☀️ Quick Price & Flow

NQ ES GC Prep for Monday, Jan 5th

⚡️TL;DR

Check out the Weekend Prep for a detailed analysis to start the week

Indices look bullish pre-market. Some big trades on ES pushing us up, but GC leading the pack with the biggest move up to start the week. Lets see if it holds.

Levels: NQ (25630s, 25490s, 25400s), ES (6940s, 6910s, 6890s),

GC (4450s, 4415s, 4385s), SPX (6900 and 6870s are the first levels I’m watching, then 6940s or 6820s depending on which way price goes)

🌐 Price & Flow

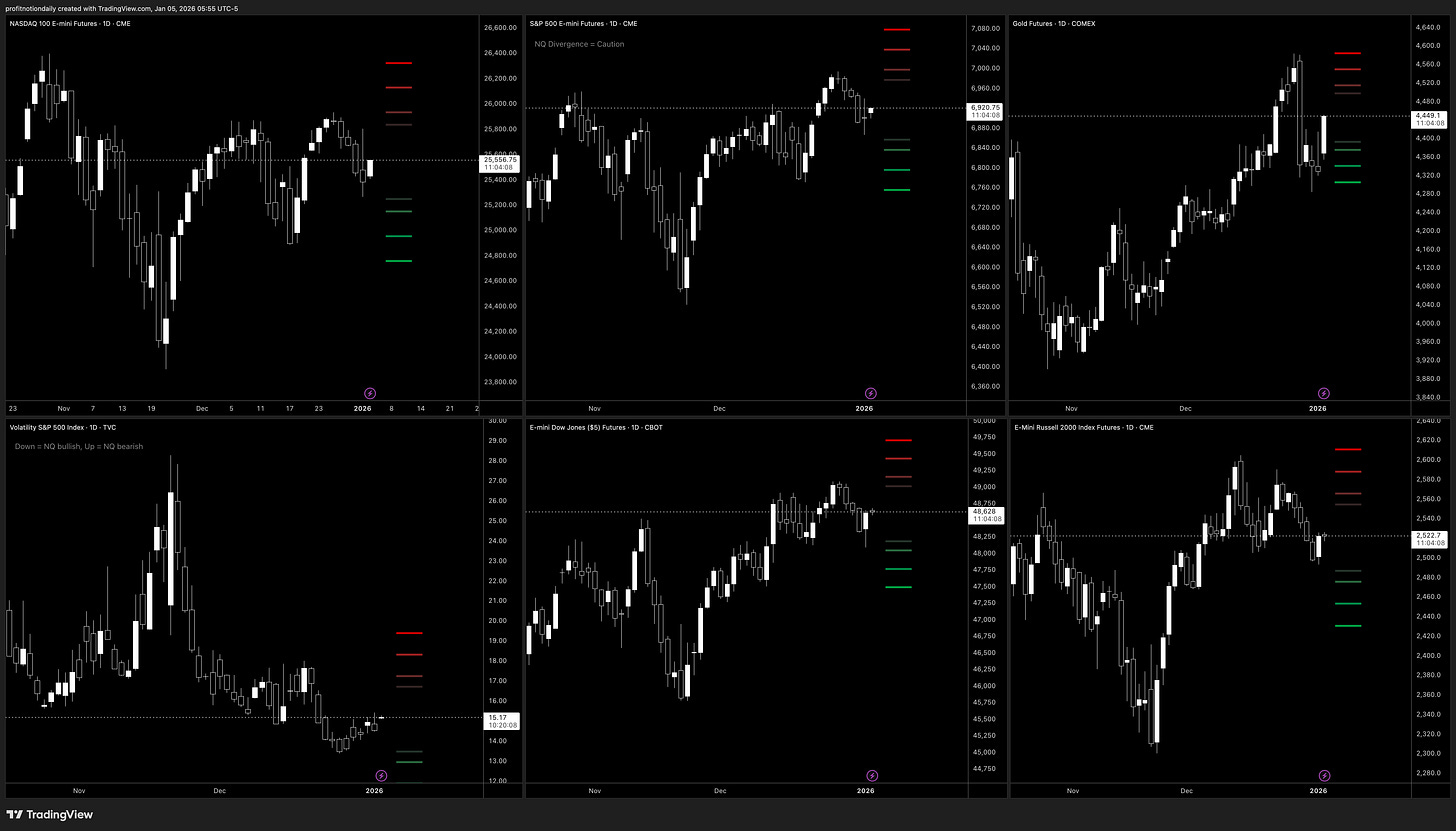

📊 Futures Indices

Looks like all indices are waking up premarket and pushing up. GC is leading the pack,

while breaking past resistance from last week. YM and RTY look poised to break to break Friday’s high, while NQ and ES stay within Friday’s range so far.

