🗞️ Weekend Price & Flow for Jan 12th

NQ ES GC Prep for week of Jan 12 to Jan 16

⚡️TL;DR

Last week was mostly bullish, and options flow supports more upside, but we are seeing divergence in cumulative volume delta (CVD), and the top eight equities that drive NQ and ES are mixed.

The divergence in price and order flow will be what I’m watching next week, especially with the CPI, PPI, Jobless claims on deck.

NQ Levels: 26000s, 25,900s, 25,880s, 25,800s, 25720s, 25600s

ES Levels: 7019s, 7000s, 6980s, 6950s, 6900s

GC Levels: 4540s, 4515s, 4490s, 4460s

🌐 Price & Flow

📊 Futures Indices

Price, Options Flow, Order Flow…

NQ (Nasdaq Futures)

Price broke above the resistance from after the breakdown in early Nov (24935s).

We pierced through on Weds, then closed at the resistance level. Steady push up all week. On Friday, options flow closed mixed between NDX/QQQ, but the trend is similar, we had bullish options flow in the morning, and trend turned down towards the close. CVD has been mostly red on the daily and price continues higher, but Friday POC did stay near the highs. If CVD can flip green for Monday’s session, we could keep going.. but must keep the daily gap close (26017) on the radar, incase we touch and flush there.

ES (S&P Futures)

Price made new highs on Weds, and then again on Friday, closing at Weds highs (7005s). If we can print above Friday’s high (7019s), then sky is the limit… but realistically 7060s to 7100s is in play on Monday, however price could pull back to 6950s and still be bullish. Options flow is mixed between ES/SPY options, but SPY is looking more bullish on flow. CVD is holding positive, but Friday did close red, even while price made new highs with POC near highs. Watch how that divergence plays out on Monday.

GC (Gold Futures) -

Price pushed back up strong on Monday, and made pushed back last week’s breakdown level (4515s) on Friday. Options flow was steady bullish from open to close on Friday, signaling more strength. It’s interesting that price has been pushing higher on generally more negative CVD. On Friday POC ended near hight, price made the hight point for the week, but CVD was the most bearish for the week.

Watching how that divergence plays out.

RTY (Russel Futures)

Strong. Making higher highs and lows all week. Closed at new all-time high.

Options flow going bearish on Friday, so lets see. Monday had a massive bullish push in CVD, but Friday closed with Red CVD at all time highs.

YM (Dow Futures)

Price made new all time highs on Weds, but rejected lower and bounced back into Friday. Options flow going bearish on Friday. On Weds, we made new highs but closed at the lows on red CVD. Thursday CVD pushed massive green, and Friday pushed higher on slight red CVD.

VIX (S&P Fear Index)

Steady climb the last two weeks, and then dropped 50% of that move on Friday. Options flow still has more upside bets, and near-term CVD flow continues to push for more upside, while price falls. Again, watching this divergence.

Last week the market mostly went up.

But underneath, the buying didn’t look super “strong” because the buy/sell pressure (CVD) was often negative even while price climbed.

Also, VIX/hedging signals suggest some traders are still protecting against a surprise selloff, even though prices are higher.

Lets see if Monday and keep pushing us higher or not.

