🗞️ Weekly Prep

NQ ES GC Prep for week of Dec. 22 - 26

⚡️TL;DR

Overall, indices closed up on Friday, looking to go higher. The test will be if we can clear the high of Monday. For NQ/QQQ, only TSLA looks really strong. The other names are trying to bounce. This makes me cautious on NQ longs.

Most SPY/ES tickers look like they want to pause or go lower. Support may hold us sideways through end of the year. GC touched a new highs.

🌐 High-level Price

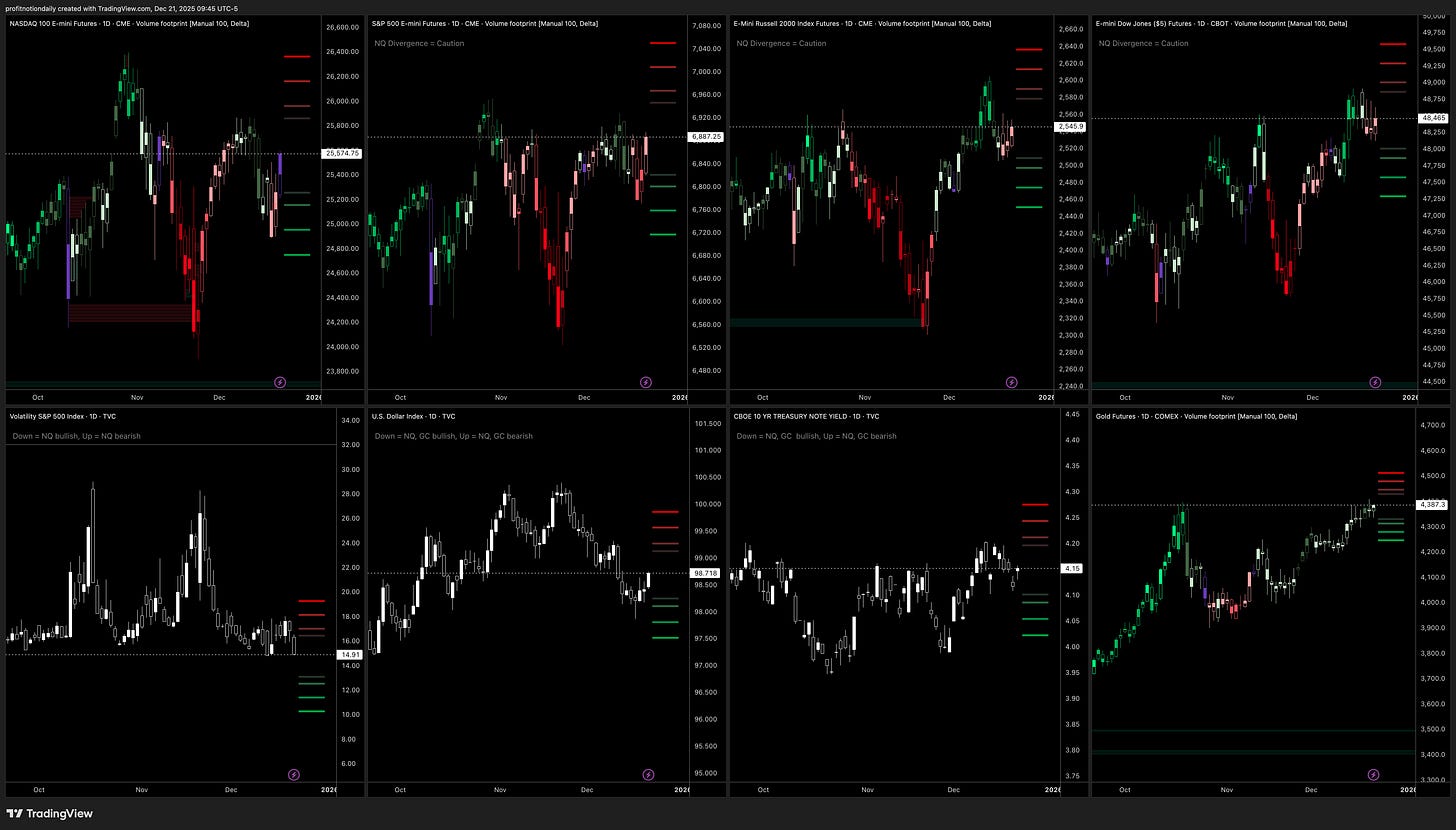

⚡️Review of Top Indices

NQ - Closed the strongest amongst the indices. Lets see if CVD goes green.

ES - Closed right at resistance, let see if we can push higher.

RTY - Coiling, forming a flag… expected to go up, but lets see.

YM - Coiling, forming a flag… expected to go up, but lets see.

VIX - Surprisingly, we are going lower… Even with all the Venezuela “war” stuff.

DXY - Rebounding after sell off, lets see

TVC - Forming a range since October.

GC - Touched new all-time-highs, weekly support held.

Overall, all indices closed up on Friday, looking to go higher. The test will be if we can clear the high of Monday.

