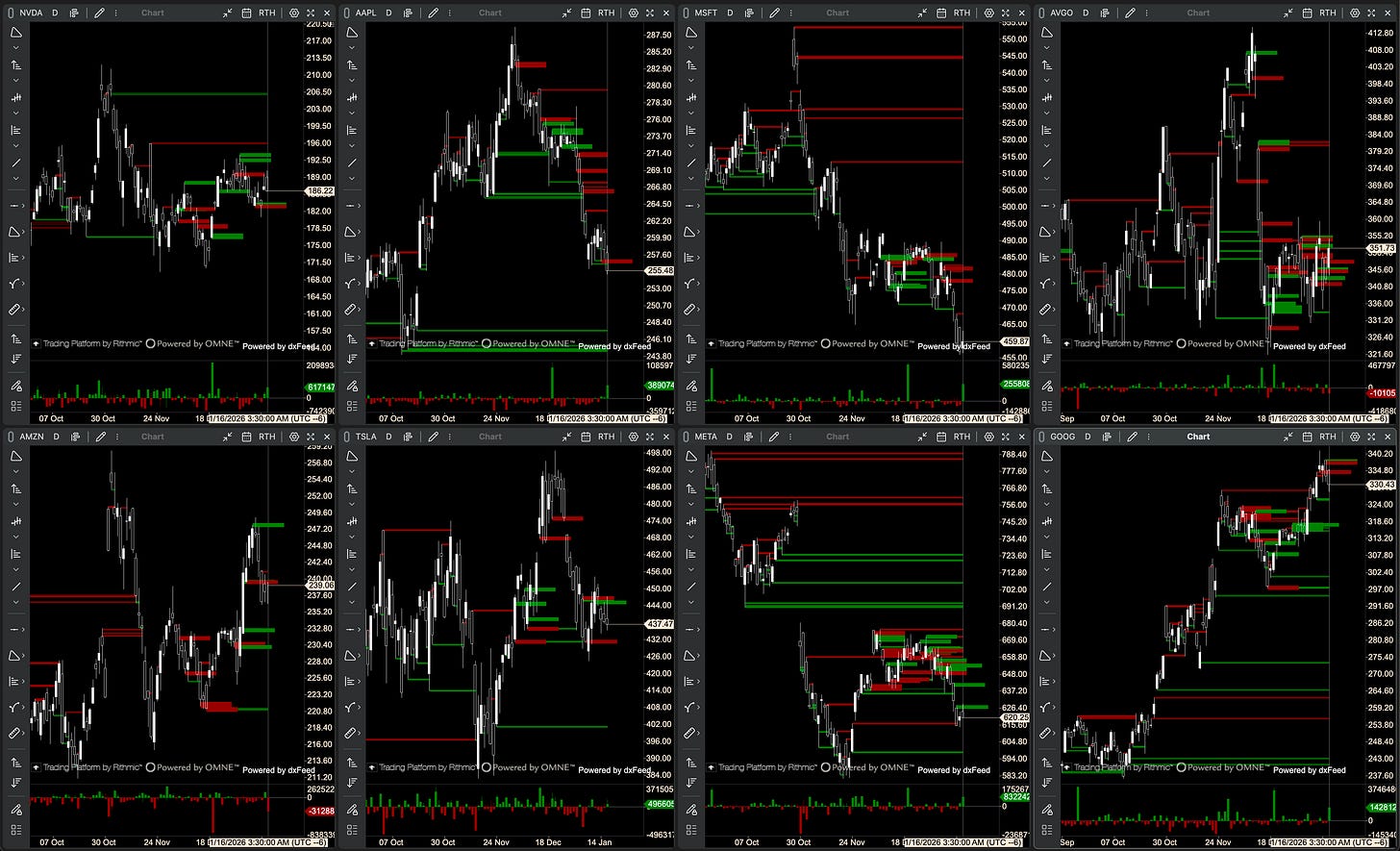

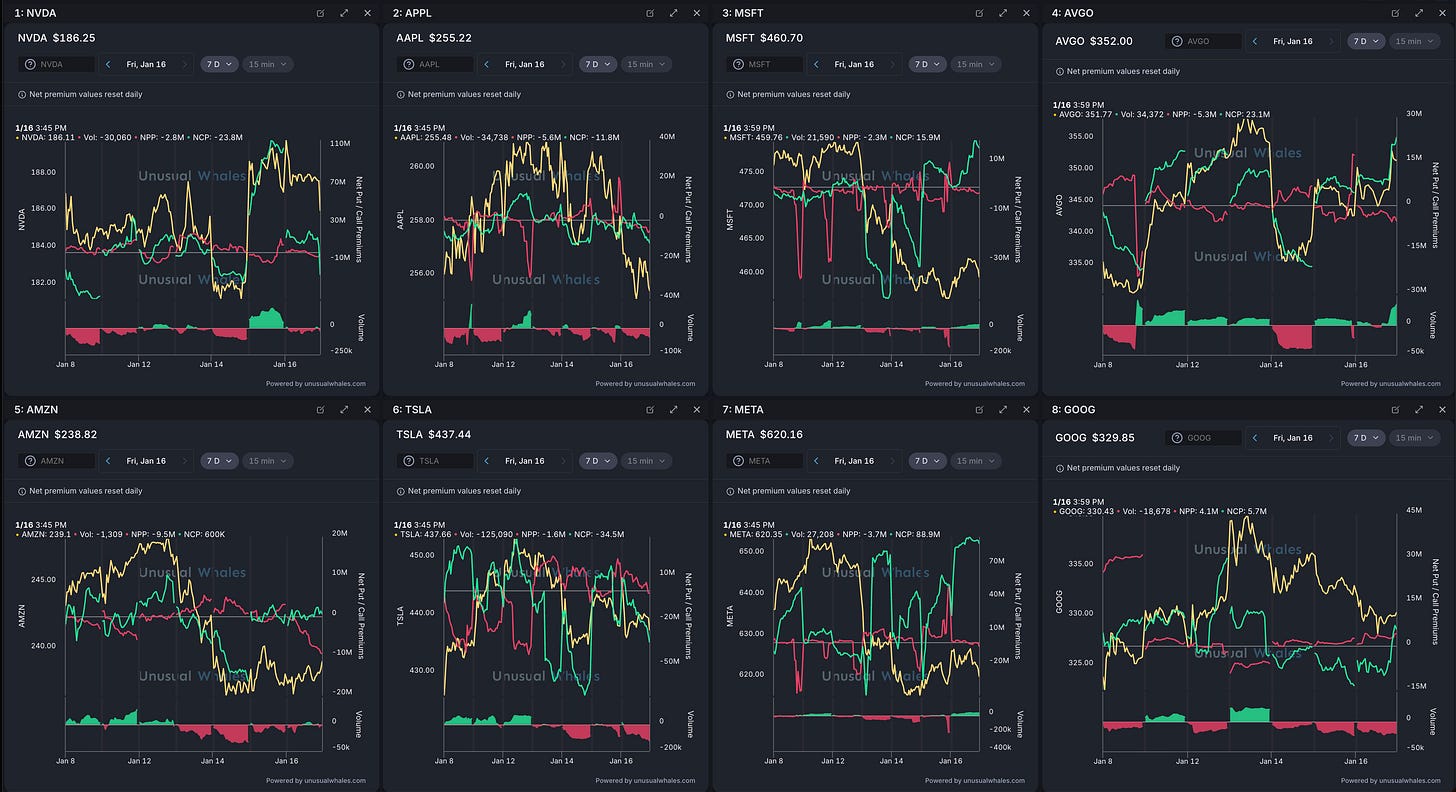

⚡️Review of Top Names QQQ (NQ), SPY (ES)

Price, Options Flow, Order Flow…

NVDA (Nvidia) - Trying to push higher. Buyers seemed to win the order flow imbalance battle at the beginning of the week, while options flow is fairly mixed.

CVD ending the week green thought.

APPL (Apple) - Tried to hold up after the big sell off last couple of weeks but broke support on Friday through selling imbalance. CVD starting go turn green but options volume is more bearish, ending the week mixed.

MSFT (Microsoft) - Breaking down, similar to APPL. Lots of selling imbalance pushing us lower, but CVD ending the week green. Calls are picking up on options flow, so perhaps a near-term support is forming.

AVGO (Broadcom) - Trying to fight back up. Lots of imbalance on both sides, but price is holding up. Call volume is slightly winning on options flow, CVD ending the week slighting red, but overall mixed for the week.

AMZN (Amazon) - Tried to push higher on Monday but fell over all week. Currently trying to hold up through the selling imbalance level from previous week. CVD is red. but options flow is mixed. Puts are steady but not rising, however, call options falling.