Options flow to end last week was mixed for NQ, ES. Bullish for YM and RTY, and bearish for Gold. Looks like GC is shaking all of that off, but lets see if we give back this gap up at the open.

⚡️AI Powered Price Score Matrix

Proprietary matrix powered by AI that provides market breadth and what it means for NQ, ES, and GC futures.

As seen on the price chart, GC (Gold) is very bullish, while other Metals support more upside. Lets see how equites and sectors change as regular trading starts.

Bias does seem bullish, at least to start for Monday.

🎟️ Pre-Market Flow & Key Levels

Yesterday and Pre-market Order/Options flow using Exocharts and SpotGamma.

Levels mentions are more like ‘zones’ than exact levels.

⚡️NQ Review

We opened strong and bullish on Sunday, and has been grinding up since.

The last few hours we’ve seen some big 10+ contract sell trades, following 4 big buy trades (green and red squares at bottom of chart).

CVD has been oscillating around 0, and has turned green again.

Watching 45630s, 25490s, 25400s

⚡️ES Review

If there was ever an example of a bullish chart, this is it.

Huge 200+ contract trade to start the pre-market session on Sunday, and up we go.

CVD has been steadily increasing and has sustained bullish all pre-market.

Can’t fight this. Watching 6940s, 6910s, 6890s

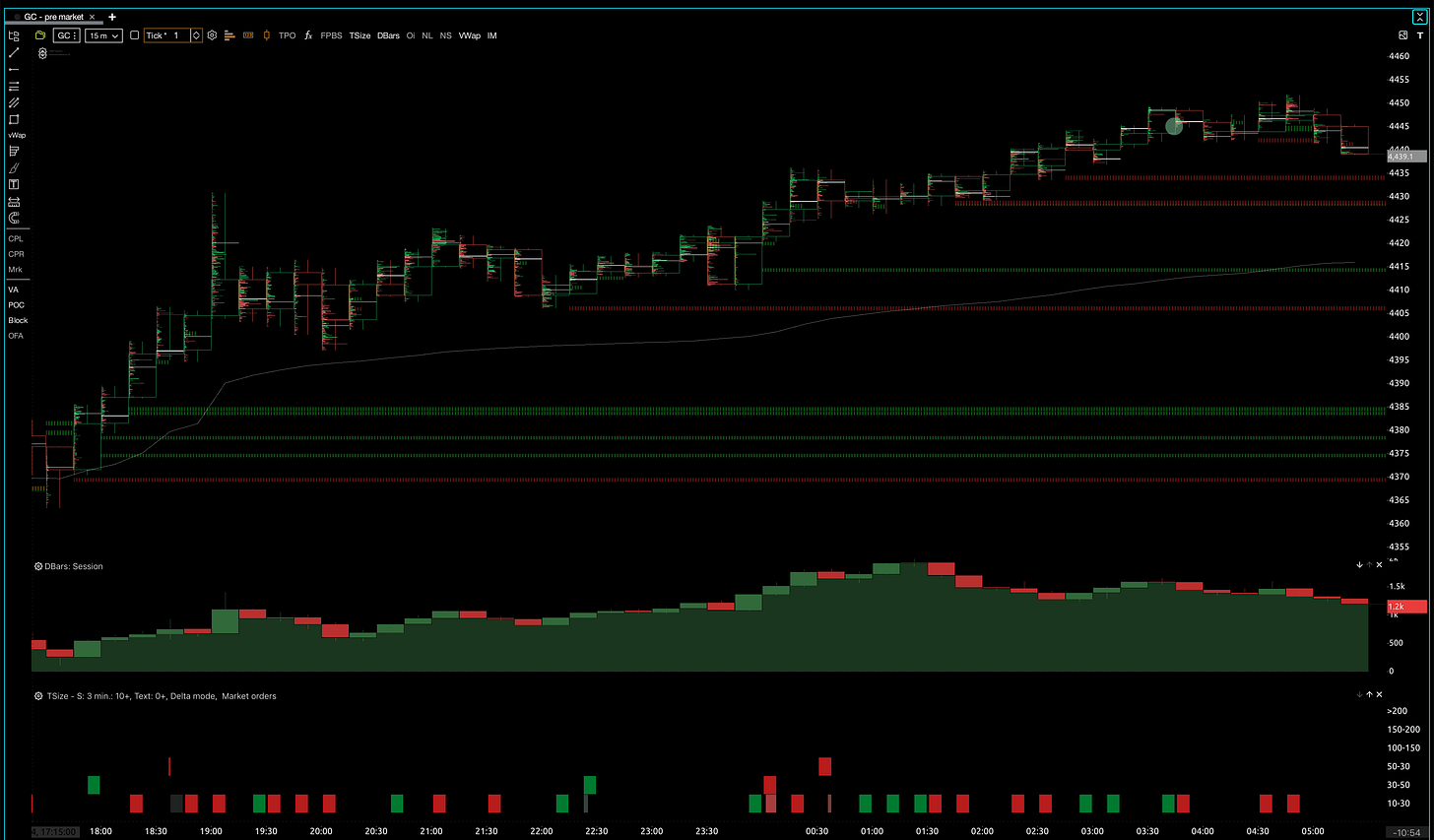

⚡️GC Review

Nice big move up. CVD consistently green, but fighting to go higher.