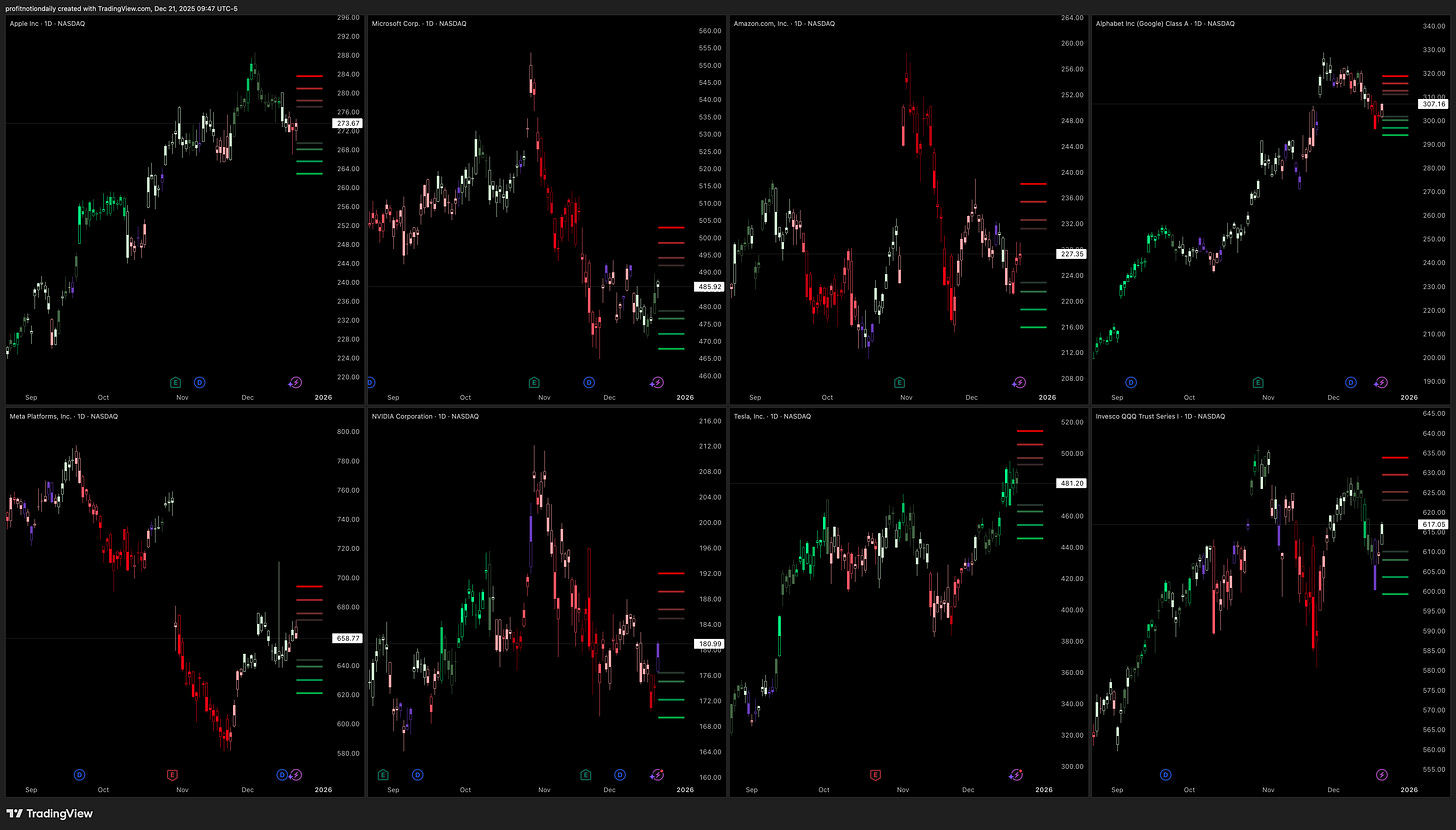

⚡️Review of Top QQQ / NQ Related Tickers

APPL - Broke Dec support, but bouncing. Lets see if Nov support holds. CVD turning red though.

MSFT - Consolidating after sell-off. Looks like we want to bounce.

AMZN - Consolidating after sell-off. Looks like we want to bounce.

GOOG - Sold off after highs. bounced off previous resistance. May consolidate.

META - Wanting to push higher, but CVD starting to turn red..

NVDA - Trying to fight back after sell-off from Nov highs… At resistance.

TSLA - Green CVD at new highs. Lets see if we break.

QQQ - Bouncing. Lets see if we can continue.

Overall, only TSLA looks really strong. The other names are trying to bounce.

This makes me cautious on NQ longs.

⚡️Review of Top SPY / ES Related Tickers

AVGO - Post earnings gap down continuing lower, breaking support, extending past daily range.

BRK - Trying to rebound, but broke recent lows Friday. Overall price is up though.

JPM - Rejected highs, but holding up strong. Not sure if we break next week though.

LLY - Strong. Continuing in it’s rebound after the sell off from highs.

V - Pushing higher, looking to break out of downward range.