TSLA (Tesla) - Still trying to come back after that gap down from highs. Imbalance on both sides the the current ‘potential bounce range’. CVD ending the week slight green, but mixed all week. Options flow had a little more put volume, but overall still bearish looking to end the week.

META (Meta) - Still falling over after trying to reclaim the high after the gap down. Lots of buying imbalance, but price keeps falling. Nice spike up on Friday, but could not close near high of day. CVD ending the week green, and call volume is up and building all week, so perhaps support will form soon.

GOOG (Google) - New high this week! But then broke down a bit. Lots of selling imbalance showing up. CVD was mixed all week, but strong green on Friday. Volume is more bearish, and options flow has slightly more puts. Call volume is falling, so maybe this is a near term top?

Overall, price seems to breaking down on more of the top names, with GOOG being the strongest this week, but sold off into end of week. We’ll have to see if support starts to form, but flow looks mixed, so I’m open to more downside with expectations of bouncing between long and short until levels firm up.

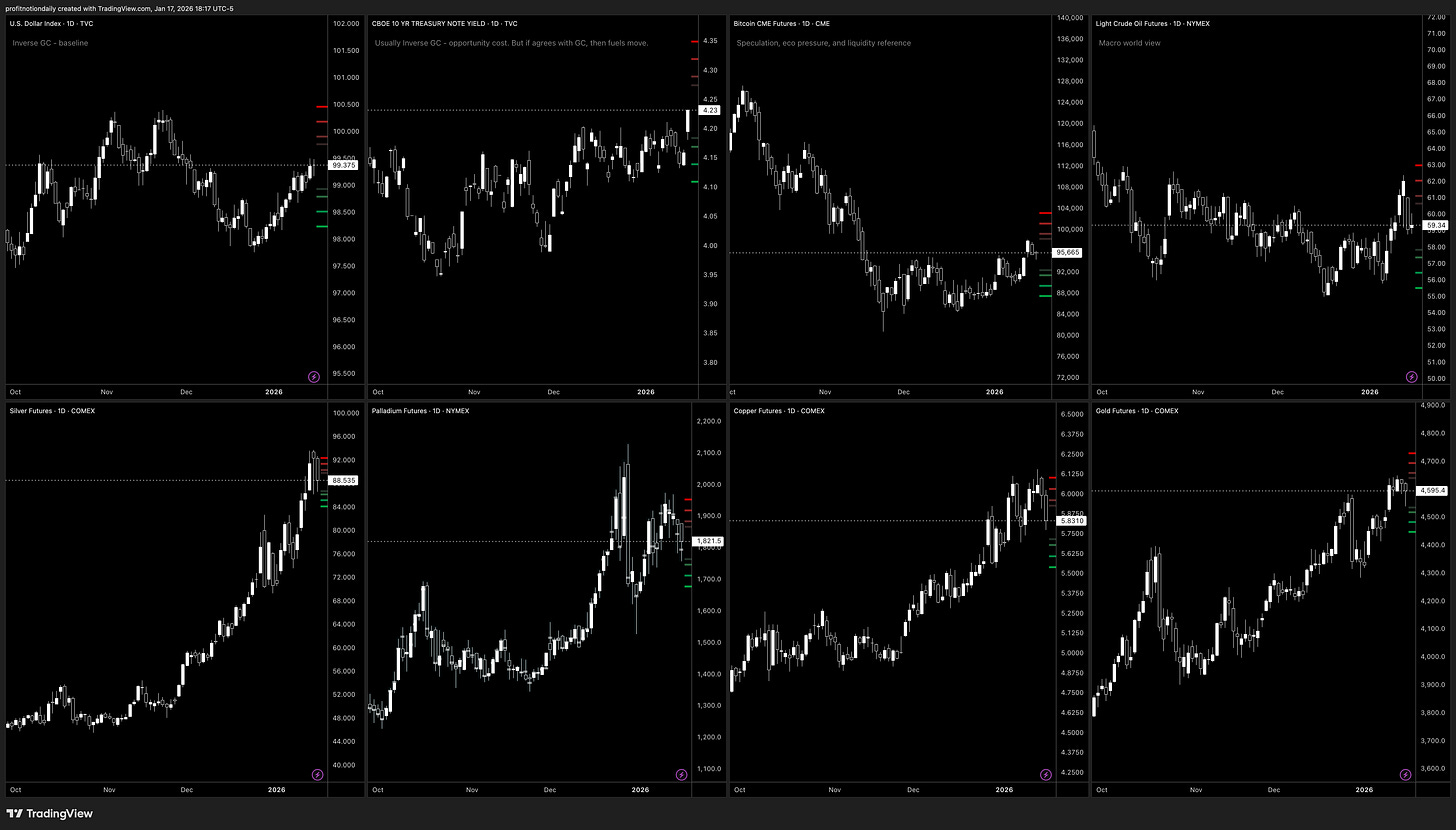

⚡️Review of Gold / Macro

Price, Options Flow…

DXY (Dollar) - Trading in the middle of range since October, but steady climb up the last couple of weeks. This could stall gold into next week.

TNX (Treasury Note) - Breaking out! Lets see if we keep up and if GC inverses.

BTC (Bitcoin) - Starting to break out of its range, but not with strength. Options flow is mixed, but volume is bearish to end the week. Is this a sleeper?

CL (Crude Oil) - Price broke out of it’s little downtrend, but starting to fall back over.

Options call volume picking up heavy on Friday, could be a sign of things to come.

SI (Silver) - Pushing to new highs last week, but with big pull backs to end the week. Looks like bearish volume is sustaining while options flow if falling, but puts winning.

PA (Palladium) - Price looks like it wants to break down. This is lagging the other metals. Call volume starting to pick up on Friday though

HG (Copper) - Made a new high this week, then had a strong pull back. Similar to GC and SI action. Friday options flow looks bullish with volume and calls pushing up.

GC (Gold) - (See section at top)

Overall, Metals still look strong, but there are some signs of resistance for GC in TNX and DXY. For now it looks like SI will lead us, just have to wait for the direction.