Interesting that we’ve had alot more 10+ contract trades to the sell side, but price kept rising, with bullish imbalance being printed along the way.

We’ll likely have a pull back to VWAP this morning. Have to follow volume and price, and current that is bullish.

Watching 4450s, 4415s, 4385s

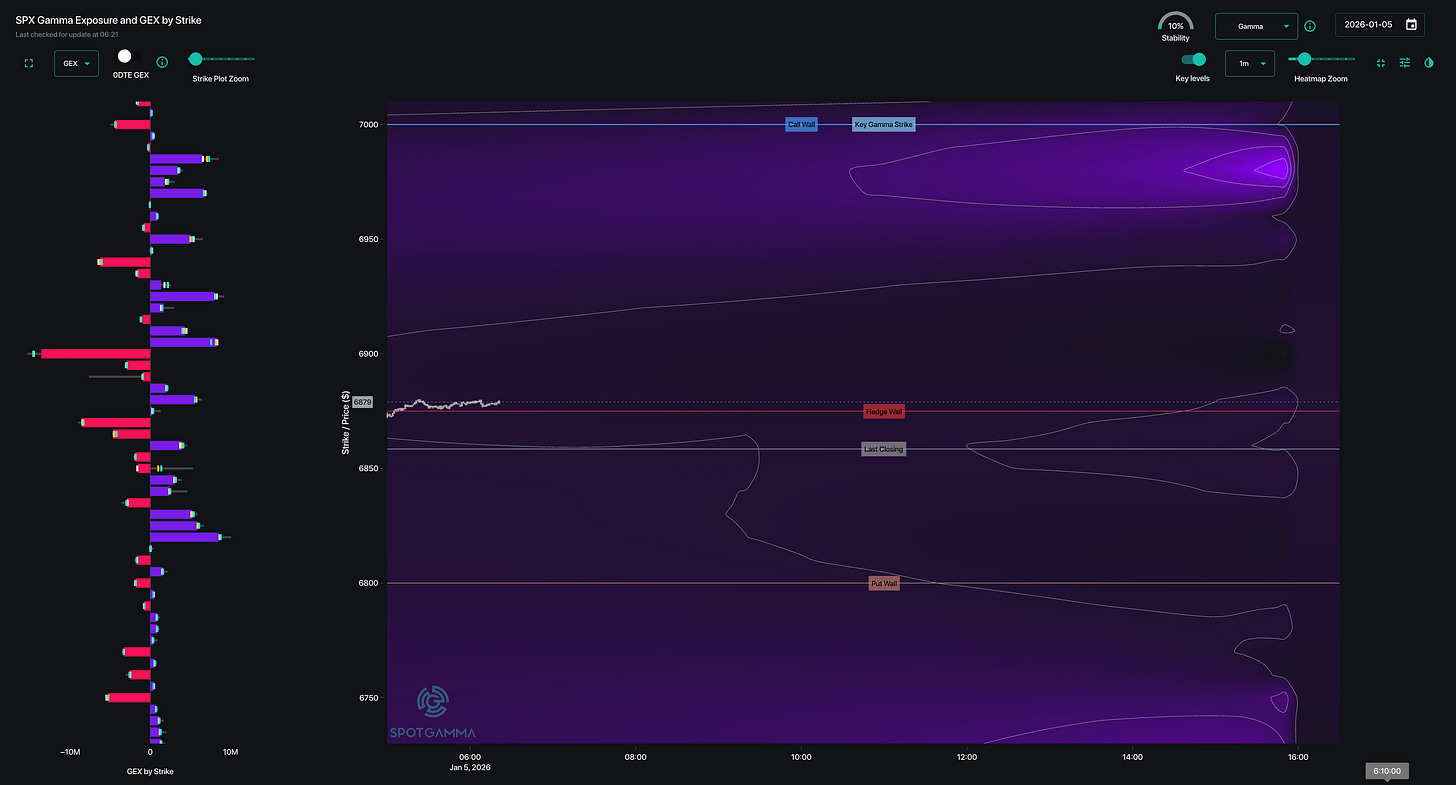

⚡️SPX TRACE

There are some nice negative gamma areas, but the majority of levels are positive gamma, so lets see if we just ‘stick’ around.

6900 and 6870s are the first levels I’m watching, then 6940s or 6820s depending on which way price goes.

📅 Important Events

US ISM Manufacturing data

More US and Venezuela headlines as the world reacts