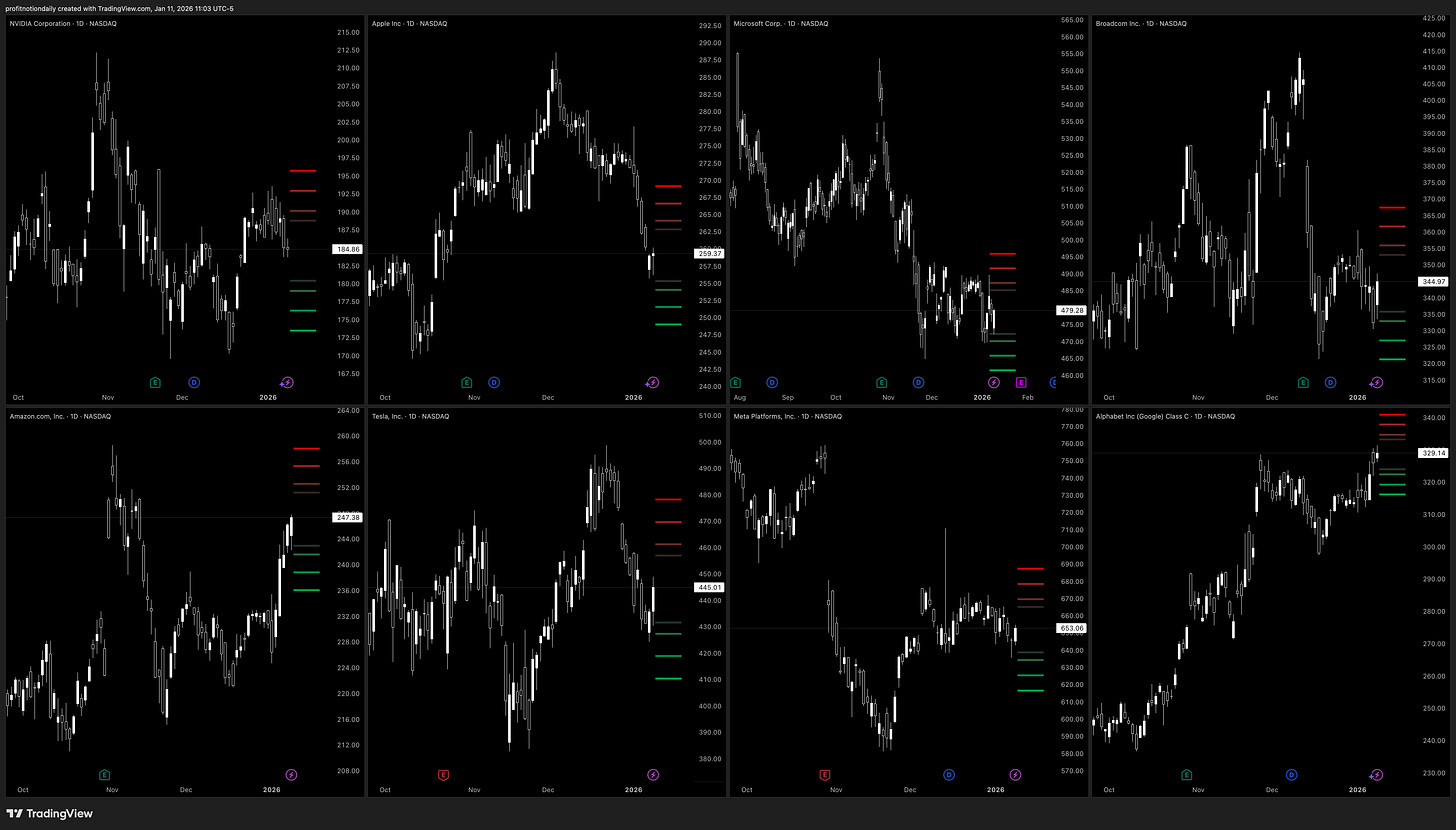

⚡️Review of Top Names QQQ (NQ), SPY (ES)

Price, Options Flow, Order Flow…

Overall, this group is mixed.

GOOG and AMZN are the strongest (GOOG is near breakout highs around the low-330s, and AMZN is acting like it reclaimed/held the mid-240s area).

AAPL and TSLA are weakest—Apple is still in a clear slide and sitting on support around the mid-250s, and Tesla has been pulling back hard from the highs and needs to stabilize before it’s trustworthy again.

Options flow is mostly bullish Friday across the board, but the buy/sell pressure (CVD) is mixed or red. This divergence is consistence with what’s happening with Indices.

Lets see how things shake our on Monday.