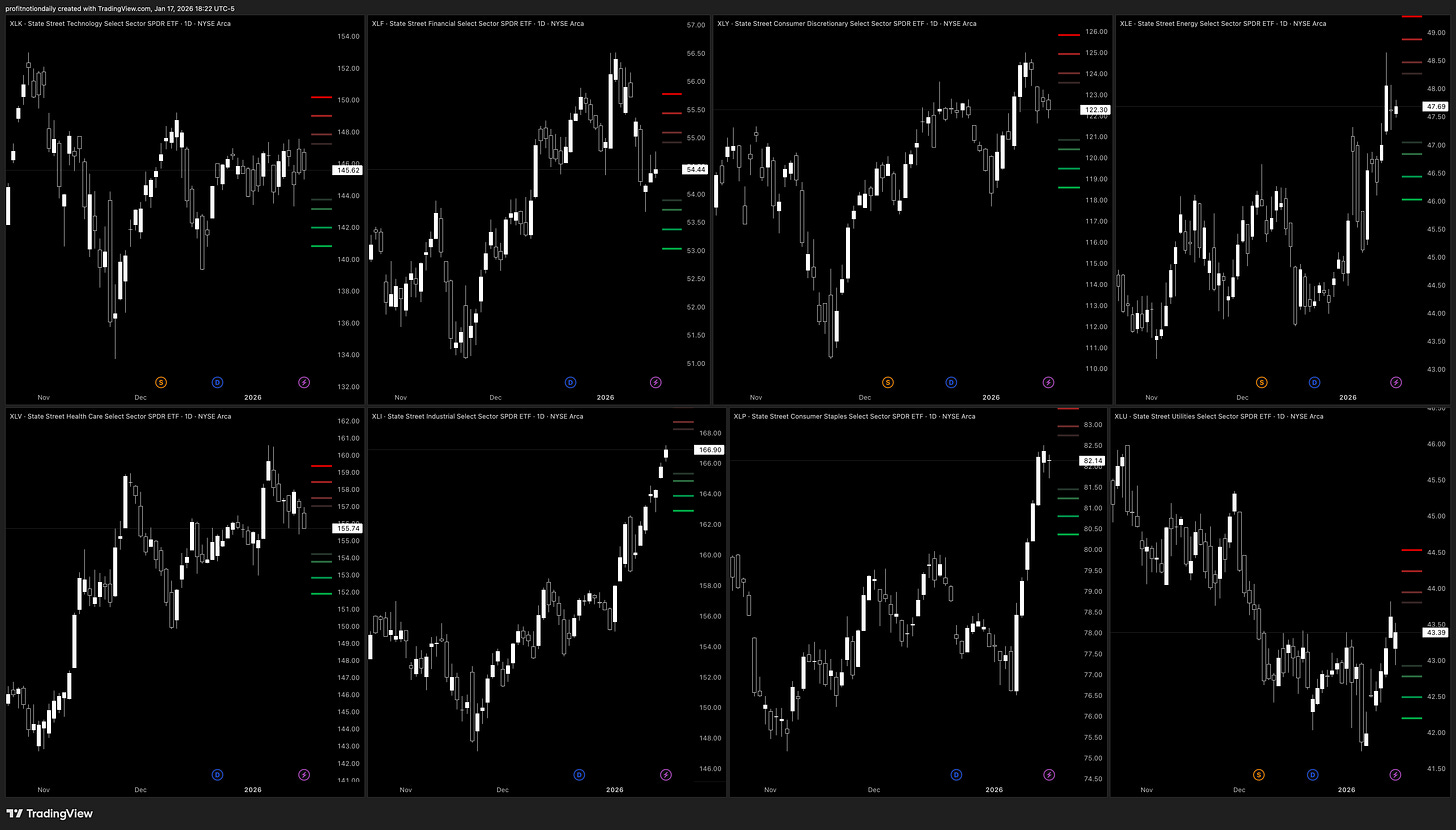

⚡️Review of Sectors

Price, Options Flow…

XLK (Technology) - Sight upward, but mostly sideways wedge. Call volume tried to pick up this week, but ending down.

XLF (Finance) - Sold off at beginning of week but trying to bounce. Call volume slightly outpacing in options flow.

XLY (Consumer) - New high for the week, but broke down. Puts picked up Friday.

XLE (Energy) - Nigh high and still looks bullish with the pull back. Calls heavy up.

XLV (Healthcare) - Still breaking down. Watching support. Slight bullish call volume.

XLI (Industrial) - New highs and strong. Price is running. Slight bullish call volume.

XLP (Staples) - New highs and strong. Price is running. Slight bearish call volume.

XLU (Utilities) - Broke recent resistance. Options flow mixed. Volume bearish.

Sector-wise, the market is still leaning bullish with Industrials (XLI), Staples (XLP), and Energy (XLE) leading, but Tech (XLK) is stuck in a sideways wedge, Consumer (XLY) is slipping after a failed high, and the mixed signals in defensives (Healthcare (XLV) / Utilities (XLU)) show traders are staying cautious even as the trend grinds up.

⚡️AI Powered Price Score Matrix

Proprietary matrix powered by AI that provides market price action summary and what it means for NQ, ES, and GC futures.

While Indices and Sector price action is slight bullish, Top 8 equities remain slight bearish and Metals/macro is neutral, signaling mixed outlook going into next week.