NFLX - Down. Forming a bearish flag? Looks like we want lower.

COST - Broke support convincingly. Looks like we want lower.

SPY - Consolidating, looking to test highs again.

Overall, most tickets look like they want to pause or go lower. Support may hold us sideways through end of the year.

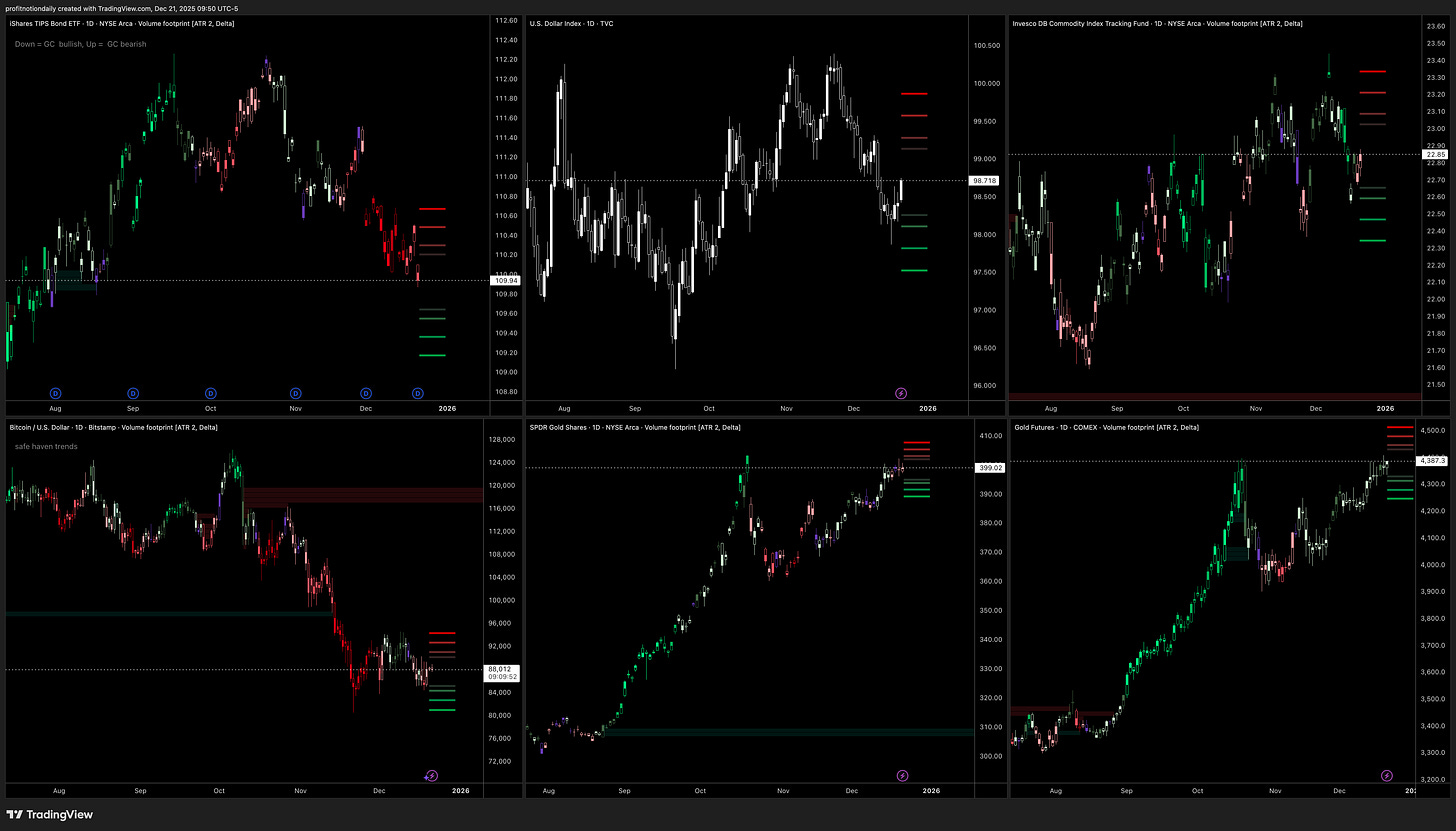

⚡️Review of Gold / GC / GLD Related Tickers

TIPS (Inflation Protection) - Continuing down bearish, supporting rise in gold

DXY (dollar) - Starting to rebound

DBC -Broad commodities sold off and not rebounding. May be holding GC back.

BTC - Bitcoin consolidating at support after sell off, trying to bounce.

GLD / GC - Gold. Futures made new all-time-highs 4200s, but did not break. We could be cooling now.

Overall, If I was a bullish gold, would I try to push higher this year? Take profit and wait for a pullback, or just hold through to next year?