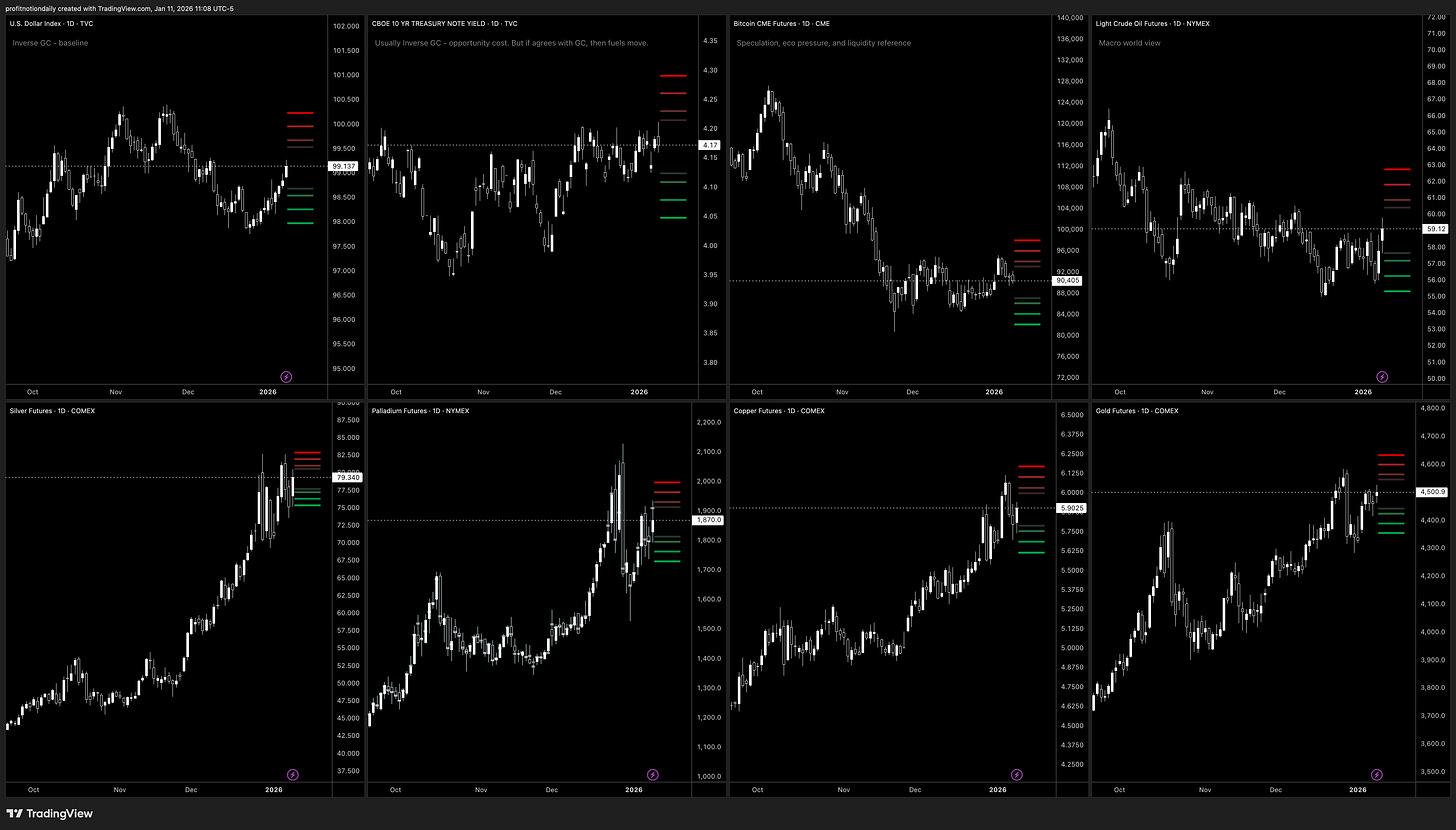

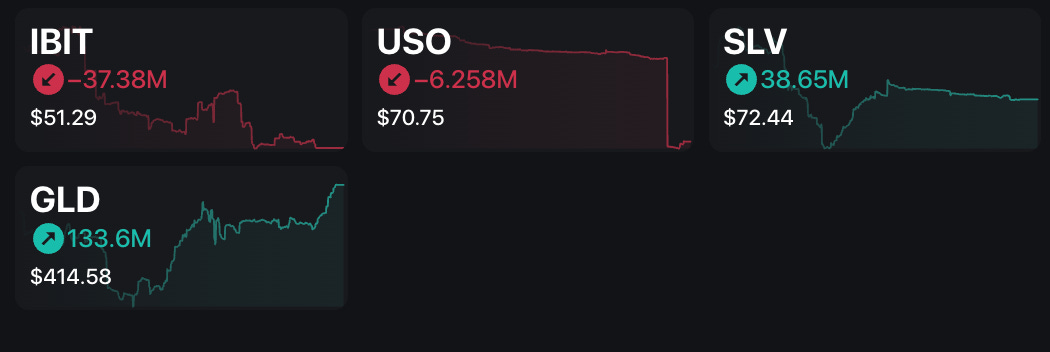

⚡️Review of Gold / Macro

Price, Options Flow…

The Dollar (DXY) and Treasury Yields (TNX) are starting to move up again, which can make it harder for equities to keep running. Bitcoin and Oil still look weak and choppy. The options flow in their ETF proxies is still leaning bearish (IBIT/USO)… lets see if that continues next week.

Metals continue to be strong.

Gold and Silver are trending up and both are seeing strong bullish options flow (GLD/SLV), and Copper also holding near highs.

Looks like more rotation back into metals could be on the horizon.