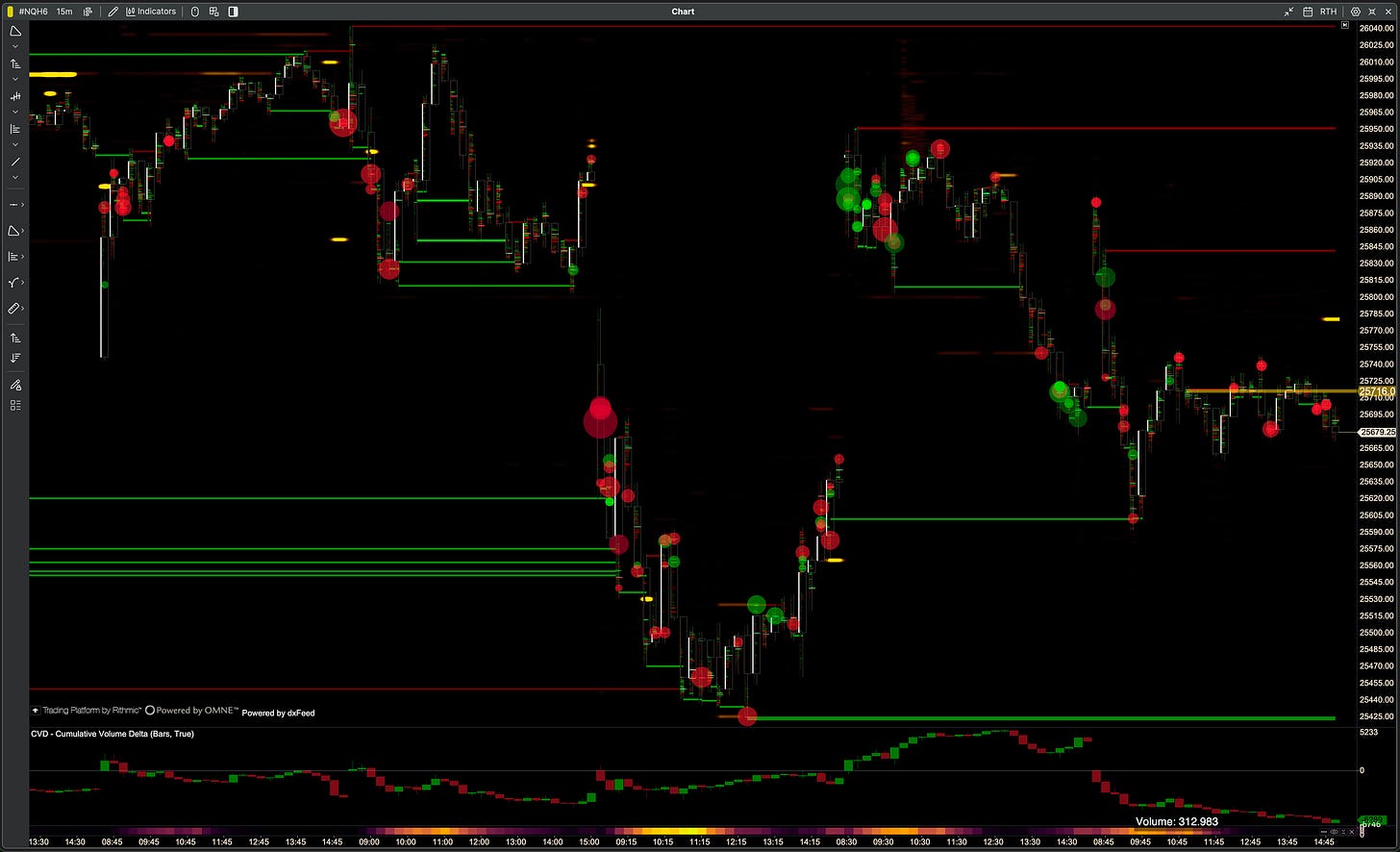

🌊 Options & Order Flow

⚡️NQ/QQQ Review

Sellers definitely won at the beginning of the week, but buyers stepped in at 25425s in the middle of the week. However, 25950s proved to be a hard level for buyers to break through and we continued to sell off.

25600s and 25840s are the levels i’ll be watching for Monday and Tuesday.

More puts being bought all week, but calls did have a strong push on Thursday, but the week ended mix

⚡️ES/SPY Review

Buyers were strong in beginning of week, and even though price fell toward the middle of week, CVD was never really bearish… Interesting divergence there.

We had some really big orders show up at 7000s level throughout the week, but we could not stay above that level.

Watching what price does if we make it down to 6920, but between 6970 and 7000s will be interesting to set direction for the week.

Overall looks a bit more bearish with put volume outpacing calls, however, we did have that push in calls on Thursday, the week ended more put heavy.

⚡️GC/GLD Review

Friday had the most intense volume of the week as buyers said “no” and took price back up after we gapped down. 4545s is the line in the sand next week, with lots of resistance levels to the upside.

For now watching what price does at 4610s and 4570s.

Lots of call flow in the beginning of the week, but ending the week mixed. Volume was steadily bullish though.