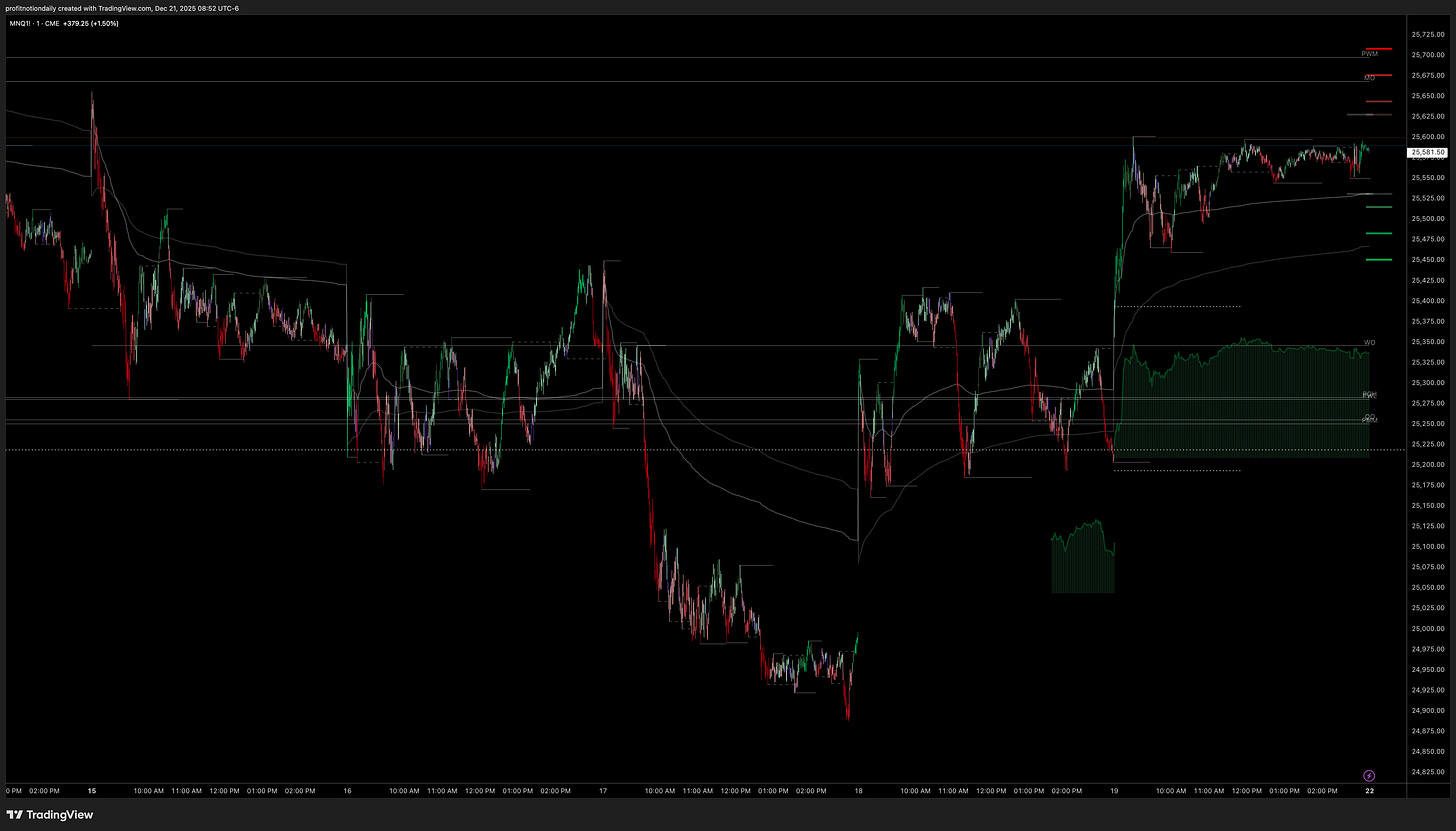

5⃣ Last 5 Intraday

Looking at the 1-minute chart over the last 5 trading days.

⚡️NQ Review

Broke Monday support and rebounded strong into Friday. Watching Monday’s high,

and 25450s level for next week.

⚡️ES Review

Price broke Monday’s support but turned back throughout the week and came back to levels on Friday. See how price reacts at 6900 and 6860s