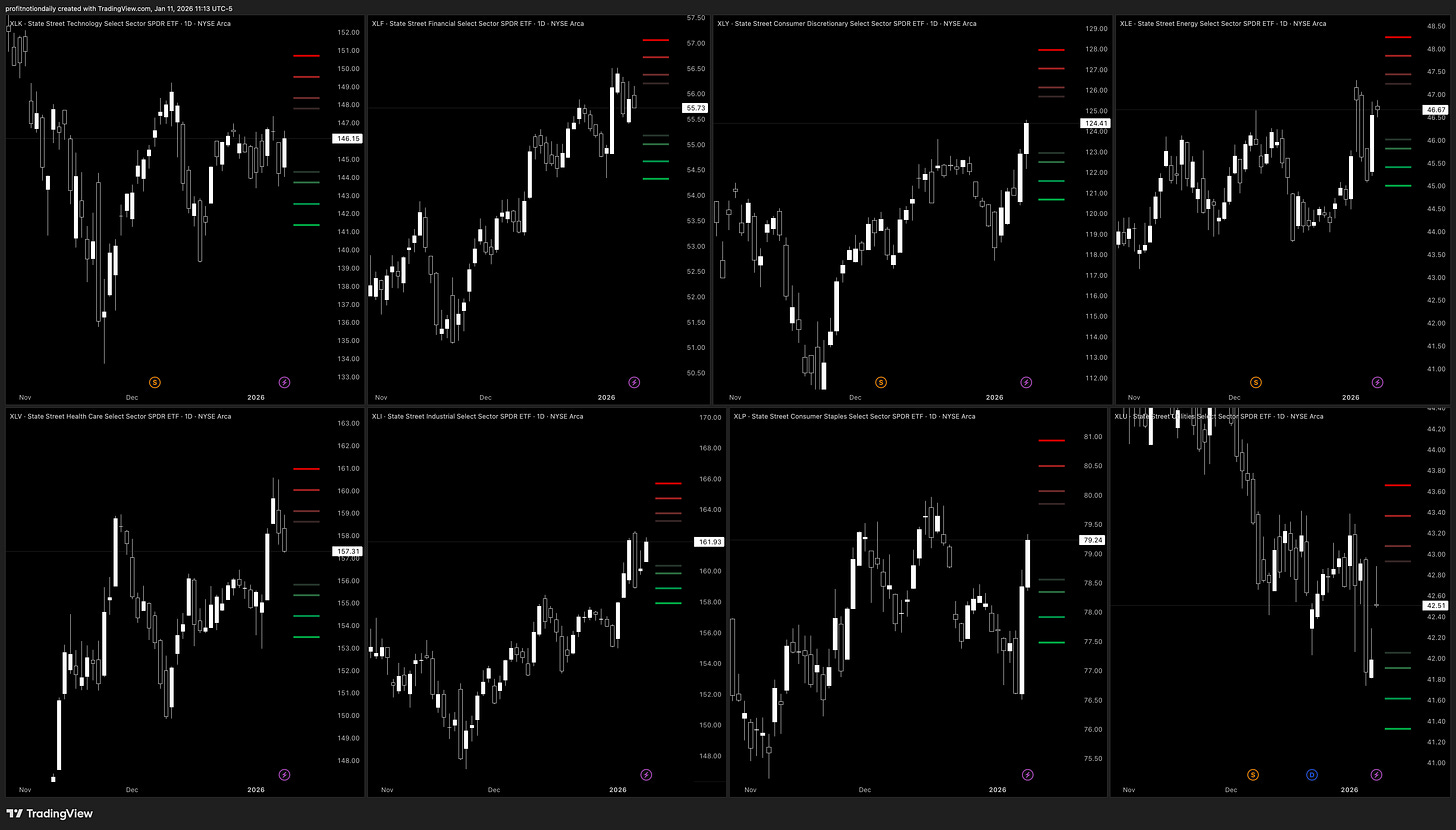

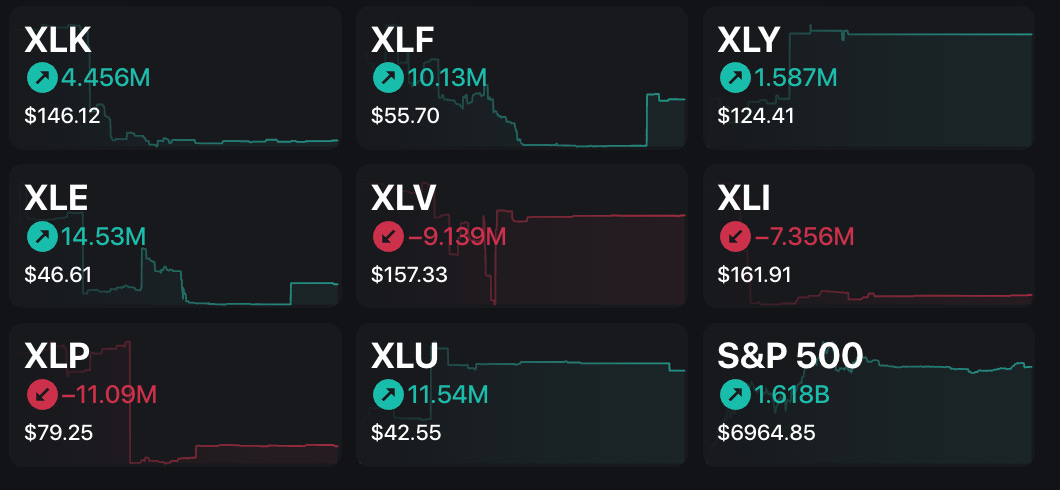

⚡️Review of Sectors

Price, Options Flow…

Last week looked mostly bullish, but you can see money rotating between sectors. Financials (XLF) were the clean leader with steady strength, and Consumer Discretionary (XLY) and Energy (XLE) also looked strong, with Energy (XLE) getting the biggest bullish options flow.

Tech (XLK) didn’t lead—it mostly moved sideways and still looks stuck in a range.

Utilities (XLU) still looks weak on price, but the options flow was bullish, which can be a hint that some traders are starting to play defense even with the market up.