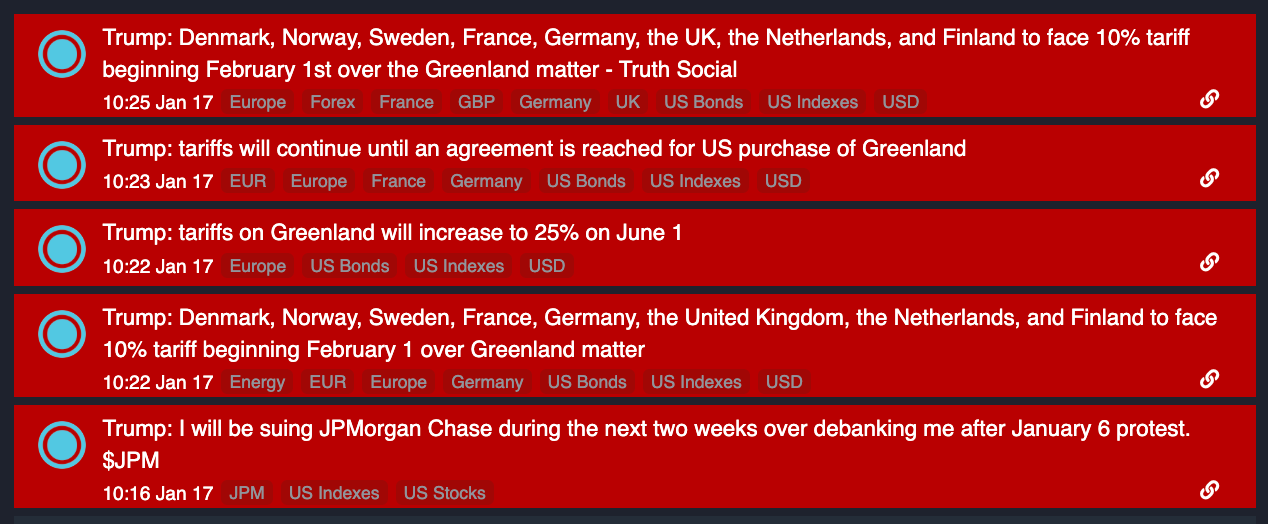

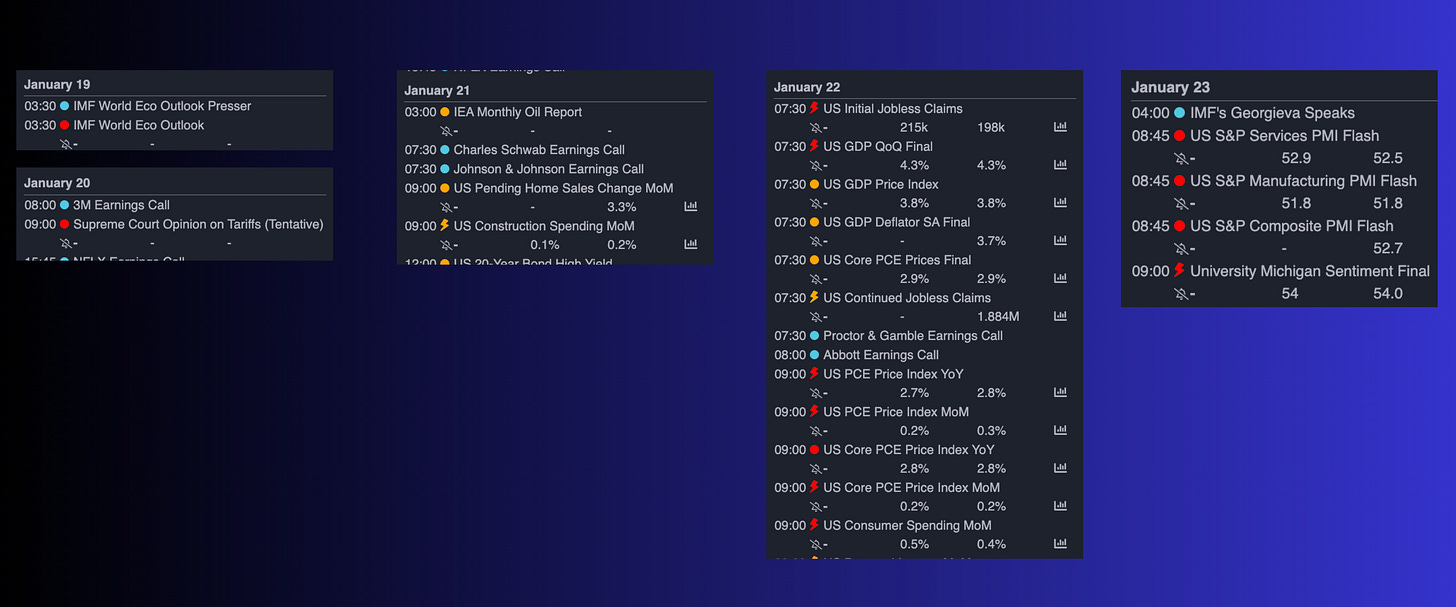

📅 Upcoming Events

Greenland, Tariff Court opinion, Jobless claims, PCE, and earnings could offer good opportunities for day trading and scalping next week.