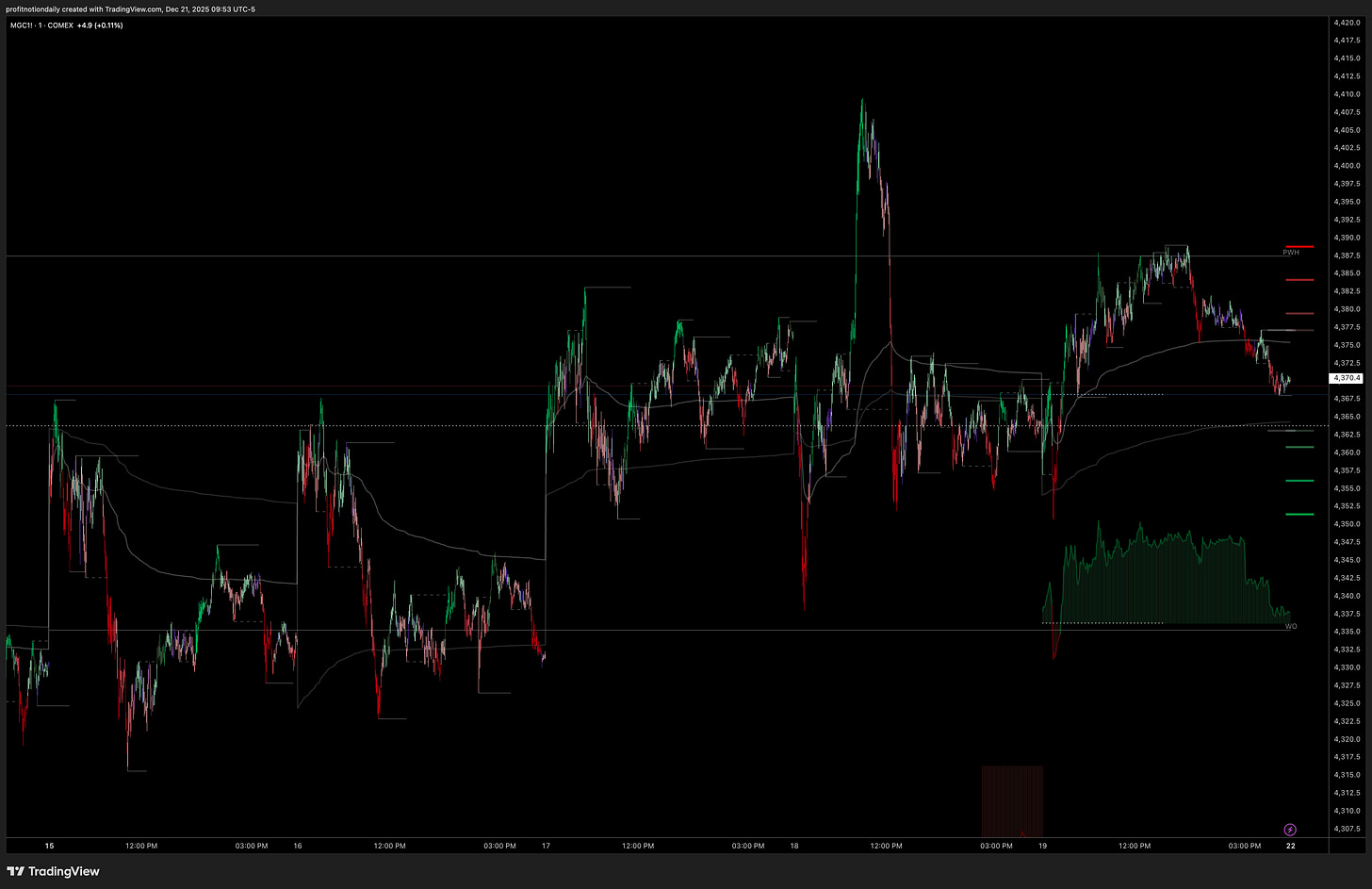

⚡️GC Review

While higher highs were not a clean progression upward, high lowers were print consistently throughout the week. A new all-time-high was printed briefly.

Watching how price behaves if we test Thursday’s high, or if Friday’s close breaks.

🌊Options Flow Insights

These insights from from SpotGamma’s HIRO Indicator. I’ve found this to be the best so far for how I trade. The bright yellow shows net 0DTE flow, while the dim yellow shows longer dated net flow. NDX is for NQ, SPX is for ES, GLD is a proxy for GC.