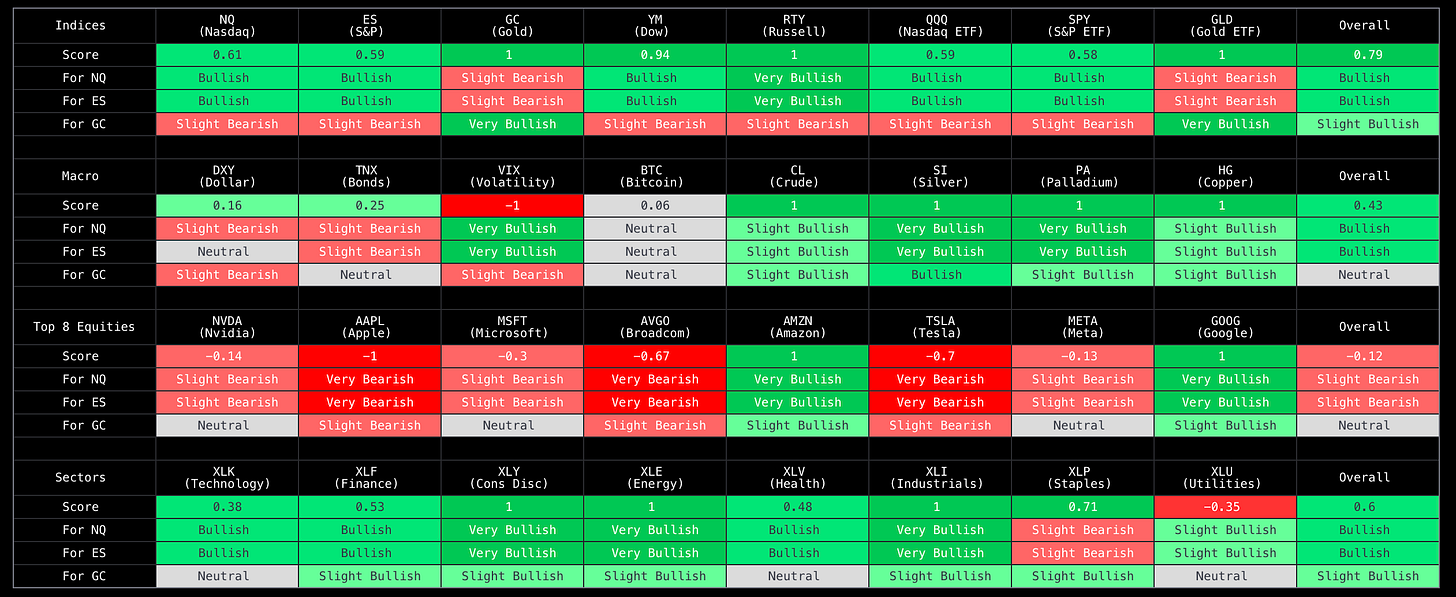

⚡️AI Powered Price Score Matrix

Proprietary matrix powered by AI that provides market breadth and what it means for NQ, ES, and GC futures.

On the daily chart, overall indices, macro, and sectors look bullish… however, the top equities are showing relative weakness. Watch how next week pans out.

🌊 Options & Order Flow

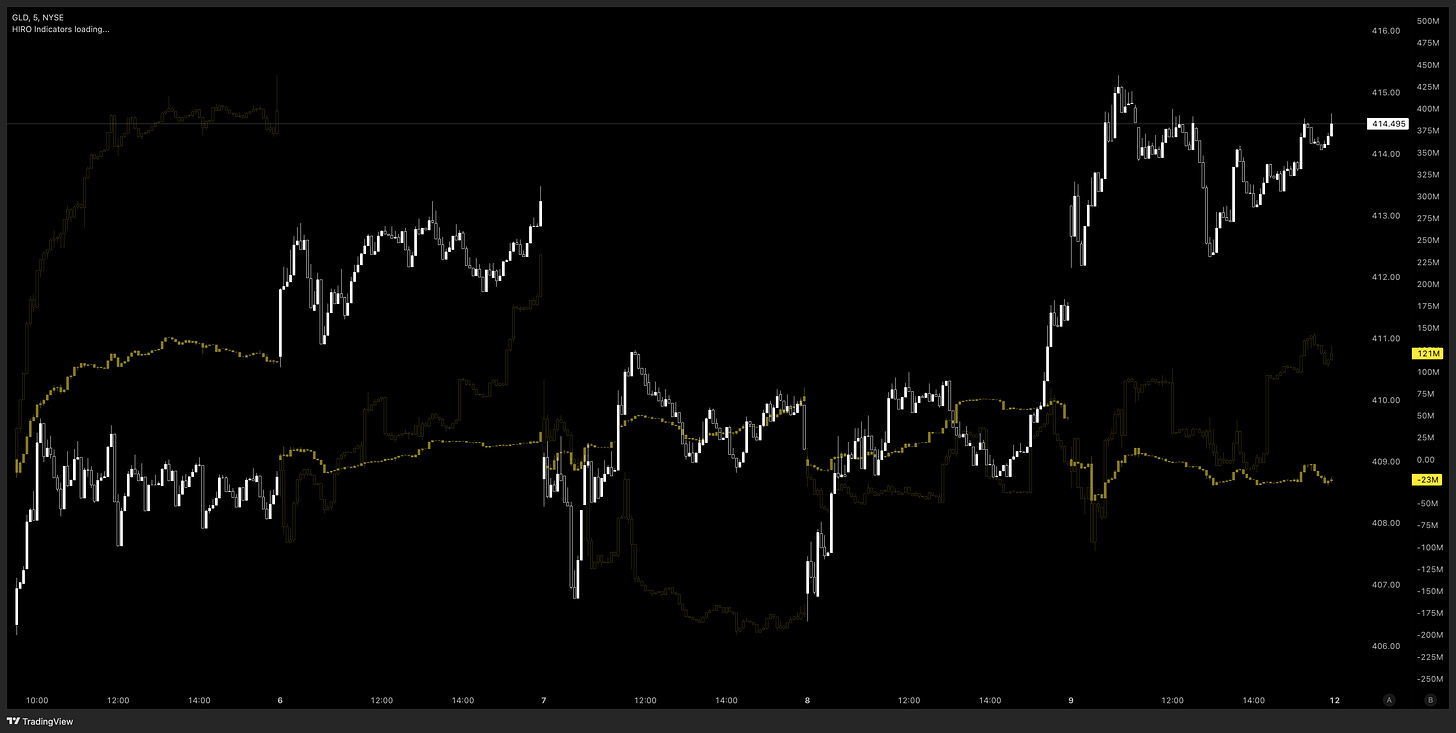

Looking at the last 5 trading days, using SpotGamma’s HIRO and TRACE insights, along with Order flow using Exocharts and DxFeed

Light yellow indicated 0DTE flow, while dim yellow indicates longer dated flow.

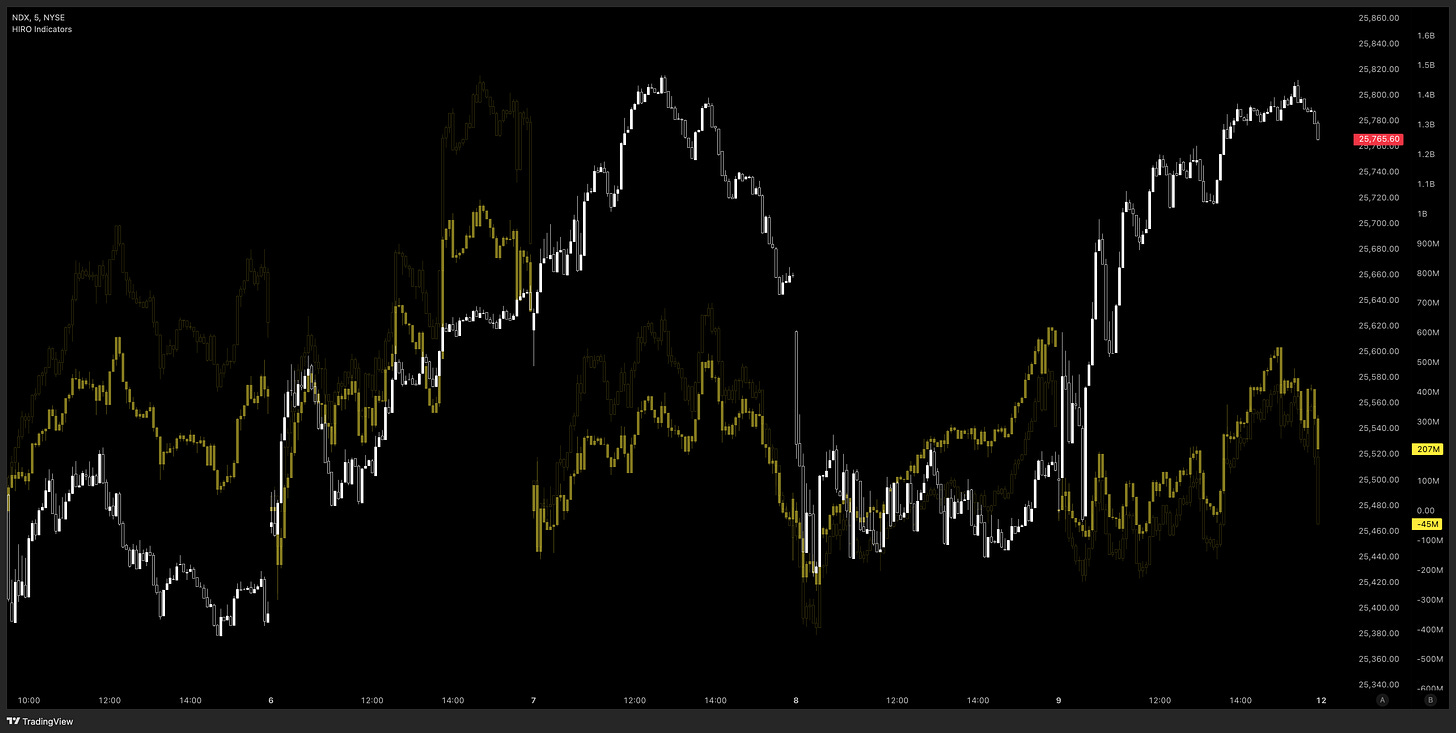

⚡️NQ Review

*NDX is our proxy for options flow

NQ still printing higher highs and higher lows, but the last few sessions feel like they’ve been powered more by short-dated (0DTE) options flow. Price seems to follow that flow pretty consistently all week.

For order flow, we saw heavy selling delta during the mid-week drop, but price eventually reclaimed and squeezed higher anyway. Sellers likely getting absorbed/trapped which pushed us higher as they had to cover.