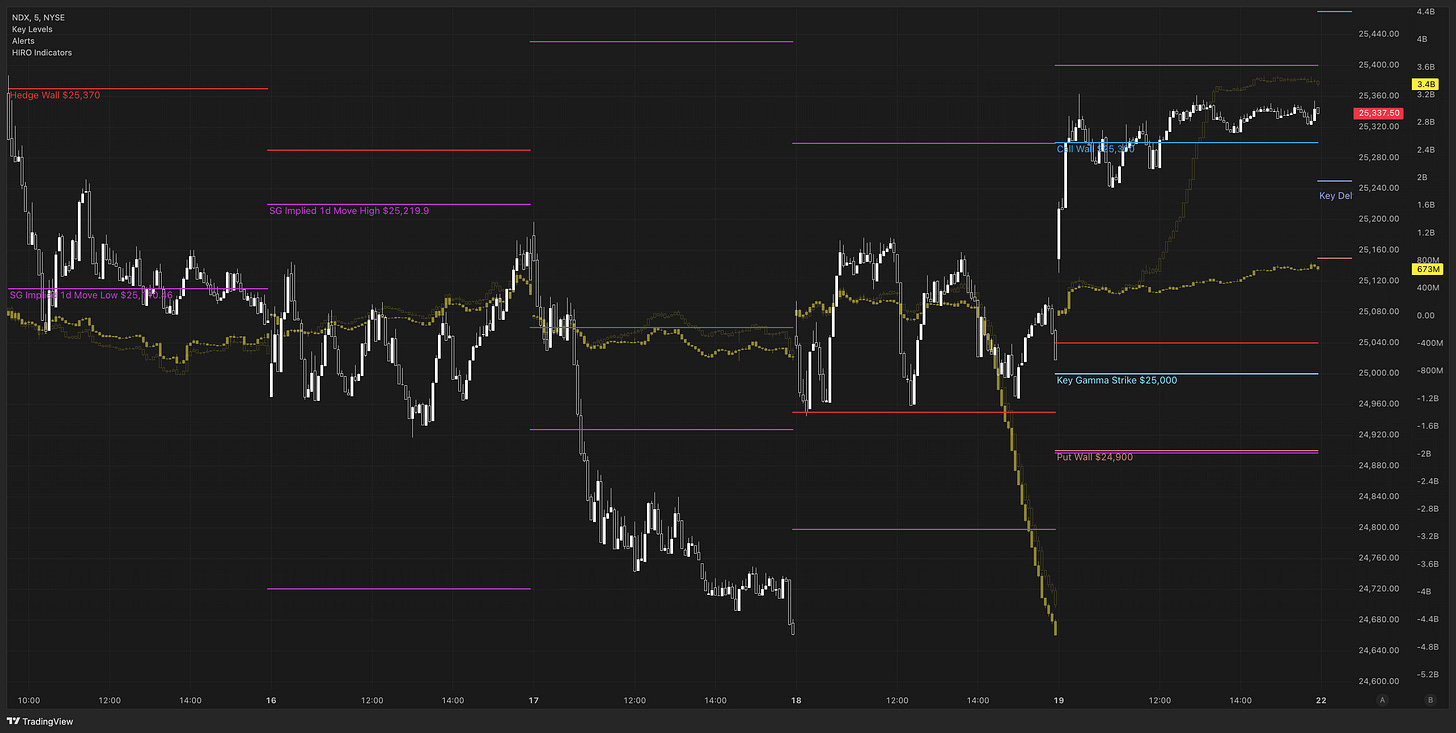

⚡️NQ Review

Flow started the week pretty neutral, then went bearish on Thursday… Everyone was wrong as we pushed higher. Lets see if we test Monday’s highs as longer dated options flow when bullish in the afternoon on Friday.

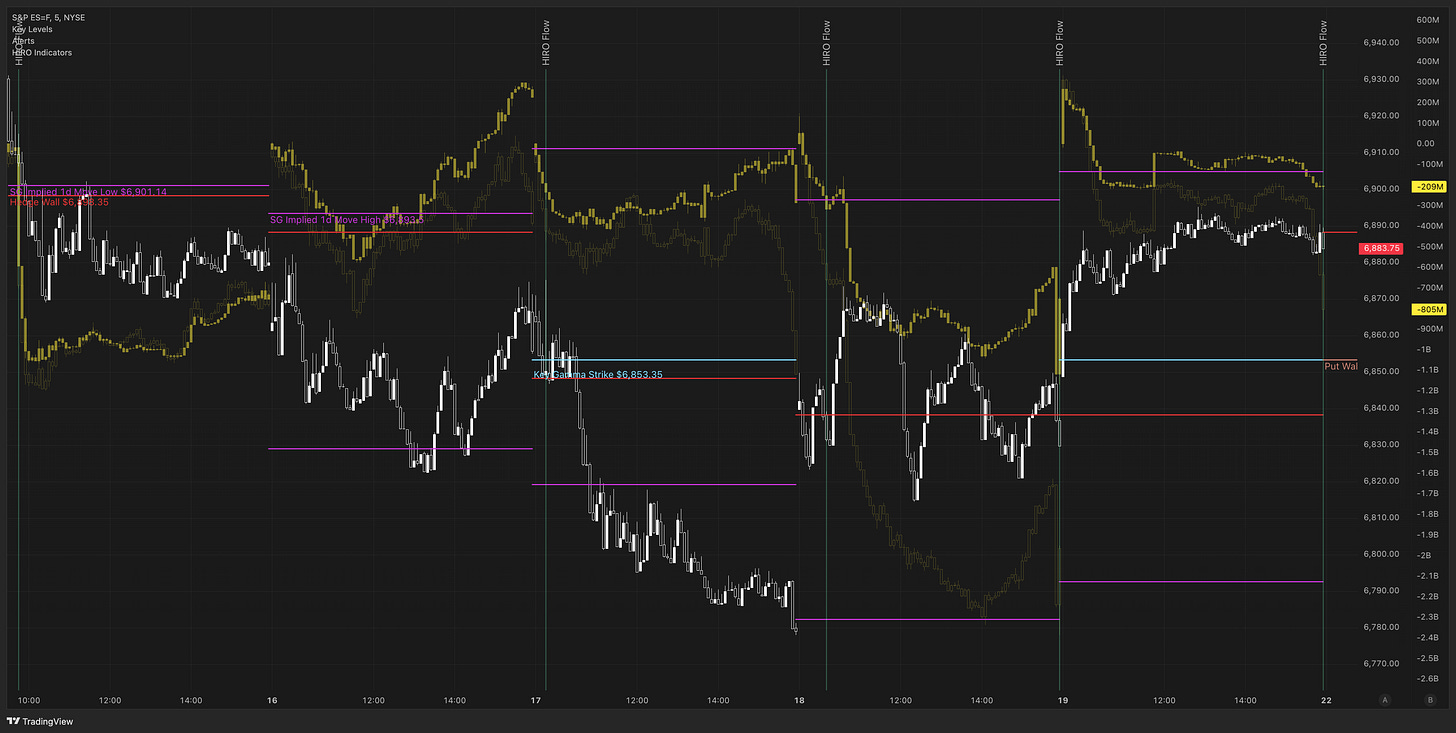

⚡️ES Review

Early in the week 0DTE flow was really betting for higher, but we did not clear Monday highs. Thursday switched more bearish on flow, but price rebounded.