NQ Levels: 26000s, 25,900s, 25,880s, 25,800s, 25720s, 25600s

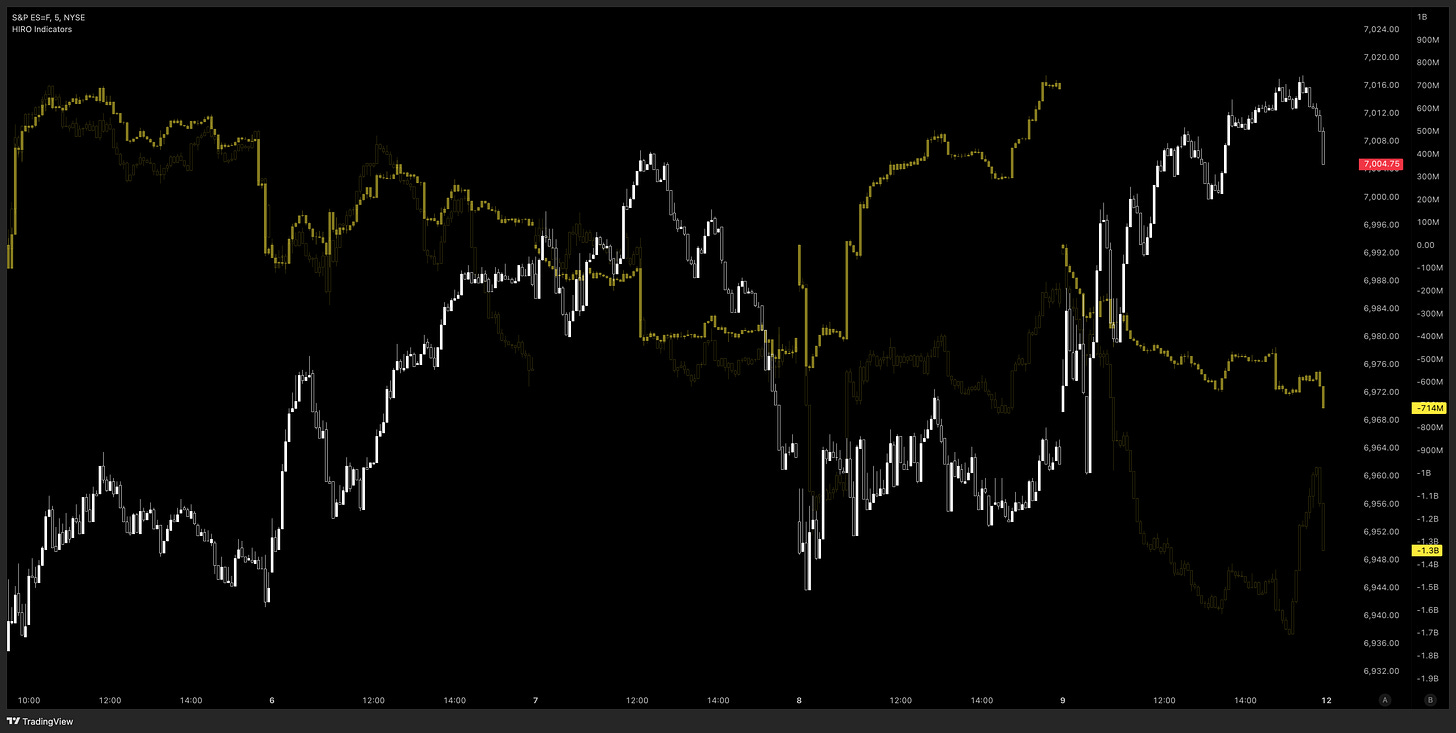

⚡️ES Review

ES looking stronger this week, 0DTE flow, as flow was bullish price followed, but when flow started turning down, price still continued up.

For order flow, we had one bearish CVD day, but the rest of the days were bullish, with price pushing through the sell tails and single prints from earlier in the week.

We also had alot of 200+ contract trades Thursday and Friday, supporting the increase in price.

ES Levels: 7019s, 7000s, 6980s, 6950s, 6900s

⚡️GC Review

*GLD for options flow

Options flow was relatively flat for most of the week, but prices continued higher.

CVD followed the relatively flat motion of options flow, with Friday seeing more selling, but price shook it off and went higher on strong imbalance impulses late Thursday.

GC Levels: 4540s, 4515s, 4490s, 4460s

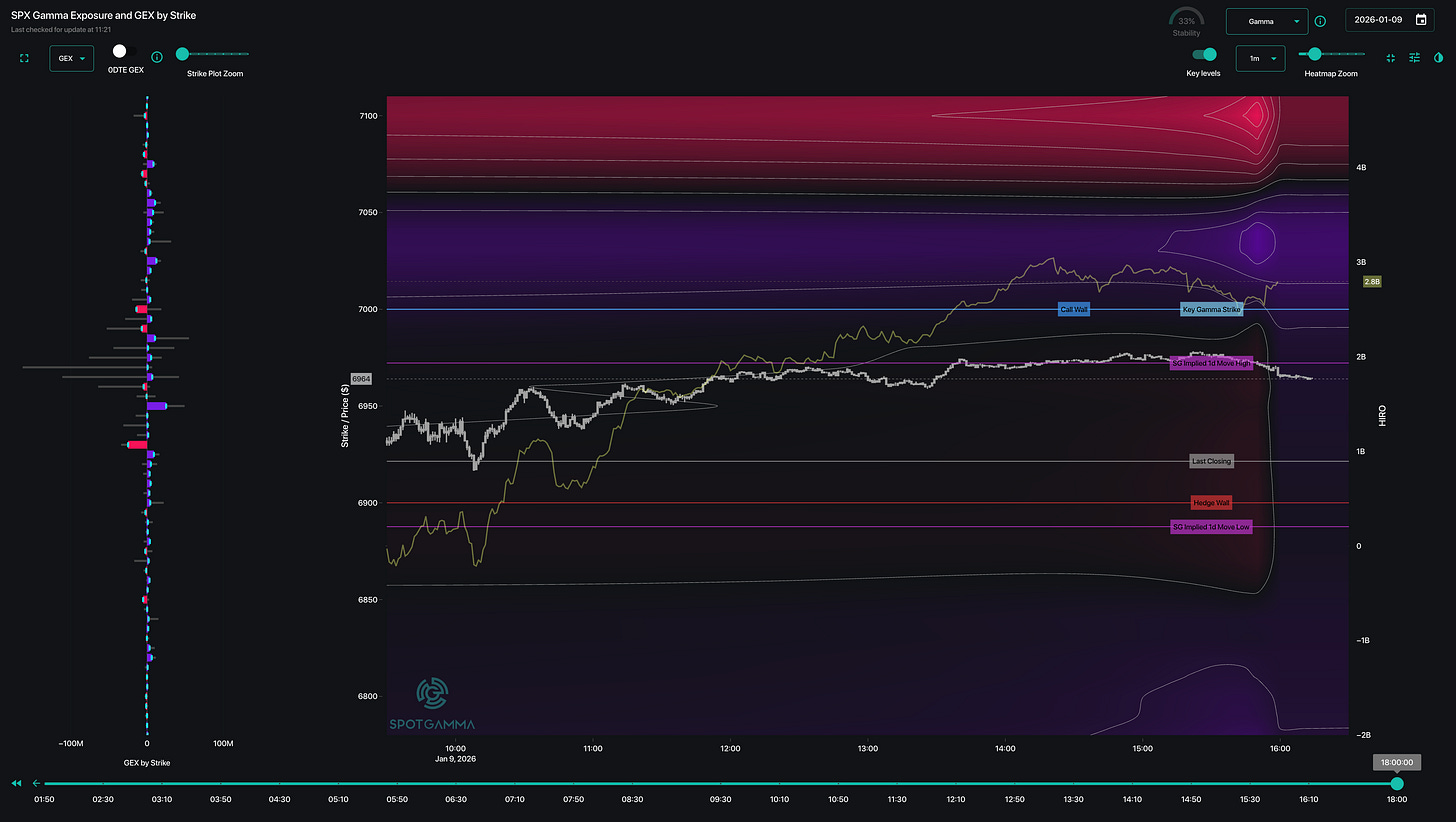

⚡️SPX - Gamma Heat map on Friday

Price pushed up into the negative gamma levels but did not exceed the implied move for the day, but since we made new highs, I suppose that’s to be expected.

Not many big positions carried over to next week.

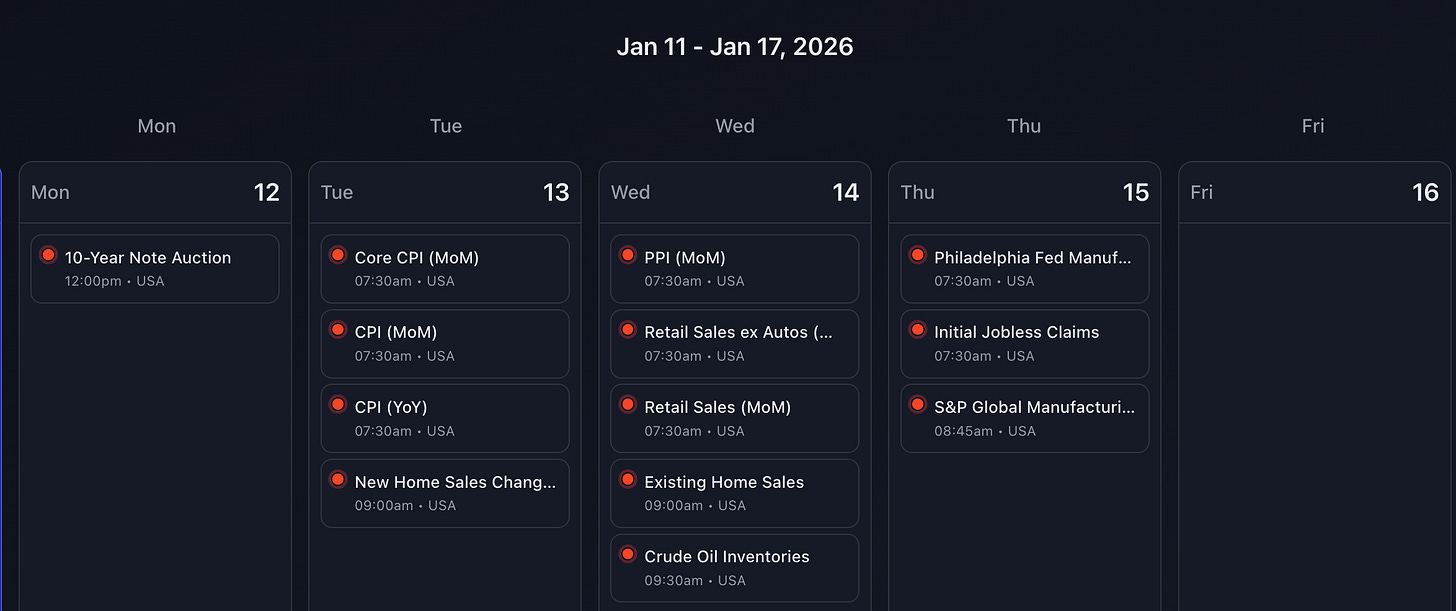

📅 Upcoming Events

CPI, PPI, Jobless claims should provide nice volatility this week.

Also watching the Greenland and Venezuela situations.

Trump on Greenland: We'll make a deal the easy or hard way. We can defend Greenland better if we own it.

Trump: We're not talking about money for Greenland yet. We'll do something on Greenland whether they like or not

Trump: We don't want Russia or China going to Greenland.

Nordics reject Trump’s claim of Chinese and Russian ships around Greenland

Trump to oil CEOs: You’ll be very physically and financially safe.

Trump to Xi: We're open for business in the US and Venezuela.

🪙 Final Two Cents

The market is overall bullish with some rotation, so you can’t fight that.

However, the divergence in price and order flow will be what I’m watching next week, especially with the CPI, PPI, Jobless claims on deck.