Feels choppy as price figures out how to close out the year.

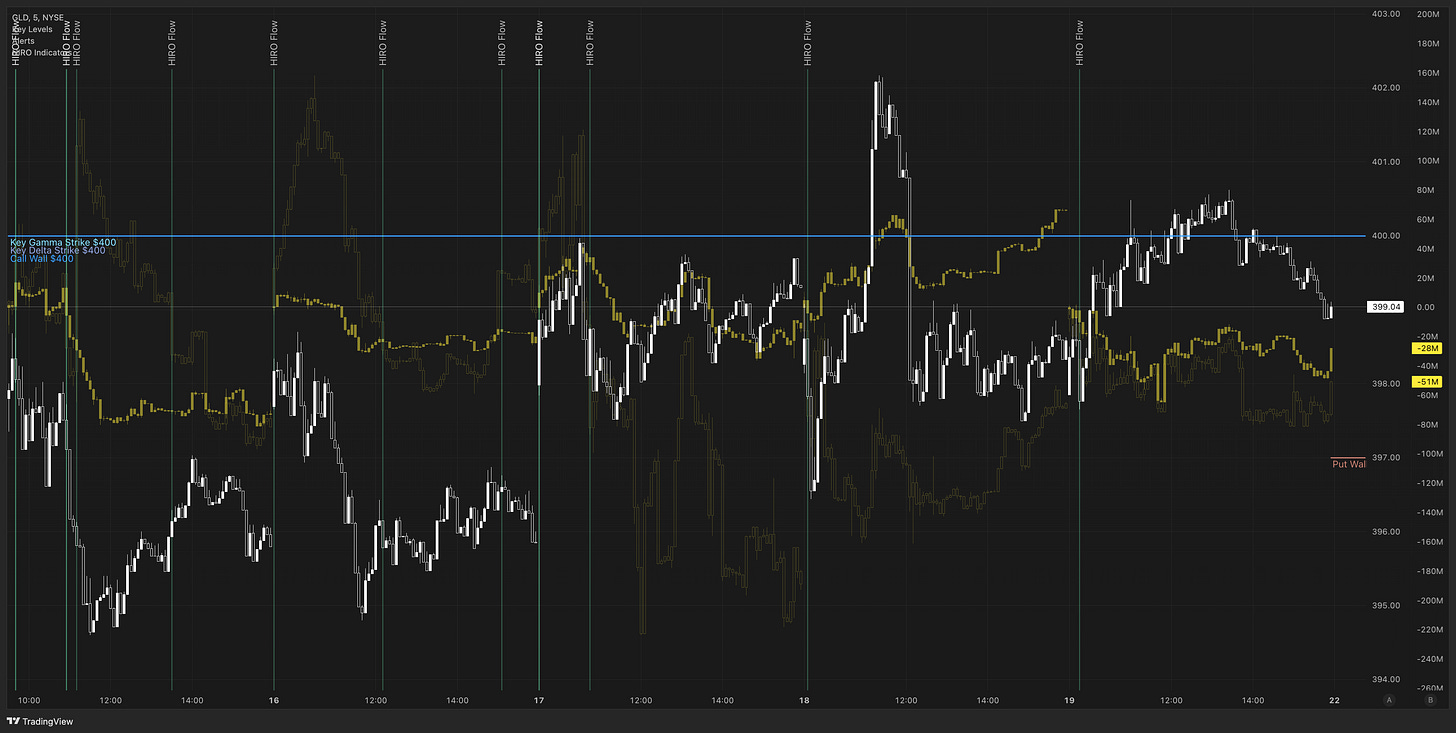

⚡️GC Review

Short dated options flow drifted higher, as longer dated flow had a wider range. Friday flow ended relatively flat. GC is at highs. Not sure if we sustain a break above all-time-highs into the close of the year?

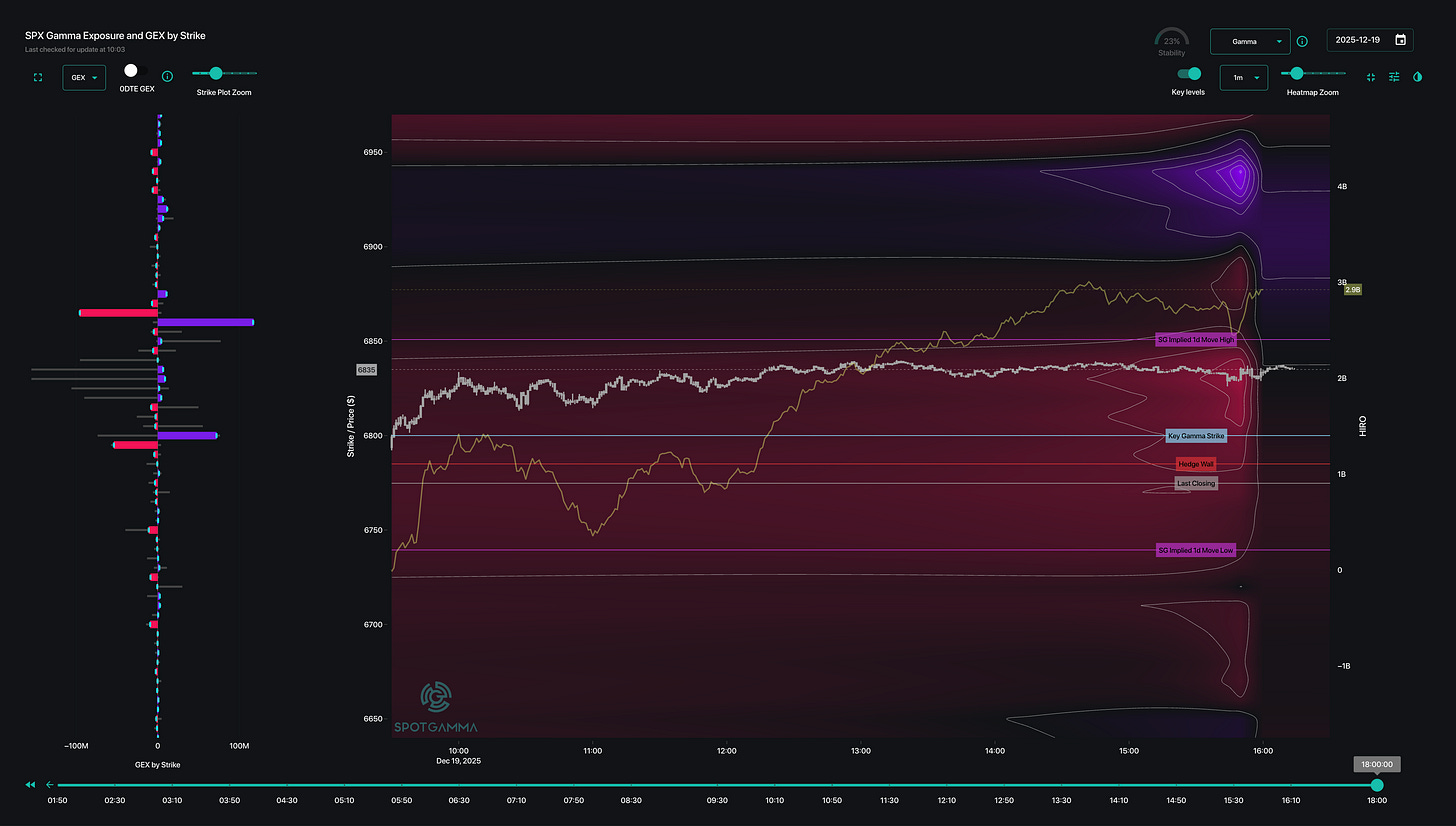

⚡️SPX - Gamma Heat map on Friday.

These insights from from SpotGamma’s TRACE Indicator. This is great to see how gamma (expectations for market makers to hedge) changes through out the day. The chart below shows what everything looked liked on SPX at the end of Friday.

On the left is the positive and negative gamma size by strike price. The skinny lines represent strikes where the contact is closed (ie ODTE trades)

SPX gapped up and stayed elevated most of the day. Options flow did turn down mid-morning, but price resisted and stayed up. Options flow finished higher towards end of day. 6800 and 6860s are the levels to watch next week.

📅 Upcoming Events

⚡️On The Calendar

Mon, Dec 22 - Quiet. 2-year note yield

Tue, Dec 23 - Durable goods, PCE, Consumer Spending & Confidence

Wed, Dec 24 - US jobless claims. Oil inventories. Christmas Eve 🎄

Thu, Dec 25 - 🎄

Fri, Dec 26 - 🎄

⚡️Asking AI - Sentiment & Outlook:

NQ - Sentiment into next week: Bearish tilt — rallies sold, shorts active, price choppy below recent highs.

ES - Sentiment into next week: Neutral — consolidation likely unless macro catalyst forces direction.

GC - Sentiment into next week: Bullish — gold bid as macro + political uncertainty persists.

🪙 Final Two Cents

It’s a short week, so looking to play mean reversions if we push into either direction.

NQ and ES looks like we want to try higher, but seeing how GC did not break highs last week, I wonder if we get the same type of action.

Open to both sides, and won’t over stay on trades. I’ll likely only trade Monday and Tuesday the full morning, and Wednesday just the first hour.. then call it a week.

Short week upcoming with new years as well, may just take the rest of the year off.